PNC Bank 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.given economic conditions, hindered PNC legacy growth

during 2009 in both categories.

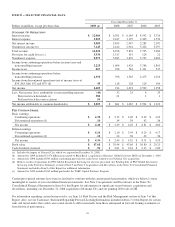

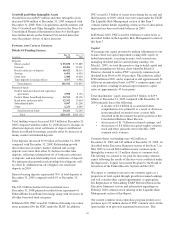

Corporate services revenue totaled $1.021 billion in 2009

compared with $704 million in 2008. Corporate services fees

include treasury management fees which increased $221

million in 2009 compared with 2008.

Residential mortgage fees totaled $990 million in 2009. Fees

from strong mortgage refinancing volumes, especially in the

first quarter, and $355 million of net hedging gains from

mortgage servicing rights contributed to this total. We do not

expect to repeat this strong performance in 2010.

Other noninterest income totaled $987 million for 2009

compared with $263 million for 2008. Other noninterest

income for 2009 included trading income of $170 million,

valuation and sale income related to our commercial mortgage

loans held for sale, net of hedges, of $107 million, other gains

of $103 million related to our equity investment in BlackRock

and net losses on private equity and alternative investments of

$93 million.

Other noninterest income for 2008 included the $114 million

gain from the sale of Hilliard Lyons, the $95 million Visa

gain, gains of $246 million related to our equity investment in

BlackRock, and losses related to our commercial mortgage

loans held for sale, net of hedges, of $197 million.

Other noninterest income typically fluctuates from period to

period depending on the nature and magnitude of transactions

completed. Further details regarding our trading activities are

included in the Market Risk Management – Trading Risk

portion of the Risk Management section of this Item 7,

information regarding private equity and alternative

investments are included in the Market Risk Management-

Equity and Other Investment Risk section, and discussion

regarding gains related to our equity investment in BlackRock

are included in the Business Segments Review section.

With the exception of hedging gains related to residential

mortgage servicing and the BlackRock/BGI gain, we expect

noninterest income to be relatively flat in 2010 compared with

2009 levels. We also expect that the conversions of National

City customers to the PNC platform scheduled for completion

by June 2010 will create more product cross-selling

opportunities.

P

RODUCT

R

EVENUE

In addition to credit and deposit products for commercial

customers, Corporate & Institutional Banking offers other

services, including treasury management and capital markets-

related products and services and commercial mortgage

banking activities, that are marketed by several businesses to

commercial and retail customers.

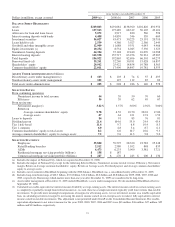

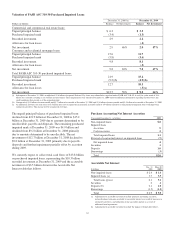

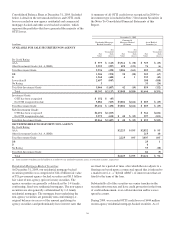

Treasury management revenue, which includes fees as well as

net interest income from customer deposit balances, totaled

$1.137 billion for 2009 and $567 million for 2008. In addition

to the impact of National City, the increase was primarily

related to deposit growth and continued growth in legacy

offerings such as purchasing cards and services provided to

the Federal government and healthcare customers.

Revenue from capital markets-related products and services

totaled $533 million in 2009 compared with $336 million in

2008. The impact of National City-related revenue helped to

offset declines in merger and acquisition revenues reflecting

the difficult economic environment.

Commercial mortgage banking activities include revenue

derived from commercial mortgage servicing (including net

interest income and noninterest income from loan servicing

and ancillary services), and revenue derived from commercial

mortgage loans intended for sale and related hedges (including

loan origination fees, net interest income, valuation

adjustments and gains or losses on sales).

Commercial mortgage banking activities resulted in revenue

of $485 million in 2009 compared with $65 million in 2008.

The impact of National City-related revenue was reflected in

the 2009 increase. Revenue for 2009 included gains of $107

million on commercial mortgage loans held for sale, net of

hedges. Losses of $197 million on commercial mortgage loans

held for sale, net of hedges, reduced revenue for 2008.

28