PNC Bank 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

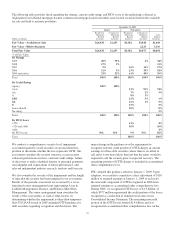

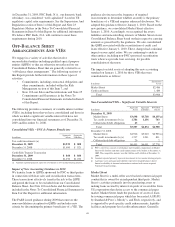

Market Street mitigates its potential interest rate risk by

entering into agreements with its borrowers that reflect

interest rates based upon its weighted average commercial

paper cost of funds. During 2008 and 2009, Market Street met

all of its funding needs through the issuance of commercial

paper.

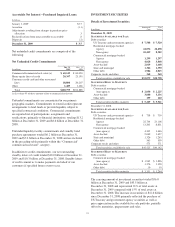

Market Street commercial paper outstanding was $3.1 billion

at December 31, 2009 and $4.4 billion at December 31, 2008.

The weighted average maturity of the commercial paper was

36 days at December 31, 2009 and 24 days at December 31,

2008.

Effective October 28, 2008, Market Street was approved to

participate in the Federal Reserve’s CPFF authorized under

Section 13(3) of the Federal Reserve Act. The CPFF

commitment to purchase up to $5.4 billion of three-month

Market Street commercial paper expired on February 1, 2010.

Market Street had no borrowings under this facility at

December 31, 2009 or during the year then ended.

During 2009, PNC Capital Markets, acting as a placement

agent for Market Street, held a maximum daily position in

Market Street commercial paper of $135 million with an

average balance of $19 million. This compares with a

maximum daily position of $75 million with an average

balance of $12 million during 2008. PNC Capital Markets

owned no Market Street commercial paper at December 31,

2009 and December 31, 2008. PNC Bank, N.A. made no

purchases of Market Street commercial paper during 2009.

PNC Bank, N.A. provides certain administrative services, the

program-level credit enhancement and all of the liquidity

facilities to Market Street in exchange for fees negotiated

based on market rates. Program administrator fees related to

PNC’s portion of liquidity facilities were $43 million for 2009

and $21 million for 2008. Commitment fees related to PNC’s

portion of the liquidity facilities for 2009 and 2008 were

insignificant.

The commercial paper obligations at December 31, 2009 and

December 31, 2008 were effectively collateralized by Market

Street’s assets. While PNC may be obligated to fund under the

$5.6 billion of liquidity facilities for events such as

commercial paper market disruptions, borrower bankruptcies,

collateral deficiencies or covenant violations, our credit risk

under the liquidity facilities is secondary to the risk of first

loss provided by the borrower or another third party in the

form of deal-specific credit enhancement, such as by the over-

collateralization of the assets. Deal-specific credit

enhancement that supports the commercial paper issued by

Market Street is generally structured to cover a multiple of

expected losses for the pool of assets and is sized to generally

meet rating agency standards for comparably structured

transactions. In addition, PNC would be required to fund $.4

billion of the liquidity facilities if the underlying assets are in

default. See Note 25 Commitments And Guarantees included

in the Notes To Consolidated Financial Statements of this

Report for additional information.

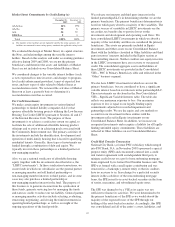

PNC provides program-level credit enhancement to cover net

losses in the amount of 10% of commitments, excluding

explicitly rated AAA/Aaa facilities. PNC provides 100% of

the enhancement in the form of a cash collateral account

funded by a loan facility. This facility expires in March 2013.

Market Street has entered into a Subordinated Note Purchase

Agreement (Note) with an unrelated third party. The Note

provides first loss coverage whereby the investor absorbs

losses up to the amount of the Note, which was $8.0 million as

of December 31, 2009. Proceeds from the issuance of the Note

are held by Market Street in a first loss reserve account that

will be used to reimburse any losses incurred by Market

Street, PNC Bank, N.A. or other providers under the liquidity

facilities and the credit enhancement arrangements.

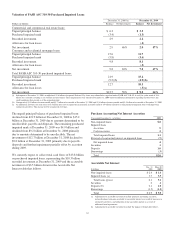

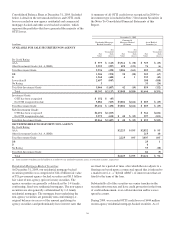

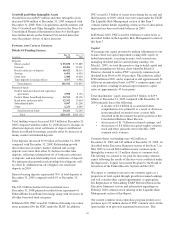

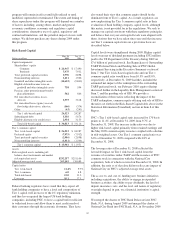

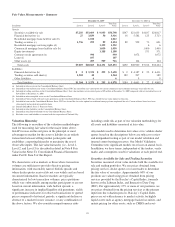

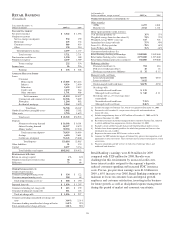

Assets of Market Street (a)

In millions Outstanding Commitments

Weighted

Average

Remaining

Maturity

In Years

December 31, 2009

Trade receivables $1,551 $4,105 2.01

Automobile financing 480 480 4.20

Auto fleet leasing 412 543 .85

Collateralized loan

obligations 126 150 .36

Residential mortgage 13 13 26.01

Other 534 567 1.65

Cash and miscellaneous

receivables 582

Total $3,698 $5,858 2.06

December 31, 2008

Trade receivables $1,516 $3,370 2.34

Automobile financing 992 992 3.94

Auto fleet leasing 473 560 1.34

Collateralized loan

obligations 306 405 1.58

Credit cards 400 400 .19

Residential mortgage 14 14 27.00

Other 695 765 2.06

Cash and miscellaneous

receivables 520

Total $4,916 $6,506 2.34

(a) Market Street did not recognize an asset impairment charge or experience any

material rating downgrades during 2008 or 2009.

41