PNC Bank 2009 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

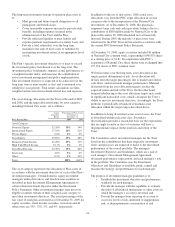

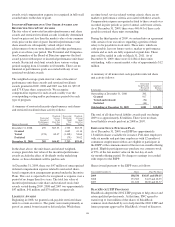

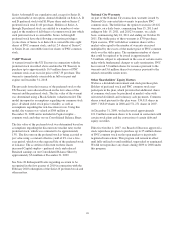

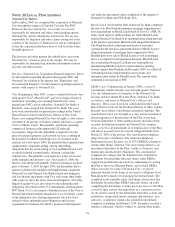

Derivatives Not Designated as Hedging Instruments

Gain (Loss) on Derivatives Recognized in Noninterest Income

In millions

Year Ended

December 31, 2009

Interest rate contracts $ 107

Foreign exchange contracts 71

Equity contracts 2

Credit contracts (59)

Other contracts (a) (178)

Total $ (57)

(a) Relates to BlackRock LTIP.

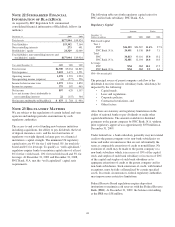

We write caps and floors for customers, risk management and

proprietary trading purposes. At December 31, 2009, the fair

value of the written caps and floors liability on our

Consolidated Balance Sheet was $15 million. Our ultimate

obligation under written options is based on future market

conditions and is only quantifiable at settlement. We manage

our market risk exposure from customer positions through

transactions with third-party dealers.

C

REDIT

D

ERIVATIVES

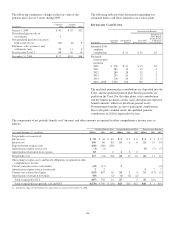

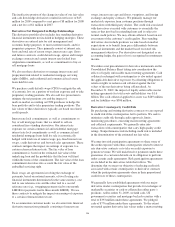

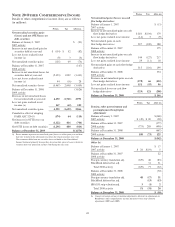

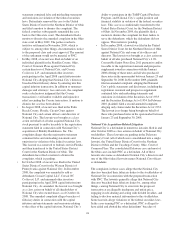

Credit Default Swaps

December 31, 2009

Dollars in millions

Notional

Amount

Estimated

Net Fair

Value

Weighted-

Average

Remaining

Maturity

In Years

Credit Default Swaps – Guarantor

Single name $ 85 $ (4) 3.18

Index traded 457 6.12

Total (a) $ 542 $ (4) 5.66

Credit Default Swaps – Beneficiary

Single name $ 586 $ 1 3.69

Index traded 460 53 35.89

Total (b) $1,046 $54 17.85

Total (c) $1,588 $50 13.69

(a) Includes $496 million notional of investment grade credit default swaps with a

rating of Baa3 or above and $46 million notional of subinvestment grade based on

published rating agency information.

(b) Includes $894 million notional of investment grade credit default swaps with a

rating of Baa3 or above and $152 million notional of subinvestment grade based on

published rating agency information.

(c) The referenced/underlying assets for these credit default swaps is approximately 66%

corporate debt, 29% commercial mortgage-backed securities and 5% related to loans.

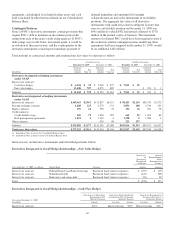

December 31, 2008

Dollars in millions

Notional

Amount

Estimated

Net Fair

Value

Weighted-

Average

Remaining

Maturity

In Years

Credit Default Swaps – Guarantor

Single name $ 278 $ (38) 3.84

Index traded 677 (42) 4.84

Total (a) $ 955 $ (80) 4.54

Credit Default Swaps – Beneficiary

Single name $ 974 $ 84 3.82

Index traded 1,008 201 31.82

Total (b) $1,982 $285 18.06

Total (c) $2,937 $205 13.67

(a) Includes $883 million notional of investment grade credit default swaps with a

rating of Baa3 or above and $72 million notional of subinvestment grade based on

published rating agency information.

(b) Includes $1.7 billion notional of investment grade credit default swaps with a rating

of Baa3 or above and $263 million notional of subinvestment grade based on

published rating agency information.

(c) The referenced/underlying assets for these credit default swaps is approximately 70%

corporate debt, 27% commercial mortgage-backed securities and 3% related to loans.

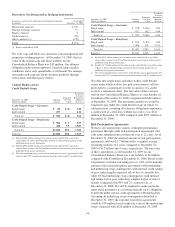

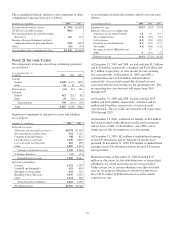

We enter into single name and index traded credit default

swaps under which we buy loss protection from or sell loss

protection to a counterparty for the occurrence of a credit

event of a referenced entity. The fair value of the contracts

sold on our Consolidated Balance Sheet was a net liability of

$4 million at December 31, 2009 compared with $80 million

at December 31, 2008. The maximum amount we would be

required to pay under the credit default swaps in which we

sold protection, assuming all reference obligations experience

a credit event at a total loss, without recoveries, was $542

million at December 31, 2009 compared with $955 million at

December 31, 2008.

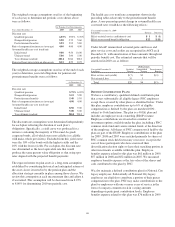

Risk Participation Agreements

We have also entered into various contingent performance

guarantees through credit risk participation agreements sold

with terms ranging from less than one year to 22 years. As of

December 31, 2009 the notional amount of risk participation

agreements sold was $1.7 billion with a weighted average

remaining maturity of 2 years compared to December 31,

2008 of $1.9 billion and 3 years, respectively. The fair value

of these agreements as of December 31, 2009 on our

Consolidated Balance Sheet was a net liability of $2 million

compared with $3 million at December 31, 2008. Based on the

Corporation’s internal risk rating process, 94% of the notional

amount of the risk participation agreements sold outstanding

had underlying swap counterparties with internal credit ratings

of pass, indicating the expected risk of loss is currently low,

while 6% had underlying swap counterparties with internal

risk ratings below pass, indicating a higher degree of risk of

default, compared with 98% and 2%, respectively, at

December 31, 2008. We will be required to make payments

under these guarantees if a customer defaults on its obligation

to perform under certain credit agreements with third parties.

Assuming all underlying swap counterparties defaulted at

December 31, 2009, the exposure from these agreements

would be $78 million based on the fair value of the underlying

swaps compared with $128 million at December 31, 2008.

148