PNC Bank 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

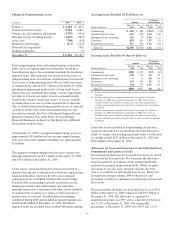

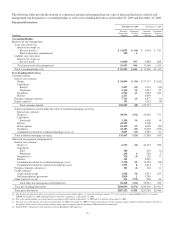

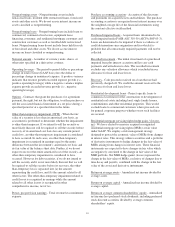

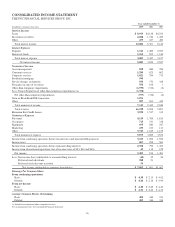

The following tables provide the notional or contractual amounts and estimated net fair value of financial derivatives used for risk

management and designated as accounting hedges as well as free-standing derivatives at December 31, 2009 and December 31, 2008.

Financial Derivatives

December 31, 2009 December 31, 2008

In millions

Notional/

Contractual

Amount

Estimated

Net Fair

Value

Notional/

Contractual

Amount

Estimated

Net Fair

Value

Accounting Hedges

Interest rate risk management

Asset rate conversion

Interest rate swaps (a)

Receive fixed (c) $ 13,055 $ (64) $ 5,618 $ 527

Forward purchase commitments 350 1

Liability rate conversion

Interest rate swaps (a)

Receive fixed 13,048 707 9,888 888

Total interest rate risk management 26,453 644 15,506 1,415

Total accounting hedges (b) $ 26,453 $ 644 $ 15,506 $1,415

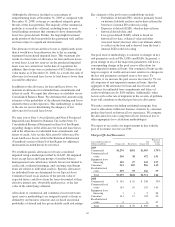

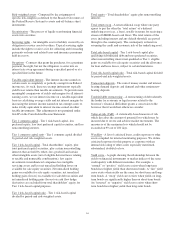

Free-Standing Derivatives

Customer-related

Interest rate contracts

Swaps $ 91,090 $ (54) $ 97,337 $ (162)

Caps/floors

Sold (c) 3,457 (15) 3,976 (13)

Purchased 2,114 14 2,647 22

Swaptions 1,996 11 3,058 160

Futures 2,271 8,839

Foreign exchange contracts 7,743 16 8,877 (3)

Equity contracts 351 1,023 (4)

Total customer-related 109,022 (28) 125,757

Various instruments used to hedge the value of residential mortgage servicing

Interest rate contracts

Swaps (c) 38,596 (152) 20,930 373

Caps/floors

Purchased 5,200 50 6,500 18

Futures 41,439 4,000

Future options 18,230 23 6,000 (29)

Swaptions 24,145 (22) 12,600 (274)

Commitments related to residential mortgage assets (c) 3,857 (15) 2,950 21

Total residential mortgage servicing 131,467 (116) 52,980 109

Other risk management and proprietary

Interest rate contracts

Swaps (c) 6,615 (12) 24,432 656

Caps/floors

Sold 100 624 (1)

Purchased 250 6 740 3

Swaptions (c) 720 (9) 276 17

Futures 315 8,359

Commitments related to residential mortgage assets 5,758 20 15,659 (20)

Commitments related to commercial mortgage assets 1,733 8 2,624 7

Foreign exchange contracts (c) 301 (1) 144 11

Credit contracts

Credit default swaps 1,588 50 2,937 205

Risk participation agreements 2,819 1 3,290

Other contracts (c) (d) 211 (275) 438 44

Total other risk management and proprietary 20,410 (212) 59,523 922

Total free-standing derivatives $260,899 $(356) $238,260 $1,031

Total gross derivatives $287,352 $ 288 $253,766 $2,446

(a) The floating rate portion of interest rate contracts is based on money-market indices. As a percent of notional amount, 57% were based on 1-month LIBOR and 43% on 3-month

LIBOR at December 31, 2009 compared with 55% and 45%, respectively, at December 31, 2008.

(b) Fair value amount includes net accrued interest receivable of $162 million at December 31, 2009 and $147 million at December 31, 2008.

(c) The increases in the negative fair values from December 31, 2008 to December 31, 2009 for interest rate contracts, foreign exchange, equity contracts and other contracts were due to

the changes in fair values of the existing contracts along with new contracts entered into during 2009 and contracts terminated.

(d) Includes PNC’s obligation to fund a portion of certain BlackRock LTIP programs.

78