PNC Bank 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

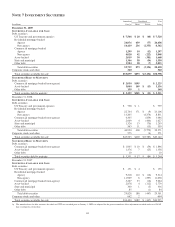

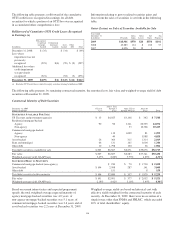

Loans whose contractual terms have been restructured in a

manner which grants a concession to a borrower experiencing

financial difficulties where we do not receive adequate

compensation are considered troubled debt restructurings.

Troubled debt restructurings typically result from our loss

mitigation activities and could include rate reductions,

principal forgiveness, forbearance and other actions intended

to minimize the economic loss and to avoid foreclosure or

repossession of collateral. Troubled debt restructurings

included in total nonperforming loans in the table above

totaled $440 million at December 31, 2009.

Net interest income less the provision for credit losses was

$5.1 billion for 2009 compared with $2.3 billion for 2008 and

$2.6 billion for 2007.

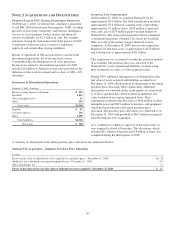

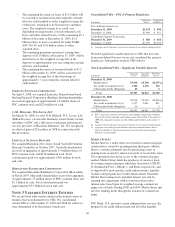

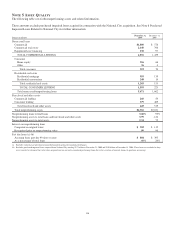

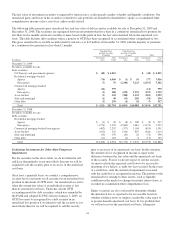

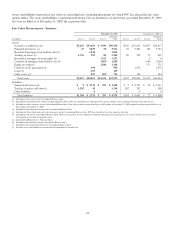

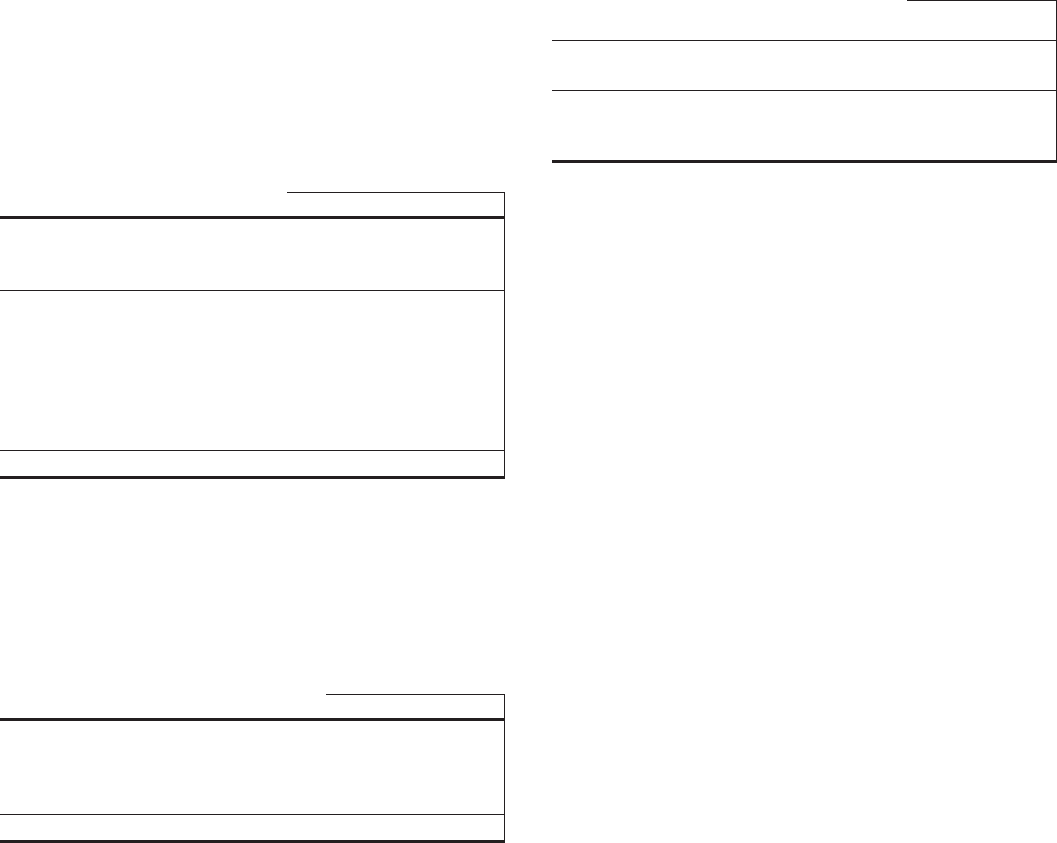

Changes in the allowance for loan and lease losses follow:

In millions 2009 2008 2007

January 1 $ 3,917 $ 830 $ 560

Charge-offs (3,155) (618) (245)

Recoveries 444 79 45

Net charge-offs (2,711) (539) (200)

Provision for credit losses 3,930 1,517 315

Acquired allowance – National City (112) 2,224

Acquired allowance – other 20 152

Net change in allowance for unfunded

loan commitments and letters of

credit 48 (135) 3

December 31 $ 5,072 $3,917 $ 830

See Note 6 Purchased Impaired Loans Related to National

City for a discussion of the release of allowance for loan and

lease losses related to additional impaired loans identified

during 2009.

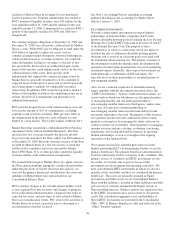

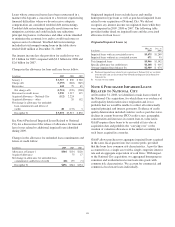

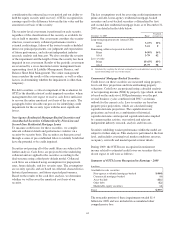

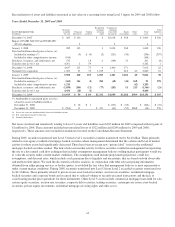

Changes in the allowance for unfunded loan commitments and

letters of credit follow:

In millions 2009 2008 2007

Allowance at January 1 $344 $134 $120

Acquired allowance 75 17

Net change in allowance for unfunded loan

commitments and letters of credit (48) 135 (3)

December 31 $296 $344 $134

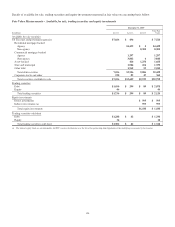

Originated impaired loans exclude leases and smaller

homogeneous type loans as well as purchased impaired loans

related to our acquisition of National City. We did not

recognize any interest income on originated loans while they

were impaired in 2009, 2008 or 2007. The following table

provides further detail on impaired loans and the associated

allowance for loan losses:

Originated Impaired Loans (a)

In millions

Dec. 31

2009

Dec. 31

2008

Impaired loans with an associated reserve $3,475 $1,249

Impaired loans without an associated reserve 471 93

Total impaired loans $3,946 $1,342

Specific allowance for credit losses $1,148 $ 405

Average impaired loan balance (b) $2,909 $ 674

(a) Purchased impaired loans related to our acquisition of National City are excluded

from this table and are disclosed in Note 6 Purchased Impaired Loans Related to

National City.

(b) Average for year ended.

N

OTE

6P

URCHASED

I

MPAIRED

L

OANS

R

ELATED TO

N

ATIONAL

C

ITY

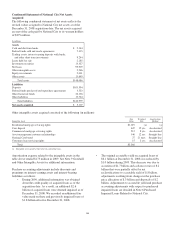

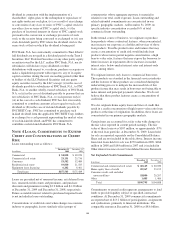

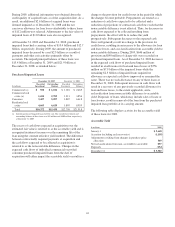

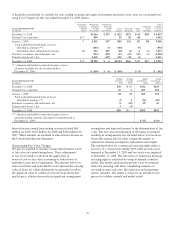

At December 31, 2008, we identified certain loans related to

the National City acquisition, for which there was evidence of

credit quality deterioration since origination and it was

probable that we would be unable to collect all contractually

required principal and interest payments. Evidence of credit

quality deterioration included statistics such as past due status,

declines in current borrower FICO credit scores, geographic

concentration and increases in current loan-to-value ratios.

GAAP requires these loans to be recorded at fair value at

acquisition date and prohibits the “carrying over” or the

creation of valuation allowances in the initial accounting for

such loans acquired in a transfer.

GAAP allows purchasers to aggregate impaired loans acquired

in the same fiscal quarter into one or more pools, provided

that the loans have common risk characteristics. A pool is then

accounted for as a single asset with a single composite interest

rate and an aggregate expectation of cash flows. With respect

to the National City acquisition, we aggregated homogeneous

consumer and residential real estate loans into pools with

common risk characteristics. We account for commercial and

commercial real estate loans individually.

111