PNC Bank 2009 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

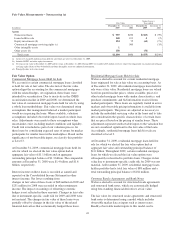

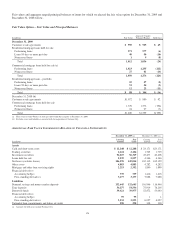

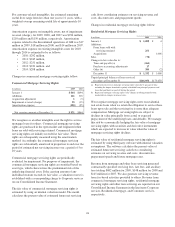

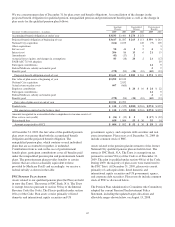

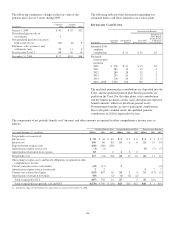

Retained interests in the credit card securitizations consist of

an interest-only strip, securities issued by the credit card

securitization QSPE, and sellers’ interest. The interest-only

strips are recognized in other assets on the Consolidated

Balance Sheet and totaled approximately $11 million at

December 31, 2009 and $20 million at December 31, 2008.

The asset-backed securities are recognized in investment

securities on the Consolidated Balance Sheet and totaled

approximately $105 million at December 31, 2009 and $25

million at December 31, 2008. These retained interests

represent the maximum exposure to loss associated with our

involvement in these securitizations.

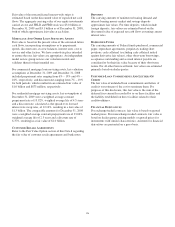

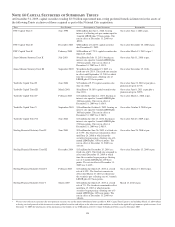

Sellers’ interest, which is recognized in loans on the

Consolidated Balance Sheet, represents our pro-rata undivided

interest in the credit card receivables in the QSPE. At

December 31, 2009 and December 31, 2008, sellers’ interest

totaled $746 million and $315 million, respectively. Our

sellers’ interest ranks equally with the investor’s interest in the

QSPE. In general, the carrying amount of sellers’ interest

varies as the amount of assets in the QSPE fluctuates due to

customer payments, purchases, cash advances, and credit

losses. The carrying amount of sellers’ interest is also affected

by the reduction of the invested or securitized receivables in

the QSPE when a securitization series matures and the

previously securitized receivables are not removed from the

QSPE or re-securitized in a new transaction. Accordingly, the

increase in sellers’ interest at December 31, 2009 was

primarily attributed to the maturity of the 2008-1 and 2008-2

series coupled with no new credit card securitizations

consummated during 2009. We are required to maintain

seller’s interest at a minimum level of 5% of the initial

invested amount in each series to ensure sufficient assets are

available for allocation to the investors’ interests. Sellers’

interest was well above the minimum level at December 31,

2009 and 2008.

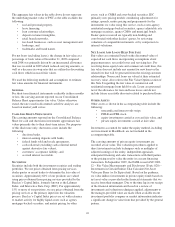

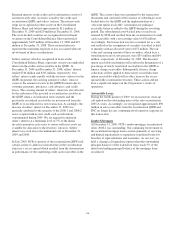

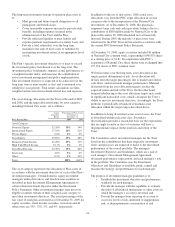

In July 2009, NCB as sponsor of the securitization QSPE took

certain actions to address recent declines in the securitization

structure’s excess spread which resulted from the deterioration

in performance of the underlying credit card receivables in the

QSPE. The actions taken were permitted by the transaction

documents and consisted of the issuance of subordinate asset-

backed notes by the QSPE and the implementation of a

“discount option receivable” mechanism for principal

receivable balances added to the QSPE during the revolving

period. The subordinated asset-backed notes issued were

retained by NCB and resulted from the securitization of credit

card receivables with a net carrying value of $78 million.

Accordingly, this transaction was not accounted for as a sale

and resulted in the recognition of securities classified as held

to maturity with an allocated value of $72 million. The fair

value and carrying amount of these securities, which have a

stated interest rate of zero percent, were $55 million and $64

million, respectively, at December 31, 2009. The discount

option receivable mechanism will result in the designation of a

percentage of newly transferred receivables to the QSPE as

finance charge receivables. Subsequently, finance charge

collections will be applied to these newly created discount

option receivables which will in effect increase the excess

spread in the securitization structure. These actions did not

have a significant impact on the Corporation’s results of

operations.

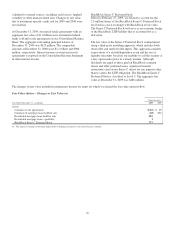

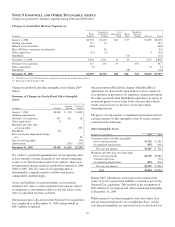

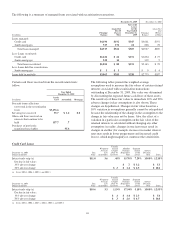

Automobile Loans

During the fourth quarter of 2009, we exercised our clean-up

call option on the outstanding notes of the auto securitization

2005-A series. Accordingly, we recognized approximately $96

million in auto receivables from the securitization QSPE and

PNC no longer has any continuing involvement or exposure in

this transaction.

Jumbo Mortgages

At December 31, 2009, NCB’s jumbo mortgage securitization

series 2008-1 was outstanding. Our continuing involvement in

the securitized mortgage loans consists primarily of servicing

and limited requirements to repurchase transferred loans for

breaches of representations and warranties. As servicer, we

hold a cleanup call repurchase option when the outstanding

principal balances of the transferred loans reach 5% of the

initial outstanding principal balance of the mortgage loans

securitized.

130