PNC Bank 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

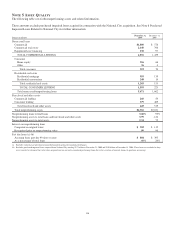

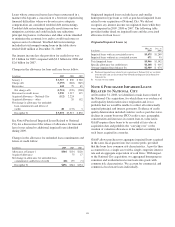

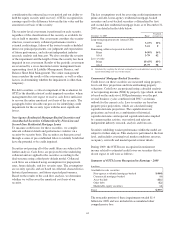

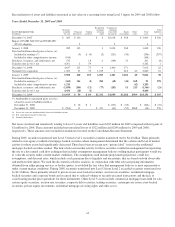

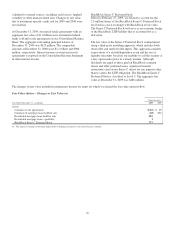

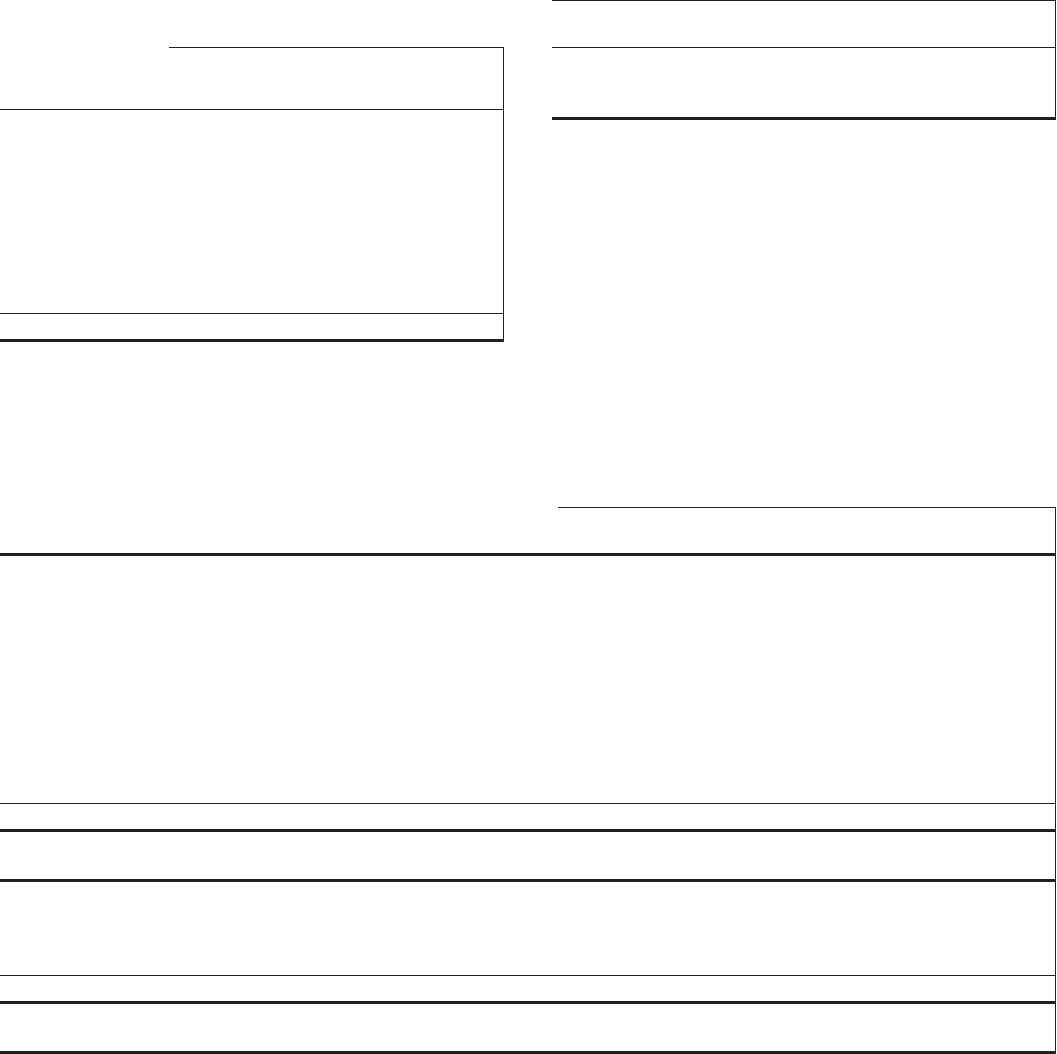

The following table presents a rollforward of the cumulative

OTTI credit losses recognized in earnings for all debt

securities for which a portion of an OTTI loss was recognized

in accumulated other comprehensive loss:

Rollforward of Cumulative OTTI Credit Losses Recognized

in Earnings (a)

In millions

Non-agency

residential

mortgage-

backed

Commercial

mortgage-

backed

Asset-

backed

Other

debt Total

December 31, 2008 $ (35) $ (34) $ (69)

Loss where

impairment was not

previously

recognized (223) $(6) (59) $ (9) (297)

Additional loss where

credit impairment

was previously

recognized (221) (52) (3) (276)

December 31, 2009 $(479) $(6) $(145) $(12) $(642)

(a) Excludes OTTI credit losses related to equity securities totaling $4 million in 2009.

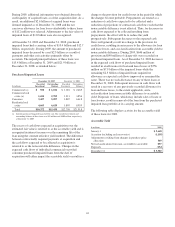

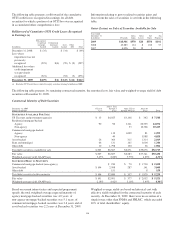

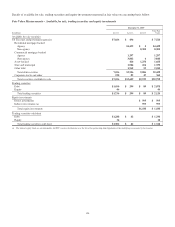

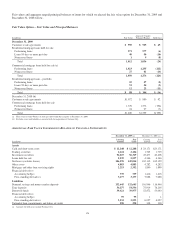

Information relating to gross realized securities gains and

losses from the sales of securities is set forth in the following

table.

Gains (Losses) on Sales of Securities Available for Sale

Year ended

December 31

In millions Proceeds

Gross

Gains

Gross

Losses

Net

Gains

Tax

Expense

2009 $18,901 $570 $20 $550 $192

2008 10,283 114 8 106 37

2007 6,056 20 19 1

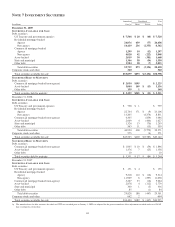

The following table presents, by remaining contractual maturity, the amortized cost, fair value and weighted-average yield of debt

securities at December 31, 2009.

Contractual Maturity of Debt Securities

December 31, 2009

Dollars in millions

1 Year or

Less

After 1 Year

through 5

Years

After 5 Years

through 10 Years

After 10

Years Total

S

ECURITIES

A

VAILABLE

F

OR

S

ALE

US Treasury and government agencies $ 33 $4,025 $3,148 $ 342 $ 7,548

Residential mortgage-backed

Agency 90 90 1,341 22,555 24,076

Non-agency 53 10,366 10,419

Commercial mortgage-backed

Agency 119 1,099 81 1,299

Non-agency 40 3,988 4,028

Asset-backed 26 364 315 1,314 2,019

State and municipal 46 131 165 1,004 1,346

Other debt 10 1,798 150 26 1,984

Total debt securities available for sale $ 205 $6,567 $6,271 $39,676 $52,719

Fair value $ 207 $6,607 $6,283 $37,341 $50,438

Weighted-average yield, GAAP basis 3.47% 2.82% 3.75% 4.65% 4.31%

S

ECURITIES

H

ELD TO

M

ATURITY

Commercial mortgage-backed (non-agency) $ 230 $ 70 $ 1,730 $ 2,030

Asset-backed $ 104 2,508 287 141 3,040

Other debt 151 8 159

Total debt securities held to maturity $ 104 $2,889 $ 357 $ 1,879 $ 5,229

Fair value $ 101 $2,991 $ 377 $ 2,052 $ 5,521

Weighted-average yield, GAAP basis 2.18% 4.02% 2.18% 5.45% 4.30%

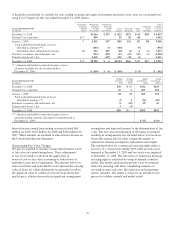

Based on current interest rates and expected prepayment

speeds, the total weighted-average expected maturity of

agency mortgage-backed securities was 4.0 years, of

non-agency mortgage-backed securities was 5.1 years, of

commercial mortgage-backed securities was 3.4 years and of

asset-backed securities was 2.2 years at December 31, 2009.

Weighted-average yields are based on historical cost with

effective yields weighted for the contractual maturity of each

security. At December 31, 2009, there were no securities of a

single issuer, other than FNMA and FHLMC, which exceeded

10% of total shareholders’ equity.

116