PNC Bank 2009 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

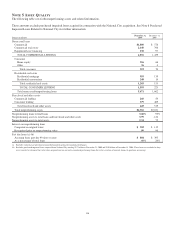

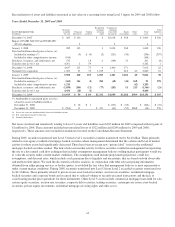

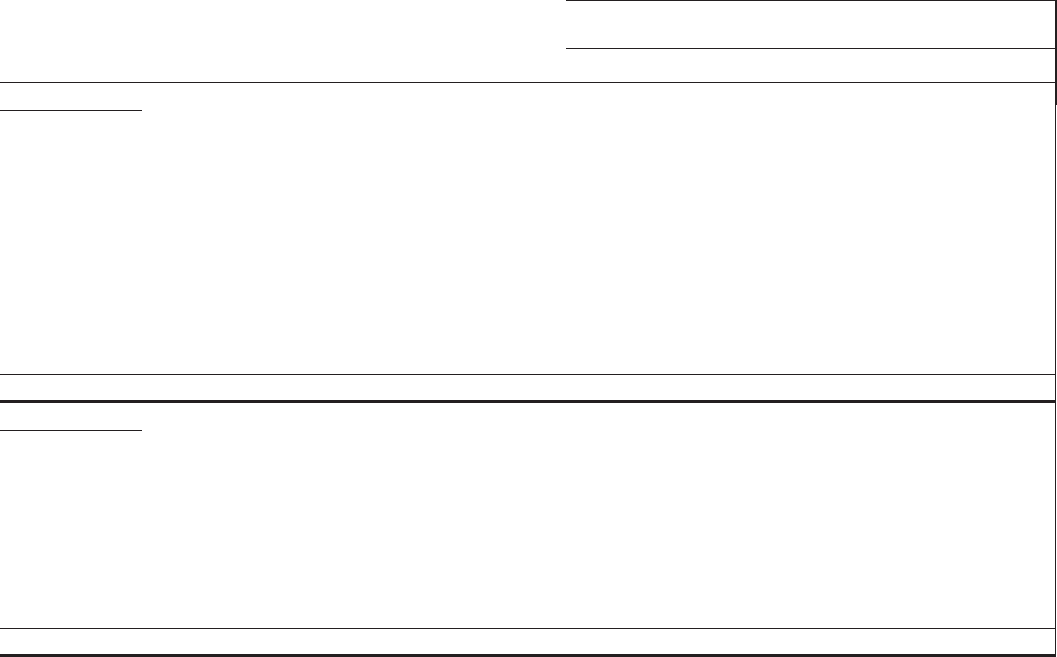

The fair value of investment securities is impacted by interest rates, credit spreads, market volatility and liquidity conditions. Net

unrealized gains and losses in the securities available for sale portfolio are included in shareholders’ equity as accumulated other

comprehensive income or loss, net of tax, unless credit-related.

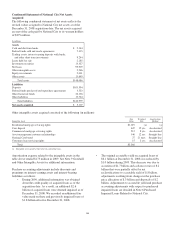

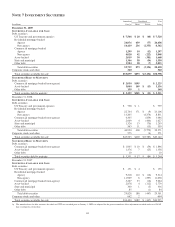

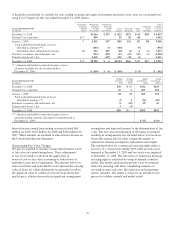

The following table presents gross unrealized loss and fair value of debt securities available for sale at December 31, 2009 and

December 31, 2008. The securities are segregated between investments that have been in a continuous unrealized loss position for

less than twelve months and twelve months or more based on the point in time the fair value declined below the amortized cost

basis. The table includes debt securities where a portion of OTTI has been recognized in accumulated other comprehensive loss.

The gross unrealized loss on debt securities held to maturity was $13 million at December 31, 2009 with the majority of positions

in a continuous loss position for less than 12 months.

Unrealized loss

position less than

12 months

Unrealized loss

position 12 months

or more Total

In millions

Unrealized

Loss

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Fair

Value

December 31, 2009

Securities available for sale

Debt securities

US Treasury and government agencies $ (48) $ 4,015 $ (48) $ 4,015

Residential mortgage-backed

Agency (76) 6,960 $ (1) $ 56 (77) 7,016

Non-agency (7) 79 (2,346) 7,223 (2,353) 7,302

Commercial mortgage-backed

Agency (12) 779 (12) 779

Non-agency (3) 380 (219) 1,353 (222) 1,733

Asset-backed (1) 142 (380) 1,153 (381) 1,295

State and municipal (1) 49 (53) 285 (54) 334

Other debt (3) 299 (4) 18 (7) 317

Total $ (151) $12,703 $(3,003) $10,088 $(3,154) $22,791

December 31, 2008

Securities available for sale

Debt securities

Residential mortgage-backed

Agency $ (1) $ 49 $ (8) $ 188 $ (9) $ 237

Non-agency (1,774) 3,570 (2,600) 3,683 (4,374) 7,253

Commercial mortgage-backed (non-agency) (482) 2,207 (377) 1,184 (859) 3,391

Asset-backed (102) 523 (344) 887 (446) 1,410

State and municipal (56) 370 (20) 26 (76) 396

Other debt (11) 185 (4) 8 (15) 193

Total $(2,426) $ 6,904 $(3,353) $ 5,976 $(5,779) $12,880

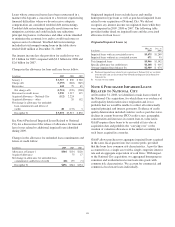

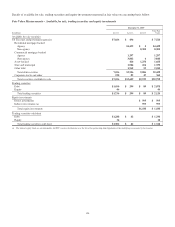

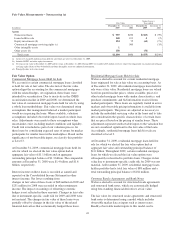

Evaluating Investments for Other-than-Temporary

Impairments

For the securities in the above table, we do not intend to sell

and have determined it is not more likely than not we will be

required to sell the security prior to recovery of the amortized

cost basis.

On at least a quarterly basis, we conduct a comprehensive

security-level assessment on all securities in an unrealized loss

position to determine if OTTI exists. An unrealized loss exists

when the current fair value of an individual security is less

than its amortized cost basis. Under the current OTTI

accounting model for debt securities, which was amended by

the FASB and adopted by PNC effective January 1, 2009, an

OTTI loss must be recognized for a debt security in an

unrealized loss position if we intend to sell the security or it is

more likely than not we will be required to sell the security

prior to recovery of its amortized cost basis. In this situation,

the amount of loss recognized in income is equal to the

difference between the fair value and the amortized cost basis

of the security. Even if we do not expect to sell the security,

we must evaluate the expected cash flows to be received to

determine if we believe a credit loss has occurred. In the event

of a credit loss, only the amount of impairment associated

with the credit loss is recognized in income. The portion of the

unrealized loss relating to other factors, such as liquidity

conditions in the market or changes in market interest rates, is

recorded in accumulated other comprehensive loss.

Equity securities are also evaluated to determine whether

the unrealized loss is expected to be recoverable based on

whether evidence exists to support a realizable value equal to

or greater than the amortized cost basis. If it is probable that

we will not recover the amortized cost basis, taking into

114