PNC Bank 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

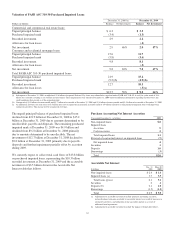

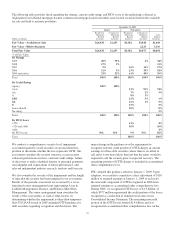

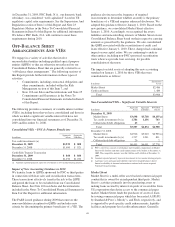

Accretable Net Interest – Purchased Impaired Loans

In billions

January 1, 2009 $3.7

Accretion (1.1)

Adjustments resulting from changes in purchase price

allocation .3

Reclassifications from nonaccretable to accretable .8

Disposals (.2)

December 31, 2009 $ 3.5

Net unfunded credit commitments are comprised of the

following:

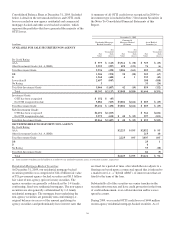

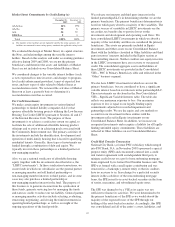

Net Unfunded Credit Commitments

In millions

Dec. 31

2009

Dec. 31

2008

Commercial/commercial real estate (a) $ 60,143 $ 60,020

Home equity lines of credit 20,367 23,195

Consumer credit card and other unsecured

lines 18,800 20,207

Other 1,485 1,466

Total $100,795 $104,888

(a) Less than 4% of these amounts relate to commercial real estate.

Unfunded commitments are concentrated in our primary

geographic markets. Commitments to extend credit represent

arrangements to lend funds or provide liquidity subject to

specified contractual conditions. Commercial commitments

are reported net of participations, assignments and

syndications, primarily to financial institutions, totaling $13.2

billion at December 31, 2009 and $8.6 billion at December 31,

2008.

Unfunded liquidity facility commitments and standby bond

purchase agreements totaled $6.2 billion at December 31,

2009 and $7.0 billion at December 31, 2008 and are included

in the preceding table primarily within the “Commercial/

commercial real estate” category.

In addition to credit commitments, our net outstanding

standby letters of credit totaled $10.0 billion at December 31,

2009 and $10.3 billion at December 31, 2008. Standby letters

of credit commit us to make payments on behalf of our

customers if specified future events occur.

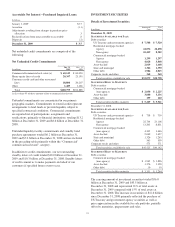

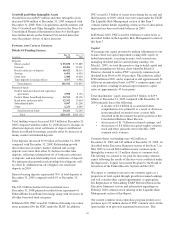

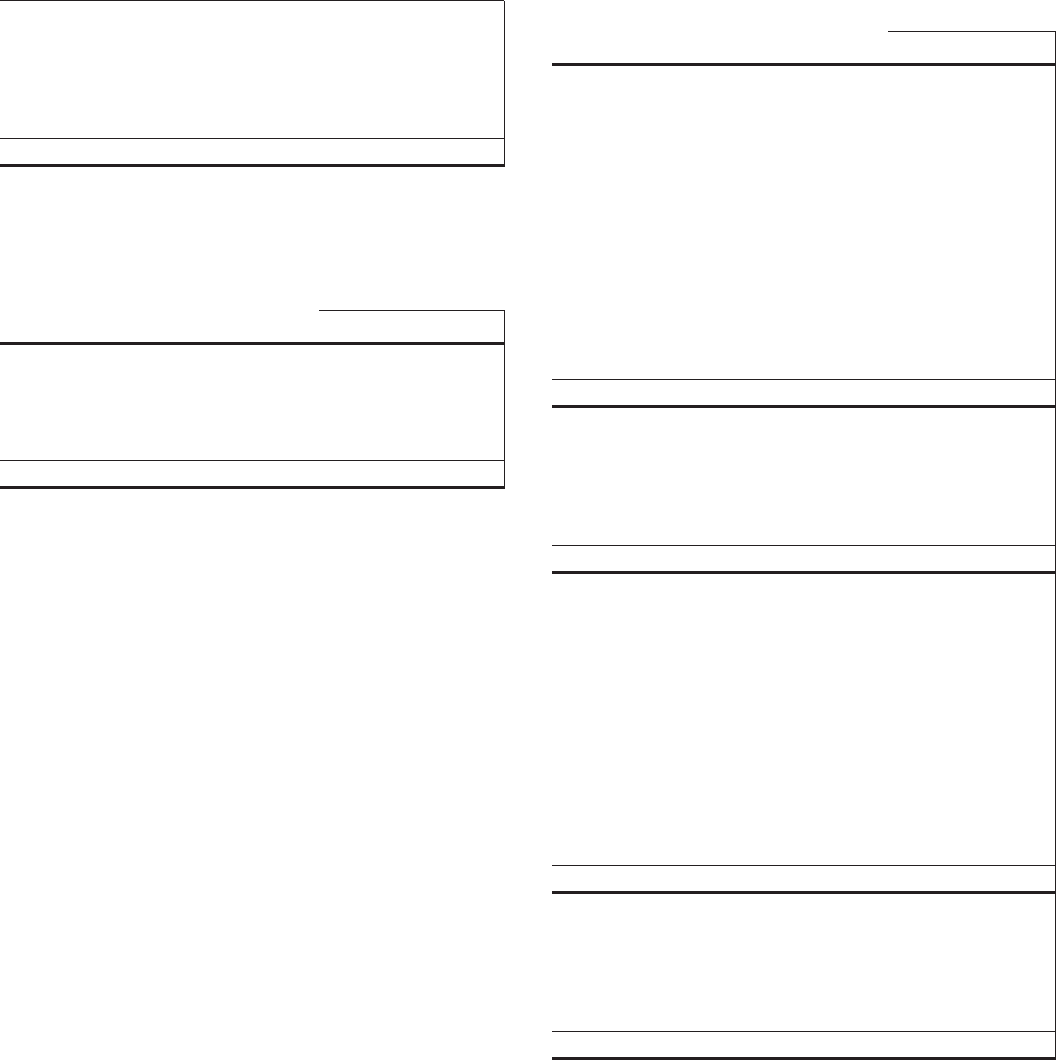

INVESTMENT SECURITIES

Details of Investment Securities

In millions

Amortized

Cost

Fair

Value

December 31, 2009

S

ECURITIES

A

VAILABLE FOR

S

ALE

Debt securities

US Treasury and government agencies $ 7,548 $ 7,520

Residential mortgage-backed

Agency 24,076 24,438

Non-agency 10,419 8,302

Commercial mortgage-backed

Agency 1,299 1,297

Non-agency 4,028 3,848

Asset-backed 2,019 1,668

State and municipal 1,346 1,350

Other debt 1,984 2,015

Corporate stocks and other 360 360

Total securities available for sale $53,079 $50,798

S

ECURITIES

H

ELD TO

M

ATURITY

Debt securities

Commercial mortgage-backed

(non-agency) $ 2,030 $ 2,225

Asset-backed 3,040 3,136

Other debt 159 160

Total securities held to maturity $ 5,229 $ 5,521

December 31, 2008

S

ECURITIES

A

VAILABLE FOR

S

ALE

Debt securities

US Treasury and government agencies $ 738 $ 739

Residential mortgage-backed

Agency 22,744 23,106

Non-agency 13,205 8,831

Commercial mortgage-backed

(non-agency) 4,305 3,446

Asset-backed 2,069 1,627

State and municipal 1,326 1,263

Other debt 563 559

Corporate stocks and other 575 571

Total securities available for sale $45,525 $40,142

S

ECURITIES

H

ELD TO

M

ATURITY

Debt securities

Commercial mortgage-backed

(non-agency) $ 1,945 $ 1,896

Asset-backed 1,376 1,358

Other debt 10 10

Total securities held to maturity $ 3,331 $ 3,264

The carrying amount of investment securities totaled $56.0

billion at December 31, 2009 and $43.5 billion at

December 31, 2008 and represented 21% of total assets at

December 31, 2009 compared with 15% of total assets at

December 31, 2008. The increase in securities of $12.6 billion

since December 31, 2008 primarily reflected the purchase of

US Treasury and government agency securities as well as

price appreciation in the available for sale portfolio, partially

offset by maturities, prepayments and sales.

33