PNC Bank 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A

SSET

M

ANAGEMENT

G

ROUP

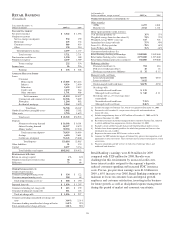

(Unaudited)

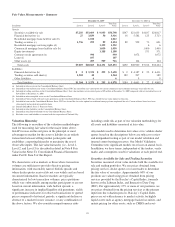

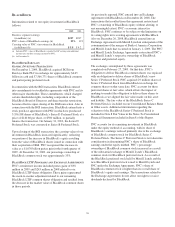

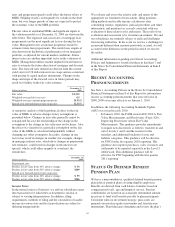

Year ended December 31

Dollars in millions except as noted 2009 (a) 2008 (b)

I

NCOME

S

TATEMENT

Net interest income $ 308 $ 130

Noninterest income 611 429

Total revenue 919 559

Provision for credit losses 97 6

Noninterest expense 654 363

Pretax earnings 168 190

Income taxes 63 71

Earnings $ 105 $ 119

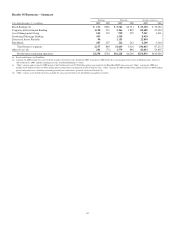

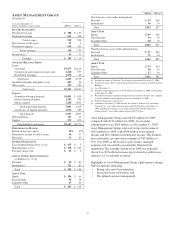

A

VERAGE

B

ALANCE

S

HEET

Loans

Consumer $3,957 $2,136

Commercial and commercial real estate 1,648 577

Residential mortgage 1,078 66

Total loans 6,683 2,779

Goodwill and other intangible assets 407 39

Other assets 251 183

Total assets $7,341 $3,001

Deposits

Noninterest-bearing demand $1,091 $ 859

Interest-bearing demand 1,582 700

Money market 3,208 1,855

Total transaction deposits 5,881 3,414

Certificates of deposit and other 1,076 589

Total deposits 6,957 4,003

Other liabilities 111 12

Capital 575 255

Total liabilities and equity $7,643 $4,270

P

ERFORMANCE

R

ATIOS

Return on average capital 18% 47%

Noninterest income to total revenue 66 77

Efficiency 71 65

O

THER

I

NFORMATION

Total nonperforming assets (c) (d) $ 155 $5

Impaired loans (c) (e) $ 198 $ 225

Total net charge-offs $63$2

A

SSETS

U

NDER

A

DMINISTRATION

(in billions) (c) (f) (g)

Personal $94$61

Institutional 111 83

Total $ 205 $ 144

A

SSET

T

YPE

Equity $ 100 $60

Fixed Income 58 38

Liquidity/Other 47 46

Total $ 205 $ 144

2009 (a) 2008 (b)

Discretionary assets under management

Personal $67 $38

Institutional 36 19

Total $103 $57

A

SSET

T

YPE

Equity $49 $26

Fixed Income 34 19

Liquidity/Other 20 12

Total $103 $57

Nondiscretionary assets under administration

Personal $27 $23

Institutional 75 64

Total $102 $87

A

SSET

T

YPE

Equity $51 $34

Fixed Income 24 19

Liquidity/Other 27 34

Total $102 $87

(a) Includes the impact of National City, which we acquired on December 31, 2008.

(b) Includes the legacy PNC wealth management business previously included in Retail

Banking.

(c) As of December 31.

(d) Includes nonperforming loans of $149 million at December 31, 2009 and $5 million

at December 31, 2008.

(e) Recorded investment of purchased impaired loans related to National City, adjusted

to reflect additional loan impairments effective December 31, 2008.

(f) Excludes brokerage account assets.

(g) Amounts at December 31, 2008 exclude the impact of National City. Including

National City, assets under administration totaled $228 billion at December 31,

2008, including discretionary assets under management of $103 billion and

nondiscretionary assets under administration of $125 billion.

Asset Management Group earned $105 million for 2009

compared with $119 million for 2008. Assets under

administration were $205 billion as of December 31, 2009.

Asset Management Group achieved strong total revenue of

$919 million for 2009, with $308 million in net interest

income and $611 million in noninterest income. The business

increased pretax, pre-provision earnings by $69 million or

35% over 2008, as the business grew clients, managed

expenses and successfully executed the National City

integration. The earnings decline from 2008 was primarily

driven by a $91 million increase in provision for credit losses

reflective of a weakened economy.

Highlights of Asset Management Group’s performance during

2009 include the following:

• Strong sales and client retention,

• Increased client satisfaction, and

• Disciplined expense management.

55