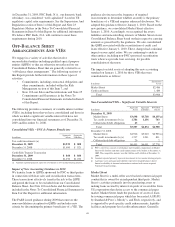

PNC Bank 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

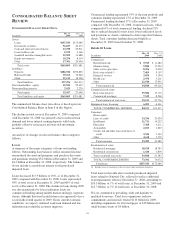

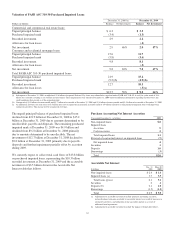

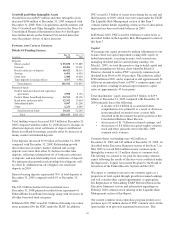

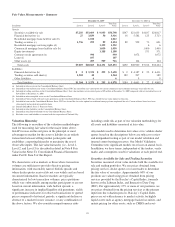

Consolidated Balance Sheet at December 31, 2009. Included

below is detail on the net unrealized losses and OTTI credit

losses recorded on non-agency residential and commercial

mortgage-backed and other asset-backed securities, which

represent the portfolios that have generated the majority of the

OTTI losses.

A summary of all OTTI credit losses recognized in 2009 by

investment type is included in Note 7 Investment Securities in

the Notes To Consolidated Financial Statements of this

Report.

December 31, 2009

In millions

Residential Mortgage-

Backed Securities

Commercial

Mortgage-Backed

Securities

Asset-Backed

Securities (a)

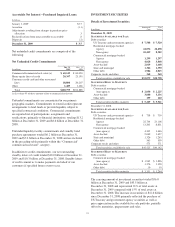

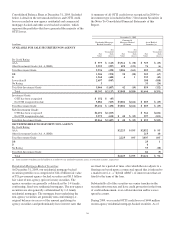

AVAILABLE FOR SALE SECURITIES NON-AGENCY

Fair

Value

Net

Unrealized

Gain

(Loss)

Fair

Value

Net

Unrealized

Gain

(Loss)

Fair

Value

Net

Unrealized

Gain

(Loss)

By Credit Rating

AAA $ 977 $ (143) $3,314 $ (30) $ 729 $ (23)

Other Investment Grade (AA, A, BBB) 2,259 (287) 492 (131) 76 (6)

Total Investment Grade 3,236 (430) 3,806 (161) 805 (29)

BB 1,306 (392) 38 (20) 203 (67)

B1,260 (448) 4 1 235 (43)

Lower than B 2,497 (847) 388 (188)

No Rating 3 33 (24)

Total Sub-Investment Grade 5,066 (1,687) 42 (19) 859 (322)

Total $8,302 $(2,117) $3,848 $(180) $1,664 $(351)

Investment Grade:

OTTI has been recognized $ 152 $ (45)

No OTTI recognized to date 3,084 (385) $3,806 $(161) $ 805 $ (29)

Total Investment Grade $3,236 $ (430) $3,806 $(161) $ 805 $ (29)

Sub-Investment Grade:

OTTI has been recognized $2,491 $(1,029) $ 562 $(221)

No OTTI recognized to date 2,575 (658) $ 42 $ (19) 297 (101)

Total Sub-Investment Grade $5,066 $(1,687) $ 42 $ (19) $ 859 $(322)

SECURITIES HELD TO MATURITY NON-AGENCY

By Credit Rating

AAA $2,225 $ 195 $2,822 $ 95

Other Investment Grade (AA, A, BBB) 215 10

Total Investment Grade 2,225 195 3,037 105

BB 25 1

B4

No Rating 55 (10)

Total Sub-Investment Grade 84 (9)

Total $2,225 $ 195 $3,121 $ 96

(a) Table excludes $4 million and $15 million of available for sale and held to maturity agency asset-backed securities, respectively.

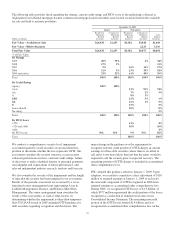

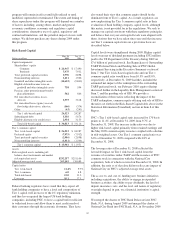

Residential Mortgage-Backed Securities

At December 31, 2009, our residential mortgage-backed

securities portfolio was comprised of $24.4 billion fair value

of US government agency-backed securities and $8.3 billion

fair value of non-agency (private issuer) securities. The

agency securities are generally collateralized by 1-4 family,

conforming, fixed-rate residential mortgages.The non-agency

securities are also generally collateralized by 1-4 family

residential mortgages. The mortgage loans underlying the

non-agency securities are generally non-conforming (i.e.,

original balances in excess of the amount qualifying for

agency securities) and predominately have interest rates that

are fixed for a period of time, after which the rate adjusts to a

floating rate based upon a contractual spread that is indexed to

a market rate (i.e., a “hybrid ARM”), or interest rates that are

fixed for the term of the loan.

Substantially all of the securities are senior tranches in the

securitization structure and have credit protection in the form

of credit enhancement, over-collateralization and/or excess

spread accounts.

During 2009, we recorded OTTI credit losses of $444 million

on non-agency residential mortgage-backed securities. As of

36