PNC Bank 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

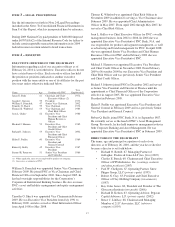

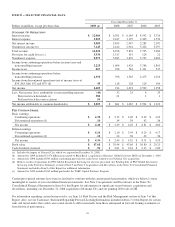

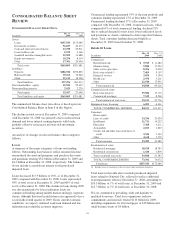

At or for the year ended December 31

Dollars in millions, except as noted 2009 (a) 2008 (b) 2007 2006 2005

B

ALANCE

S

HEET

H

IGHLIGHTS

Assets $269,863 $291,081 $138,920 $101,820 $91,954

Loans 157,543 175,489 68,319 50,105 49,101

Allowance for loan and lease losses 5,072 3,917 830 560 596

Interest-earning deposits with banks 4,488 14,859 346 339 669

Investment securities 56,027 43,473 30,225 23,191 20,710

Loans held for sale 2,539 4,366 3,927 2,366 2,449

Goodwill and other intangible assets 12,909 11,688 9,551 4,043 4,466

Equity investments (c) 10,254 8,554 6,045 5,330 1,323

Noninterest-bearing deposits 44,384 37,148 19,440 16,070 14,988

Interest-bearing deposits 142,538 155,717 63,256 50,231 45,287

Total deposits 186,922 192,865 82,696 66,301 60,275

Borrowed funds (d) 39,261 52,240 30,931 15,028 16,897

Shareholders’ equity 29,942 25,422 14,854 10,788 8,563

Common shareholders’ equity 22,011 17,490 14,847 10,781 8,555

A

SSETS

U

NDER

A

DMINISTRATION

(billions)

Discretionary assets under management (e) $ 103 $ 103 $ 74 $ 55 $ 495

Nondiscretionary assets under management 102 125 112 85 83

Total assets under administration $ 205 $ 228 $ 186 $ 140 $ 578

S

ELECTED

R

ATIOS

From continuing operations

Noninterest income to total revenue 44 39 50 70 60

Efficiency 56 59 62 49 67

From net income

Net interest margin (f) 3.82% 3.37% 3.00% 2.92% 3.00%

Return on

Average common shareholders’ equity 9.78 6.52 10.70 28.01 17.00

Average assets .87 .64 1.21 2.74 1.53

Loans to deposits 84 91 83 76 81

Dividend payout 21.4 104.6 55.0 24.4 43.4

Tier 1 risk-based 11.4 9.7 6.8 10.4 8.3

Tier 1 common 6.0 4.8 5.4 8.7 6.1

Common shareholders’ equity to total assets 8.2 6.0 10.7 10.6 9.3

Average common shareholders’ equity to average assets 7.2 9.6 11.3 9.8 9.0

S

ELECTED

S

TATISTICS

Employees 55,820 59,595 28,320 23,783 25,348

Retail Banking branches 2,512 2,580 1,102 848 835

ATMs 6,473 6,233 3,900 3,581 3,721

Residential mortgage servicing portfolio (billions) $ 158 $ 187

Commercial mortgage servicing portfolio (billions) $ 287 $ 270 $ 243 $ 200 $ 136

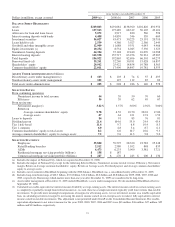

(a) Includes the impact of National City, which we acquired on December 31, 2008.

(b) Includes the impact of National City except for the following Selected Ratios: Noninterest income to total revenue, Efficiency, Net interest

margin, Return on Average common shareholders’ equity, Return on Average assets, Dividend payout, and Average common shareholders’

equity to average assets.

(c) Includes our investment in BlackRock beginning with the 2006 balance. BlackRock was a consolidated entity at December 31, 2005.

(d) Includes long-term borrowings of $26.3 billion, $33.6 billion, $12.6 billion, $6.6 billion and $6.8 billion for 2009, 2008, 2007, 2006 and

2005, respectively. Borrowings which mature more than one year after December 31, 2009 are considered to be long-term.

(e) Assets under management at December 31, 2005 include BlackRock’s assets under management. We deconsolidated BlackRock effective

September 29, 2006.

(f) Calculated as taxable-equivalent net interest income divided by average earning assets. The interest income earned on certain earning assets

is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than taxable

investments. To provide more meaningful comparisons of margins for all earning assets, we use net interest income on a taxable-equivalent

basis in calculating net interest margin by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest

income earned on taxable investments. This adjustment is not permitted under GAAP on the Consolidated Income Statement. The taxable-

equivalent adjustments to net interest income for the years 2009, 2008, 2007, 2006 and 2005 were $65 million, $36 million, $27 million, $25

million and $33 million, respectively.

21