PNC Bank 2009 Annual Report Download - page 60

Download and view the complete annual report

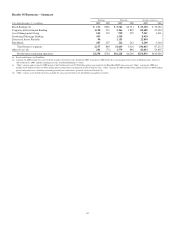

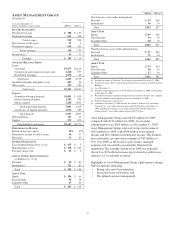

Please find page 60 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Assets under administration of $205 billion at December 31,

2009 increased $61 billion compared with the balance at

December 31, 2008. Including National City, assets under

administration were $228 billion at December 31, 2008.

Discretionary assets under management of $103 billion at

December 31, 2009 increased $46 billion compared with the

prior year-end balance. The increase in discretionary assets

under management is attributable to the National City

acquisition.

Nondiscretionary assets under administration of $102 billion

at December 31, 2009 increased $15 billion compared with the

balance at December 31, 2008. This increase was driven by

the National City acquisition, somewhat mitigated by a

decline in institutional assets related to the exit of a noncore

product offering and other National City integration impacts.

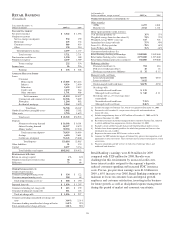

Total revenue for 2009 was $919 million compared with $559

million for 2008. Net interest income of $308 million reflected

additional revenue from the National City loan and deposit

portfolios and strong yields from the loan portfolio. The year-

over-year increase in net interest income was partially offset

by lower interest credits assigned to the segment’s deposits in

this low interest rate environment. Noninterest income of $611

million increased $182 million compared with 2008 primarily

in asset management fees. The growth was attributable to the

National City acquisition, client retention and new business

development activities.

The provision for credit losses of $97 million increased from

$6 million in 2008 as loan loss reserves were increased

beyond charge-offs due to credit quality deterioration. Net

charge-offs were $63 million for 2009 and $2 million for

2008.

Noninterest expense of $654 million increased $291 million in

2009 compared with 2008. The increase is attributable to the

National City acquisition. Implementation of various

integration-related initiatives has mitigated this increase in

expenses. Expense management remains a key focal point for

this business and the implementation of efficiency initiatives

will continue throughout 2010.

Balance sheet activity for 2009 reflected both core and

acquisition-related growth. Average loans of $6.7 billion

increased $3.9 billion compared with 2008. Average total

deposits of $7.0 billion increased $3.0 billion compared with

2008. During the economic downturn, customers shifted from

riskier equity investments into safer deposit products,

resulting in solid money market and demand deposit growth.

56