PNC Bank 2009 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

agreement, cash pledged is included in other assets and cash

held is included in other borrowed funds on our Consolidated

Balance Sheet.

Contingent Features

Some of PNC’s derivative instruments contain provisions that

require PNC’s debt to maintain an investment grade credit

rating from each of the major credit rating agencies. If PNC’s

debt ratings were to fall below investment grade, it would be

in violation of these provisions, and the counterparties to the

derivative instruments could request immediate payment or

demand immediate and ongoing full overnight

collateralization on derivative instruments in net liability

positions. The aggregate fair value of all derivative

instruments with credit-risk-related contingent features that

were in a net liability position on December 31, 2009 was

$941 million for which PNC had posted collateral of $776

million in the normal course of business. The maximum

amount of collateral PNC would have been required to post if

the credit-risk-related contingent features underlying these

agreements had been triggered on December 31, 2009, would

be an additional $165 million.

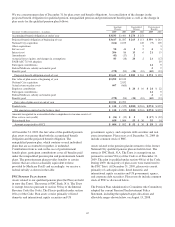

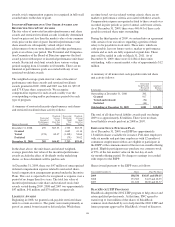

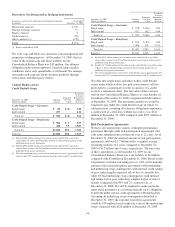

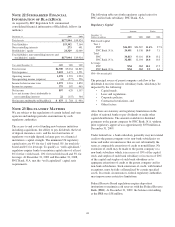

Total notional or contractual amounts and estimated net fair values for derivatives follow:

Asset Derivatives Liability Derivatives

December 31, 2009 December 31, 2008 December 31, 2009 December 31, 2008

In millions

Notional/

Contract

Amount

Fair

Value (a)

Notional/

Contract

Amount

Fair

Value (a)

Notional/

Contract

Amount

Fair

Value (b)

Notional/

Contract

Amount

Fair

Value (b)

Derivatives designated as hedging instruments

under GAAP

Interest rate contracts:

Cash flow hedges $ 6,394 $ 32 $ 5,618 $ 527 $ 7,011 $ 95

Fair value hedges 13,048 707 8,975 889 $ 913 $ 1

Subtotal $ 19,442 $ 739 $ 14,593 $1,416 $ 7,011 $ 95 $ 913 $ 1

Derivatives not designated as hedging instruments

under GAAP

Interest rate contracts $149,463 $2,963 $132,827 $6,351 $ 98,423 $3,110 $88,724 $5,573

Foreign exchange contracts 4,208 123 4,272 331 3,836 108 4,749 323

Equity contracts 195 16 520 72 156 16 503 76

Credit contracts:

Credit default swaps 926 72 1,936 287 662 22 1,001 82

Risk participation agreements 1,091 3 1,350 3 1,728 2 1,940 3

Other contracts 438 44 211 275

Subtotal $155,883 $3,177 $141,343 $7,088 $105,016 $3,533 $96,917 $6,057

Total gross derivatives $175,325 $3,916 $155,936 $8,504 $112,027 $3,628 $97,830 $6,058

(a) Included in Other Assets on the Consolidated Balance Sheet.

(b) Included in Other Liabilities on the Consolidated Balance Sheet.

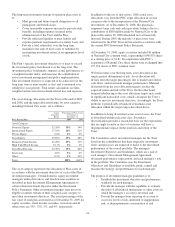

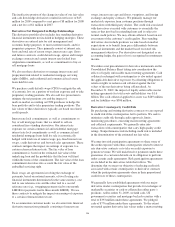

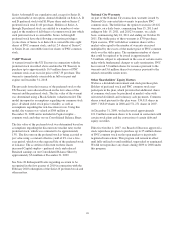

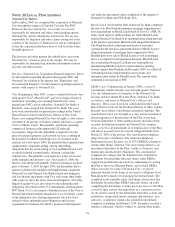

Gains (losses) on derivative instruments and related hedged items follow:

Derivatives Designated in GAAP Hedge Relationships – Fair Value Hedges

Gain (Loss)

on

Derivatives

Recognized

in Income

Gain on

Related Hedged

Items

Recognized in

Income

Year ended Dec. 31, 2009 - in millions Hedged Items Location Amount Amount

Interest rate contracts Federal Home Loan Bank borrowings Borrowed funds (interest expense) $ (107) $ 109

Interest rate contracts Subordinated debt Borrowed funds (interest expense) (447) 398

Interest rate contracts Bank notes and senior debt Borrowed funds (interest expense) (24) 28

Total $ (578) $ 535

Derivatives Designated in GAAP Hedge Relationships – Cash Flow Hedges

Year ended December 31, 2009

In millions

Gain (Loss) on Derivatives

Recognized in OCI

(Effective Portion)

Gain (Loss) Reclassified from

Accumulated OCI into Income

(Effective Portion)

Gain (Loss) Recognized in

Income on Derivatives,

Ineffective Portion

Amount Location Amount Location Amount

Interest rate contracts $(12) Interest income $319 Interest income $(2)

147