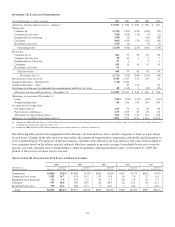

PNC Bank 2009 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

TATISTICAL

I

NFORMATION

(U

NAUDITED

)

THE PNC FINANCIAL SERVICES GROUP, INC.

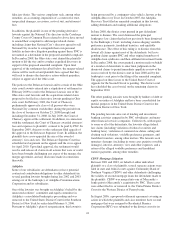

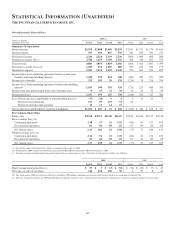

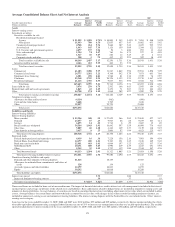

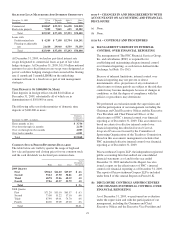

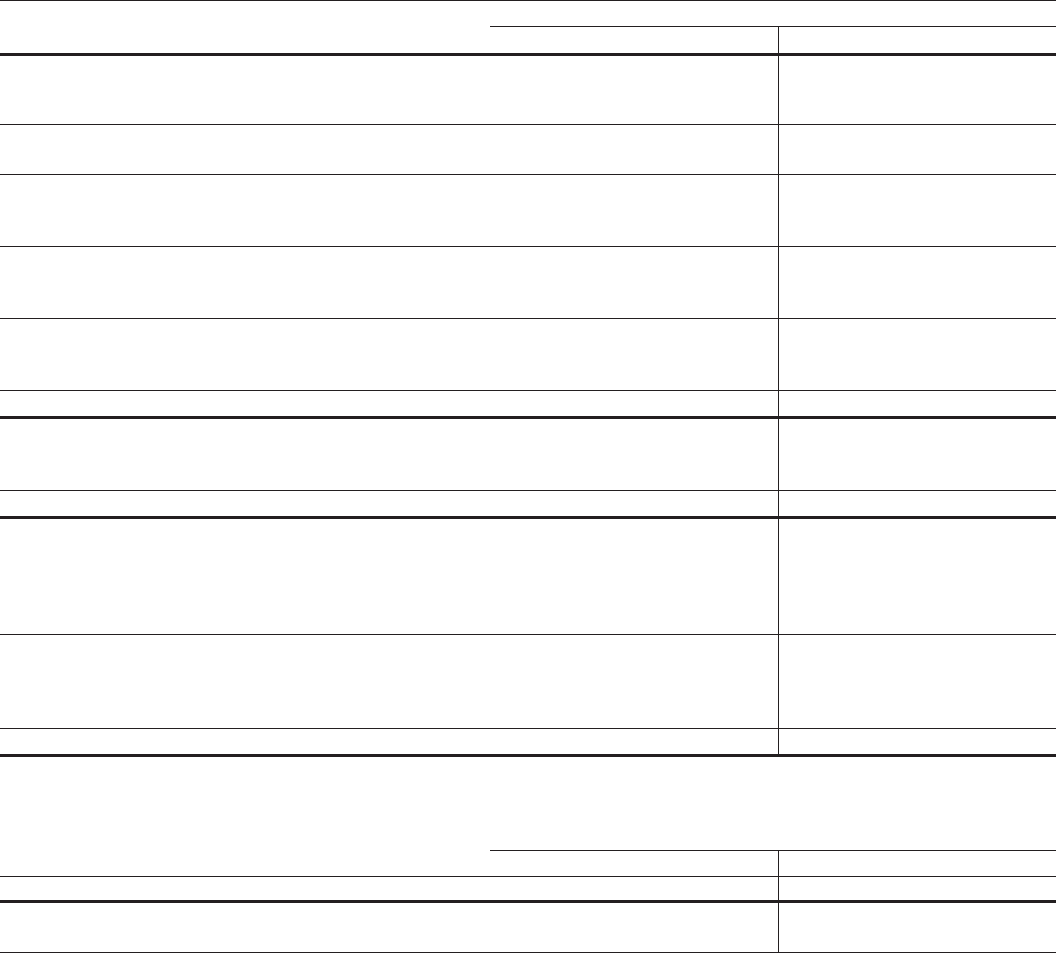

Selected Quarterly Financial Data

Dollars in millions,

except per share data

2009 (a) 2008

Fourth Third Second First Fourth Third Second First

Summary Of Operations

Interest income $2,939 $2,888 $3,000 $3,259 $1,541 $1,571 $1,574 $1,615

Interest expense 593 664 807 939 541 565 590 751

Net interest income 2,346 2,224 2,193 2,320 1,000 1,006 984 864

Noninterest income (b) (c) 2,540 1,629 1,610 1,366 468 416 823 735

Total revenue 4,886 3,853 3,803 3,686 1,468 1,422 1,807 1,599

Provision for credit losses (d) 1,049 914 1,087 880 990 190 186 151

Noninterest expense 2,209 2,214 2,492 2,158 959 947 920 859

Income (loss) from continuing operations before income taxes

(benefit) and noncontrolling interests 1,628 725 224 648 (481) 285 701 589

Income taxes (benefit) 525 185 29 128 (210) 58 216 234

Income (loss) from continuing operations before noncontrolling

interests 1,103 540 195 520 (271) 227 485 355

Income from discontinued operations, net of income taxes 4191210 25 32 32 29

Net income (loss) 1,107 559 207 530 (246) 259 517 384

Less: Net income (loss) attributable to noncontrolling interests (37) (20) 9 4 21112 7

Preferred stock dividends 119 99 119 51 21

Preferred stock discount accretion 14 13 14 15

Net income (loss) attributable to common shareholders $1,011 $ 467 $ 65 $ 460 $ (269) $ 248 $ 505 $ 377

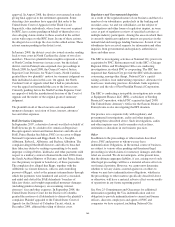

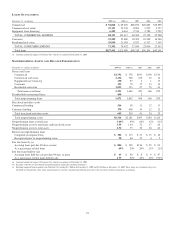

Per Common Share Data

Book value $47.68 $45.52 $42.00 $41.67 $39.44 $39.44 $42.17 $42.26

Basic earnings (loss) (e)

Continuing operations 2.18 .97 .11 1.02 (.84) .63 1.37 1.02

Discontinued operations .01 .04 .03 .02 .07 .09 .09 .09

Net income (loss) 2.19 1.01 .14 1.04 (.77) .72 1.46 1.11

Diluted earnings (loss) (e)

Continuing operations 2.16 .96 .11 1.01 (.84) .60 1.36 1.00

Discontinued operations .01 .04 .03 .02 .07 .10 .09 .09

Net income (loss) 2.17 1.00 .14 1.03 (.77) .70 1.45 1.09

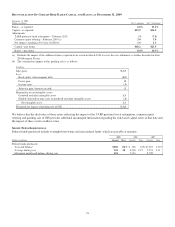

(a) Includes the impact of National City, which we acquired on December 31, 2008.

(b) Fourth quarter 2009 included a $1.076 billion gain related to BlackRock's acquisition of BGI on December 1, 2009.

(c) Noninterest income included equity management gains /(losses) and net gains on sales of securities in each quarter as follows (in millions):

2009 2008

Fourth Third Second First Fourth Third Second First

Equity management gains/(losses) $ 35 $ 3 $ (13) $ (52) $ (16) $ (24) $ (7) $ 23

Net gains on sales of securities 144 168 182 56 255 841

(d) The fourth quarter 2008 provision for credit losses included a $504 million conforming provision for credit losses related to our acquisition of National City.

(e) The sum of quarterly amounts for 2009 and 2008 does not equal the respective year’s amount because the quarterly calculations are based on a changing number of average shares.

169