PNC Bank 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

P

ROVISION

F

OR

C

REDIT

L

OSSES

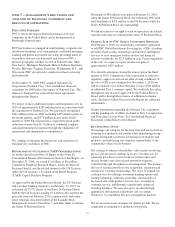

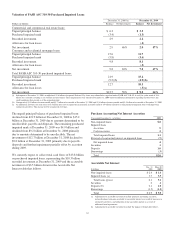

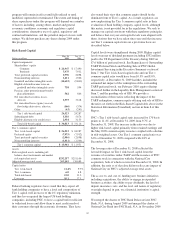

The provision for credit losses totaled $3.9 billion for 2009

compared with $1.5 billion for 2008. The provision for credit

losses for 2009 was in excess of net charge-offs of $2.7 billion

primarily due to required increases to our allowance for loan

and lease losses reflecting continued deterioration in the credit

markets and the resulting increase in nonperforming loans.

The Credit Risk Management portion of the Risk Management

section of this Item 7 includes additional information

regarding factors impacting the provision for credit losses. See

also Item 1A Risk Factors and the Cautionary Statement

Regarding Forward-Looking Information section of Item 7 of

this Report.

We expect the provision for credit losses in the first quarter of

2010 to be similar to the provision recognized in the third

quarter of 2009.

N

ONINTEREST

E

XPENSE

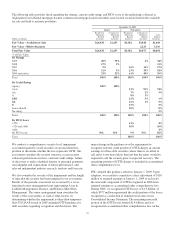

Noninterest expense for 2009 was $9.1 billion compared with

$3.7 billion in 2008. Acquisition cost savings totaled $800

million in 2009. The increase was substantially related to

National City. We also recorded a special FDIC assessment of

$133 million in the second quarter of 2009, which was

intended to build the FDIC’s Deposit Insurance Fund.

Integration costs included in noninterest expense totaled $421

million in 2009 compared with $122 million in 2008. Our

quarterly run rate of acquisition cost savings related to

National City increased to $300 million in the fourth quarter

of 2009, or $1.2 billion per year.

We anticipate meaningful expense reductions in 2010, driven

by acquisition cost saves, as we continue to focus on

effectively managing expenses and achieving cost savings

targets and credit cost improvements.

E

FFECTIVE

T

AX

R

ATE

Our effective tax rate was 26.9% for 2009 and 27.2% for

2008. The decrease in the effective tax rate for 2009 compared

with 2008 was principally due to additional tax expense in

2008 related to the sale of Hilliard Lyons partially offset by

additional tax expense associated with an increase in the level

of pretax earnings in 2009.

29