PNC Bank 2009 Annual Report Download - page 129

Download and view the complete annual report

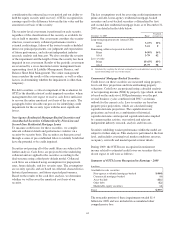

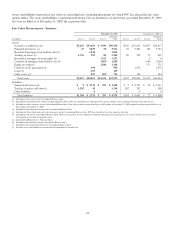

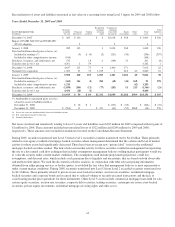

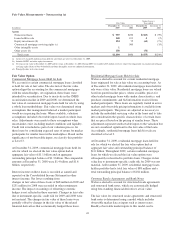

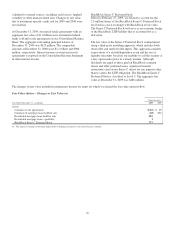

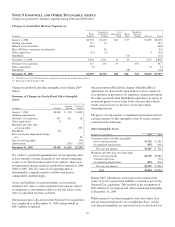

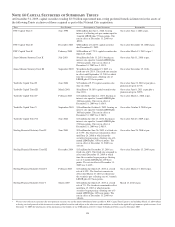

Please find page 129 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The aggregate fair values in the table above do not represent

the underlying market value of PNC as the table excludes the

following:

• real and personal property,

• lease financing,

• loan customer relationships,

• deposit customer intangibles,

• retail branch networks,

• fee-based businesses, such as asset management and

brokerage, and

• trademarks and brand names.

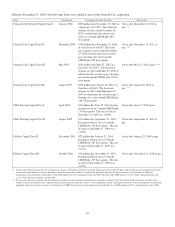

For net loans (excluding leases), the change in fair value as a

percentage of book value at December 31, 2009 compared

with 2008 was primarily driven by an incremental allowance

that was recorded in 2009 which reduced carrying amounts, as

well as a decrease in swap rates that are utilized in discounting

cash flows which increased fair values.

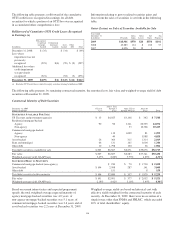

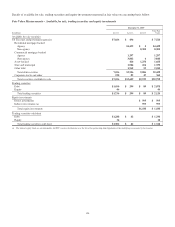

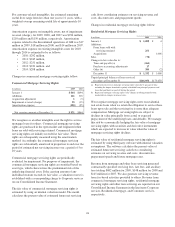

We used the following methods and assumptions to estimate

fair value amounts for financial instruments.

G

ENERAL

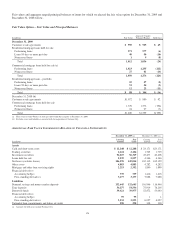

For short-term financial instruments realizable in three months

or less, the carrying amount reported on our Consolidated

Balance Sheet approximates fair value. Unless otherwise

stated, the rates used in discounted cash flow analyses are

based on market yield curves.

C

ASH

A

ND

S

HORT

-T

ERM

A

SSETS

The carrying amounts reported on the Consolidated Balance

Sheet for cash and short-term investments approximate fair

values primarily due to their short-term nature. For purposes

of this disclosure only, short-term assets include the

following:

• due from banks,

• interest-earning deposits with banks,

• federal funds sold and resale agreements,

• cash collateral (excluding cash collateral netted

against derivative fair values),

• customers’ acceptance liability, and

• accrued interest receivable.

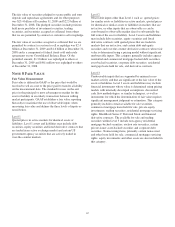

S

ECURITIES

Securities include both the investment securities and trading

portfolios. We use prices obtained from pricing services,

dealer quotes or recent trades to determine the fair value of

securities. Approximately 60% of our positions are valued

using prices obtained from pricing services provided by the

Barclay’s Capital Index, formerly known as the Lehman

Index, and Interactive Data Corp. (IDC). For approximately

15% or more of our positions, we use prices obtained from the

pricing services as the primary input into the valuation

process. Barclay’s Capital Index prices are set with reference

to market activity for highly liquid assets such as agency

mortgage-backed securities, and matrix pricing for other

assets, such as CMBS and asset-backed securities. IDC

primarily uses pricing models considering adjustments for

ratings, spreads, matrix pricing and prepayments for the

instruments we value using this service, such as non-agency

residential mortgage-backed securities, agency adjustable rate

mortgage securities, agency CMOs and municipal bonds.

Dealer quotes received are typically non-binding and

corroborated with other dealers’ quotes, by reviewing

valuations of comparable instruments, or by comparison to

internal valuations.

N

ET

L

OANS

A

ND

L

OANS

H

ELD

F

OR

S

ALE

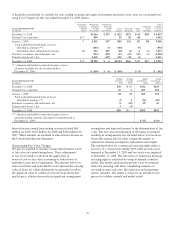

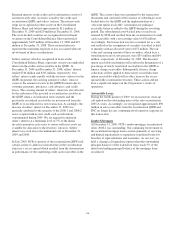

Fair values are estimated based on the discounted value of

expected net cash flows incorporating assumptions about

prepayment rates, net credit losses and servicing fees. For

revolving home equity loans and commercial credit lines, this

fair value does not include any amount for new loans or the

related fees that will be generated from the existing customer

relationships. Nonaccrual loans are valued at their estimated

recovery value. Also refer to the Fair Value Option section of

this Note 8 regarding the fair value of commercial and

residential mortgage loans held for sale. Loans are presented

net of the allowance for loan and lease losses and do not

include future accretable discounts related to purchased loans.

O

THER

A

SSETS

Other assets as shown in the accompanying table include the

following:

• noncertificated interest-only strips,

• FHLB and FRB stock,

• equity investments carried at cost and fair value, and

• private equity investments carried at fair value.

Investments accounted for under the equity method, including

our investment in BlackRock, are not included in the

accompanying table.

The carrying amounts of private equity investments are

recorded at fair value. The valuation procedures applied to

direct investments include techniques such as multiples of

adjusted earnings of the entity, independent appraisals,

anticipated financing and sales transactions with third parties,

or the pricing used to value the entity in a recent financing

transaction. In September 2009, the FASB issued ASU 2009-

12 – Fair Value Measurements and Disclosures (Topic 820) –

Investments in Certain Entities That Calculate Net Asset

Value per Share (or Its Equivalent). Based on the guidance,

we value indirect investments in private equity funds based on

net asset value as provided in the financial statements that we

receive from their managers. Due to the time lag in our receipt

of the financial information and based on a review of

investments and valuation techniques applied, adjustments to

the manager-provided value are made when available recent

investment portfolio company or market information indicates

a significant change in value from that provided by the general

partner.

125