PNC Bank 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

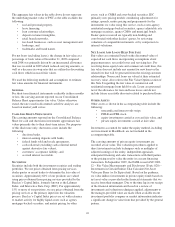

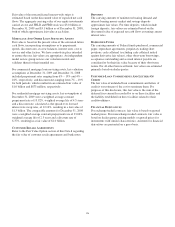

For customer-related intangibles, the estimated remaining

useful lives range from less than one year to 11 years, with a

weighted-average remaining useful life of approximately 10

years.

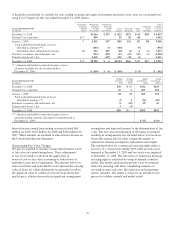

Amortization expense on intangible assets, net of impairment

reversal (charge), for 2009, 2008, and 2007 was $296 million,

$210 million and $159 million, respectively. Amortization

expense related to the discontinued operations of GIS was $17

million in 2009, $18 million in 2008, and $14 million in 2007.

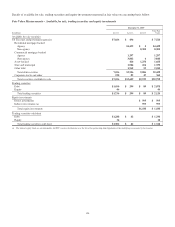

Amortization expense on existing intangible assets for 2010

through 2014 is estimated to be as follows:

• 2010: $292 million,

• 2011: $245 million,

• 2012: $251 million,

• 2013: $231 million, and

• 2014: $208 million.

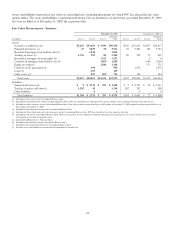

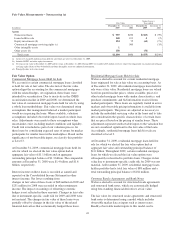

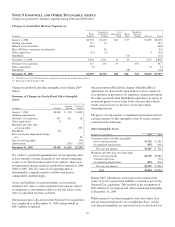

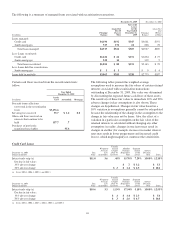

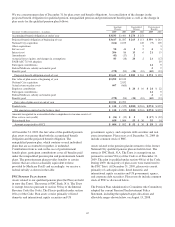

Changes in commercial mortgage servicing rights follow:

Commercial Mortgage Servicing Rights

In millions 2009 2008

January 1 $ 864 $694

Additions 121 303

Acquisition adjustment 1(3)

Impairment reversal (charge) 35 (35)

Amortization expense (100) (95)

Net carrying amount at December 31 $ 921 $864

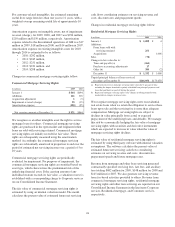

We recognize as an other intangible asset the right to service

mortgage loans for others. Commercial mortgage servicing

rights are purchased in the open market and originated when

loans are sold with servicing retained. Commercial mortgage

servicing rights are initially recorded at fair value. These

rights are subsequently measured using the amortization

method. Accordingly, the commercial mortgage servicing

rights are substantially amortized in proportion to and over the

period of estimated net servicing income over a period of 5 to

10 years.

Commercial mortgage servicing rights are periodically

evaluated for impairment. For purposes of impairment, the

commercial mortgage servicing rights are stratified based on

asset type, which characterizes the predominant risk of the

underlying financial asset. If the carrying amount of any

individual stratum exceeds its fair value, a valuation reserve is

established with a corresponding charge to Corporate services

on our Consolidated Income Statement.

The fair value of commercial mortgage servicing rights is

estimated by using an internal valuation model. The model

calculates the present value of estimated future net servicing

cash flows considering estimates on servicing revenue and

costs, discount rates and prepayment speeds.

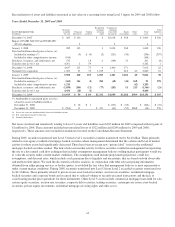

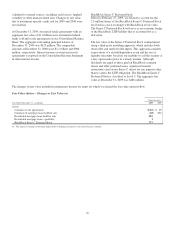

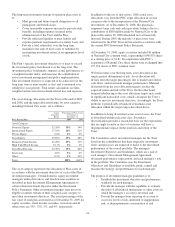

Changes in residential mortgage servicing rights follow:

Residential Mortgage Servicing Rights

In millions 2009 2008

January 1 $ 1,008 $4

Additions:

From loans sold with

servicing retained 261

Acquisitions 1,006

Sales (74)

Changes in fair value due to:

Time and payoffs (a) (264)

Purchase accounting adjustments 17

Other (b) 384 (2)

December 31 $ 1,332 $ 1,008

Unpaid principal balance of loans serviced

for others at December 31 $146,050 $173,658

(a) Represents decrease in mortgage servicing rights value due to passage of time,

including the impact from both regularly scheduled loan principal payments and

loans that paid down or paid off during the period.

(b) Represents mortgage servicing rights value changes resulting primarily from

market-driven changes in interest rates.

We recognize mortgage servicing right assets on residential

real estate loans when we retain the obligation to service these

loans upon sale and the servicing fee is more than adequate

compensation. Mortgage servicing rights are subject to

declines in value principally from actual or expected

prepayment of the underlying loans and defaults. We manage

this risk by economically hedging the fair value of mortgage

servicing rights with securities and derivative instruments

which are expected to increase in value when the value of

mortgage servicing rights declines.

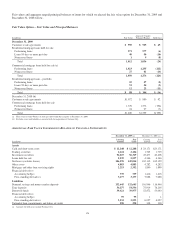

The fair value of residential mortgage servicing rights is

estimated by using third party software with internal valuation

assumptions. The software calculates the present value of

estimated future net servicing cash flows considering

estimates on servicing revenue and costs, discount rates,

prepayment speeds and future mortgage rates.

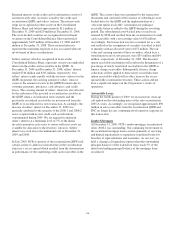

Revenue from mortgage and other loan servicing generated

contractually specified servicing fees, late fees, and ancillary

fees totaling $682 million for 2009, $148 million for 2008 and

$145 million for 2007. We also generate servicing revenue

from fee-based activities provided to others. Revenue from

commercial mortgage servicing rights, residential mortgage

servicing rights and other loan servicing are reported on our

Consolidated Income Statement in the line items Corporate

services, Residential mortgage, and Consumer services,

respectively.

128