PNC Bank 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

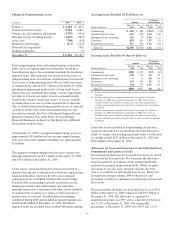

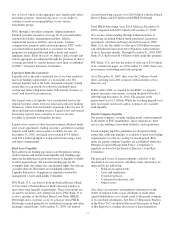

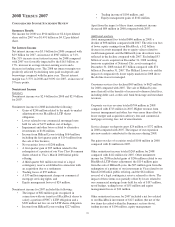

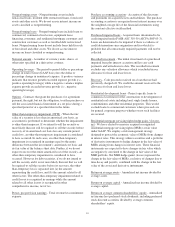

Net Interest Income Sensitivity To Alternative Rate

Scenarios (Fourth Quarter 2009)

PNC

Economist

Market

Forward

Two-Ten

Inversion

First year sensitivity .9% .6% .9%

Second year sensitivity (1.4)% (1.3)% .3%

All changes in forecasted net interest income are relative to

results in a base rate scenario where current market rates are

assumed to remain unchanged over the forecast horizon.

When forecasting net interest income, we make assumptions

about interest rates and the shape of the yield curve, the

volume and characteristics of new business, and the behavior

of existing on- and off-balance sheet positions. These

assumptions determine the future level of simulated net

interest income in the base interest rate scenario and the other

interest rate scenarios presented in the following table. These

simulations assume that as assets and liabilities mature, they

are replaced or repriced at then current market rates.

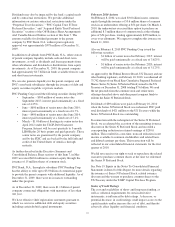

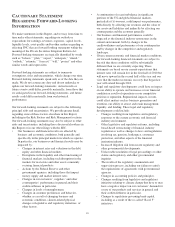

The following graph presents the yield curves for the base rate

scenario and each of the alternate scenarios one year forward.

Alternate Interest Rate Scenarios

One Year Forward

0.0

1.0

2.0

3.0

5.0

4.0

1M LIBOR 2Y Swap 3Y Swap 5Y Swap 10Y Swap

Base Rates PNC Economist Market Forward Two-Ten Inversion

The results of the interest sensitivity analyses reflect our

current best estimates of the impact of integrating National

City’s balance sheet, including the effects of purchase

accounting, balance sheet repositioning, and deposit pricing

strategies. Going forward as these estimates and strategies are

revised, the results of our analyses may change. The fourth

quarter 2008 analyses also reflect the impact of the rapid

decline in market interest rates that occurred during that

quarter, in which period-end one-month LIBOR and three-

year swap rates declined 349 basis points and 197 basis points,

respectively.

The fourth quarter 2009 interest sensitivity analyses indicate

that our Consolidated Balance Sheet is positioned to benefit

from an increase in interest rates. We believe that we have the

deposit funding base and balance sheet flexibility to adjust,

where appropriate and permissible, to changing interest rates

and market conditions.

M

ARKET

R

ISK

M

ANAGEMENT

–T

RADING

R

ISK

Our trading activities include customer-driven trading in fixed

income securities, equities, derivatives, and foreign exchange

contracts. They also include the underwriting of fixed income

and equity securities and proprietary trading.

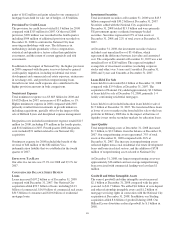

We use value-at-risk (VaR) as the primary means to measure

and monitor market risk in trading activities. The Risk

Committee of the Board establishes an enterprise-wide VaR

limit on our trading activities.

During 2009, our VaR ranged between $5.8 million and $10.4

million, averaging $7.7 million. During 2008, our VaR ranged

between $5.4 million and $18.4 million, averaging $10.8

million.

To help ensure the integrity of the models used to calculate

VaR for each portfolio and enterprise-wide, we use a process

known as backtesting. The backtesting process consists of

comparing actual observations of trading-related gains or

losses against the VaR levels that were calculated at the close

of the prior day. Under typical market conditions, we would

expect an average of two to three instances a year in which

actual losses exceeded the prior day VaR measure at the

enterprise-wide level. There were no such instances during

2009. As a result of increased volatility in certain markets,

there were 10 such instances during 2008.

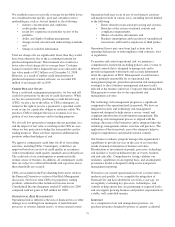

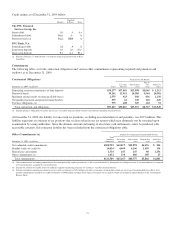

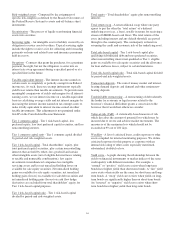

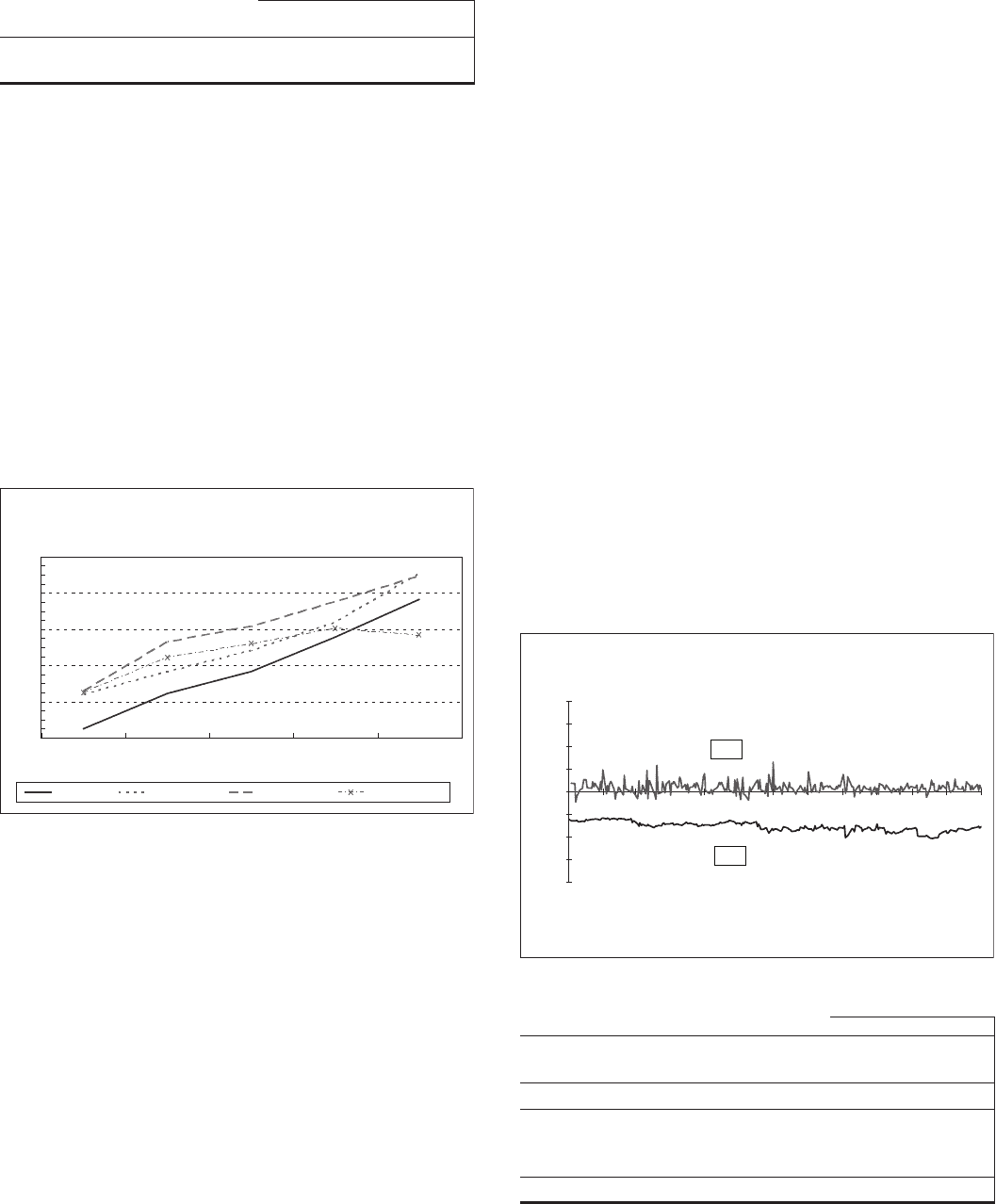

The following graph shows a comparison of enterprise-wide

trading-related gains and losses against prior day VaR for the

period.

Enterprise-Wide Trading-Related

Gains/Losses Versus Value at Risk

(20)

(15)

(10)

(5)

0

5

10

15

20

12/31/08

1/31/09

2/28/09

3/31/09

4/30/09

5/31/09

6/30/09

7/31/09

8/31/09

9/30/09

10/31/09

11/30/09

12/31/09

Millions

VaR

P&L

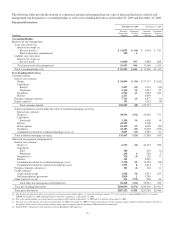

Total trading revenue was as follows:

Year end December 31 – in millions 2009 2008 2007

Net interest income $61 $72 $ 7

Noninterest income 170 (55) 104

Total trading revenue $231 $ 17 $111

Securities underwriting and trading (a) $75 $(17) $ 41

Foreign exchange 73 73 58

Financial derivatives 83 (39) 12

Total trading revenue $231 $ 17 $111

(a) Includes changes in fair value for certain loans accounted for at fair value.

75