PNC Bank 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.gains of $102 million and gains related to our commercial

mortgage loans held for sale, net of hedges, of $3 million.

Provision For Credit Losses

The provision for credit losses totaled $1.5 billion for 2008

compared with $315 million for 2007. Of the total 2008

provision, $990 million was recorded in the fourth quarter,

including $504 million of additional provision recorded on

December 31, 2008 to conform the National City loan

reserving methodology with ours. The differences in

methodology include granularity of loss computations,

statistical and quantitative factors rather than qualitative

assessment, and the extent of current appraisals and risk

assessments.

In addition to the impact of National City, the higher provision

in 2008 compared with the prior year was driven by general

credit quality migration, including residential real estate

development and commercial real estate exposure, an increase

in net charge-offs, and growth in nonperforming loans.

Growth in our total credit exposure also contributed to the

higher provision amounts in both comparisons.

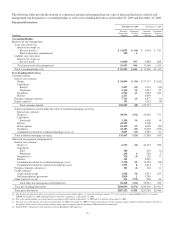

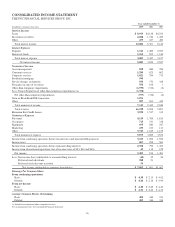

Noninterest Expense

Total noninterest expense was $3.685 billion for 2008 and

$3.652 billion for 2007, an increase of $33 million, or 1%.

Higher noninterest expense in 2008 compared with 2007

primarily resulted from investments in growth initiatives,

including acquisitions, partially offset by the impact of the

sale of Hilliard Lyons and disciplined expense management.

Integration costs included in noninterest expense totaled $115

million for 2008, including $79 million in the fourth quarter,

and $102 million for 2007. Fourth quarter 2008 integration

costs included $71 million related to our National City

acquisition.

Noninterest expense for 2008 included the benefit of the

reversal of $46 million of the $82 million Visa

indemnification liability that we established in the fourth

quarter of 2007.

E

FFECTIVE

T

AX

R

ATE

Our effective tax rate was 27.2% for 2008 and 29.2% for

2007.

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

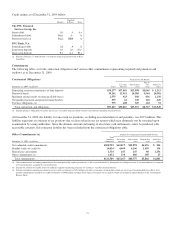

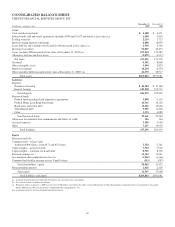

Loans

Loans increased $107.2 billion as of December 31, 2008

compared with December 31, 2007. Our National City

acquisition added $99.7 billion of loans, including $34.3

billion of commercial, $16.0 billion of commercial real estate,

$30.5 billion of consumer and $10.6 billion of residential

mortgage loans.

Investment Securities

Total investment securities at December 31, 2008 were $43.5

billion compared with $30.2 billion at December 31, 2007.

Securities added with the National City acquisition at

December 31, 2008 totaled $13.3 billion and were primarily

US government agency residential mortgage-backed

securities. Securities represented 15% of total assets at

December 31, 2008 and 22% of total assets at December 31,

2007.

At December 31, 2008, the investment securities balance

included a net unrealized loss of $5.4 billion, which

represented the difference between fair value and amortized

cost. The comparable amount at December 31, 2007 was a net

unrealized loss of $265 million. The expected weighted-

average life of investment securities (excluding corporate

stocks and other) was 3 years and 1 month at December 31,

2008 and 3 years and 6 months at December 31, 2007.

Loans Held For Sale

Loans held for sale totaled $4.4 billion at December 31, 2008

compared with $3.9 billion at December 31, 2007. The

acquisition of National City added approximately $2.2 billion

of loans held for sale at December 31, 2008, primarily 1-4

family conforming residential mortgages.

Loans held for sale included education loans held for sale of

$1.5 billion at December 31, 2007. We transferred these loans

at lower of cost or market value from held for sale to the loan

portfolio in February 2008 due to the impact at that time of

liquidity issues on the secondary markets for education loans.

Asset Quality

Total nonperforming assets at December 31, 2008 increased

$1.7 billion, to $2.2 billion, from the balance at December 31,

2007. Our nonperforming assets represented .75% of total

assets at December 31, 2008 compared with .36% at

December 31, 2007. The increase in nonperforming assets

reflected higher nonaccrual residential real estate development

loans and loans in related sectors, and the addition of $738

million of nonperforming assets related to National City.

At December 31, 2008, our largest nonperforming asset was

approximately $36 million and our average nonperforming

loan associated with commercial lending was less than $1

million.

Goodwill and Other Intangible Assets

The sum of goodwill and other intangible assets increased

$2.1 billion at December 31, 2008 compared with the prior

year end, to $11.7 billion. We added $.6 billion of core deposit

and other relationship intangible assets and $1.2 billion of

mortgage servicing rights in connection with the National City

acquisition at December 31, 2008. In addition, our Sterling

acquisition added $.6 billion of goodwill during 2008. Our

Hilliard Lyons divestiture reduced goodwill by $.1 billion in

2008.

80