PNC Bank 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.relationships is the primary objective of our deposit strategy.

Furthermore, core checking accounts are critical to our

strategy of expanding our payments business. The deposit

strategy of Retail Banking is to remain disciplined on pricing,

target specific products and markets for growth, and focus on

the retention and growth of balances for relationship

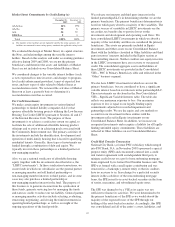

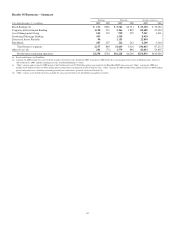

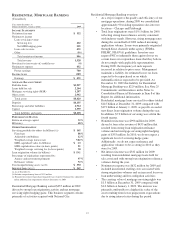

customers. Average total deposits increased $80.8 billion

compared with 2008.

• Average money market deposits increased $22.2

billion over 2008. This increase was primarily due to

the National City acquisition and core money market

growth as customers generally prefer more liquid

deposits in a low rate environment.

• In 2009, average certificates of deposit increased

$37.3 billion over the prior year. The increase was

due to the National City acquisition, which was

partially offset by a decrease in legacy certificates of

deposits. The legacy decline is a result of a focus on

relationship customers rather than pursuing higher-

rate single service customers. A continued decline in

certificates of deposit is expected in 2010 due to the

planned run off of higher rate certificates of deposits

that were primarily acquired through acquisition.

• Average demand deposits increased $17.4 billion

over 2008. This increase was driven by acquisitions

and organic growth.

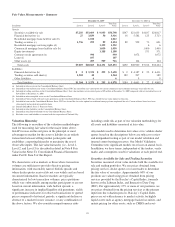

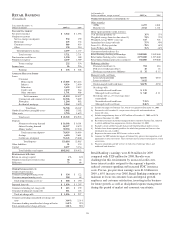

Currently, we are predominately focused on a relationship-

based lending strategy that targets specific customer sectors

(mass consumers, homeowners, students, small businesses and

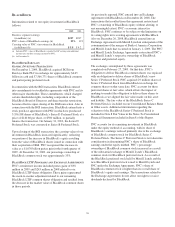

auto dealerships). In 2009, average total loans were $56.7

billion, an increase of $30.6 billion over 2008. In the current

environment, consumer and commercial loan demand is being

outpaced by refinances, paydowns, and charge-offs.

• Average commercial and commercial real estate

loans grew $7.3 billion compared with 2008. The

increase was primarily due to the National City

acquisition.

• Average home equity loans grew $14.1 billion over

2008. The majority of the increase is attributable to

the National City acquisition. Our home equity loan

portfolio is relationship based, with 96% of the

portfolio attributable to borrowers in our primary

geographic footprint. The nonperforming assets and

charge-offs that we have experienced are within our

expectations given current market conditions.

• Average education loans grew $3.6 billion compared

with 2008. The increase was due to the National City

acquisition and an increase in the core business. The

core business increase was primarily a result of the

transfer of approximately $1.8 billion of education

loans previously held for sale to the loan portfolio

during the first quarter of 2008. The education

lending business may be adversely impacted by the

proposed legislation surrounding guaranteed

education loans issued under the current Federal

program.

• Average credit card balances increased $2.0 billion

over 2008. The increase was primarily the result of

the National City acquisition and also reflected

legacy growth of 71% over 2008. Effective January

2010, we will consolidate in our financial statements

the securitized portfolio of approximately $1.6 billion

of credit card loans. See Impact of New Accounting

Guidance in 2010 in the Off-Balance Sheet

Arrangements and VIEs section of Item 7.

52