PNC Bank 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

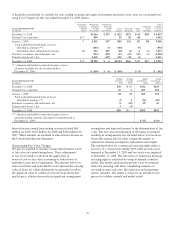

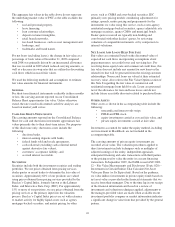

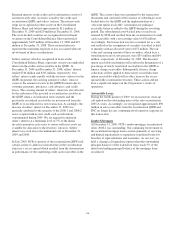

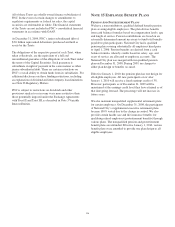

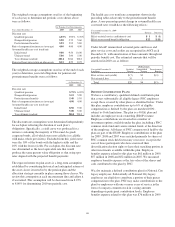

The following is a summary of managed loans associated with securitization transactions.

December 31, 2009 December 31, 2008

In millions

Principal

Balance

Loans Past

Due 30

Days or

More

Net Credit

Losses

for the

Year Ended

December 31,

2009

Principal

Balance

Loans Past

Due

30 Days

or More

Loans managed

Credit card $4,190 $192 $345 $4,061 $191

Jumbo mortgages 729 174 24 866 78

Total loans managed $4,919 $366 $369 $4,927 $269

Less: Loans securitized

Credit card $1,622 $ 66 $131 $1,824 $ 73

Jumbo mortgages 232 14 319 5

Total loans securitized $1,854 $ 80 $131 $2,143 $ 78

Less: Loans held for securitization

Jumbo mortgages $3 $3 $9 $4

Loans held in portfolio $3,062 $283 $238 $2,775 $187

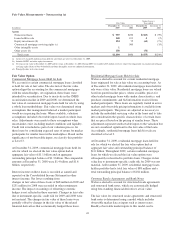

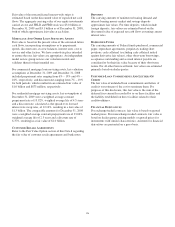

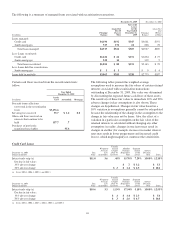

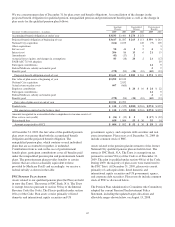

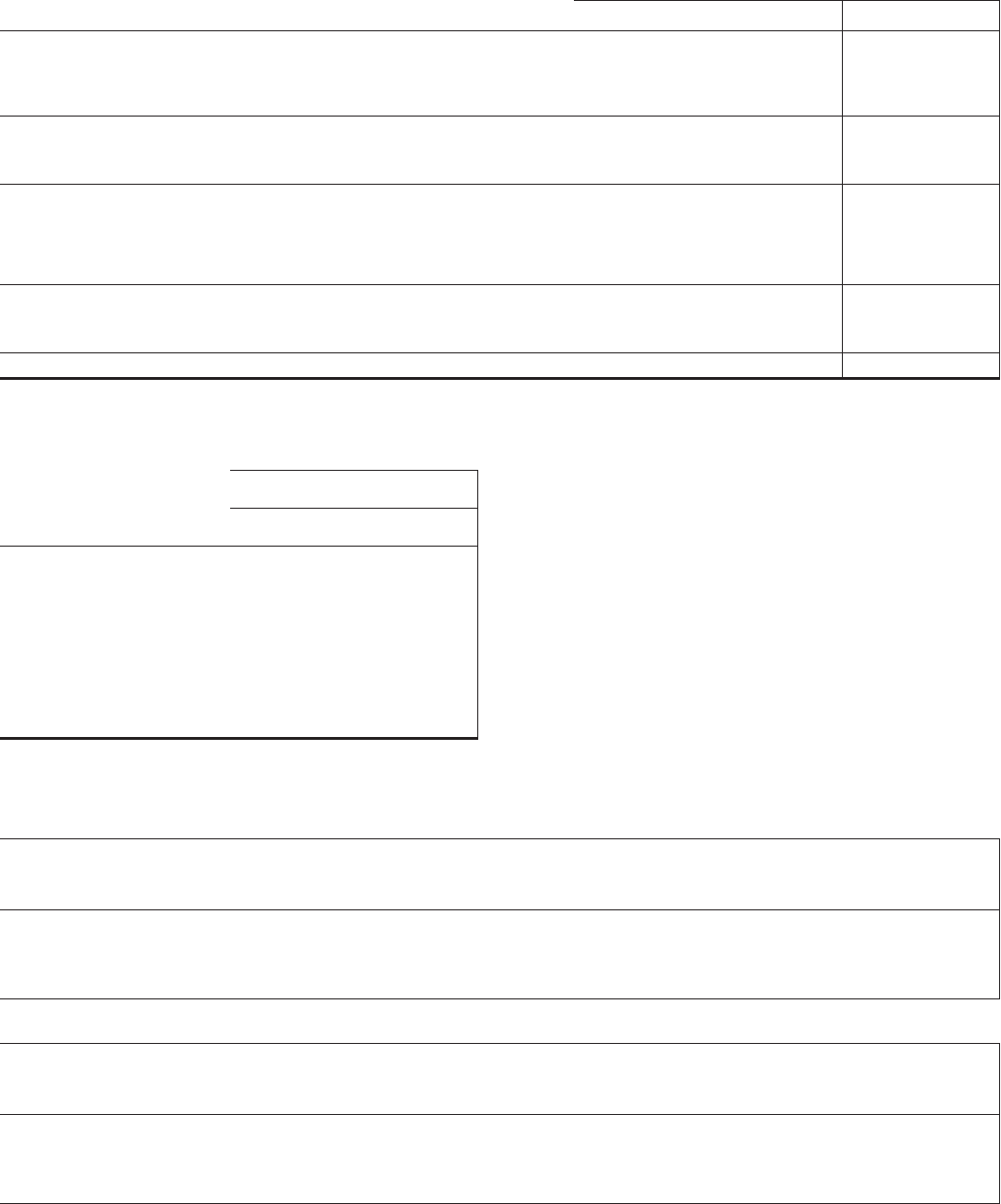

Certain cash flows received from the securitization trusts

follow:

Year Ended

December 31, 2009

In millions

Credit

Card Automobile Mortgage

Proceeds from collections

reinvested in the securitization

trusts $3,476.6

Servicing fees received 35.7 $ 1.4 $.8

Other cash flows received on

interests that continue to be

held 157.7 .7

Purchases of previously

transferred receivables 95.6

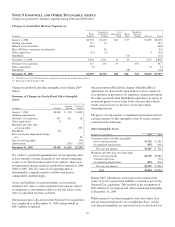

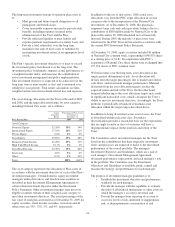

The following tables present the weighted-average

assumptions used to measure the fair values of certain retained

interests associated with securitization transactions

outstanding at December 31, 2009. Fair value was determined

by discounting the expected future cash flows of these assets.

The sensitivity of these fair values to immediate 10% and 20%

adverse changes in key assumptions is also shown. These

changes are hypothetical. Changes in fair value based on a

10% variation in assumptions generally cannot be extrapolated

because the relationship of the change in the assumption to the

change in fair value may not be linear. Also, the effect of a

variation in a particular assumption on the fair value of the

retained interests is calculated without changing any other

assumption; in reality, changes in one factor may result in

changes in another (for example, increases in market interest

rates may result in lower prepayments and increased credit

losses), which might magnify or counteract the sensitivities.

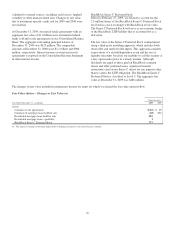

Credit Card Loans

December 31, 2009

Dollars in millions

Fair

Value

Weighted-

Average

Life

(in months)

Variable

Annual

Coupon

Rate To

Investors

Monthly

Principal

Repayment

Rate

Expected

Annual

Credit

Losses

Annual

Discount

Rate Yield

Interest-only strip (a) $11.0 3.6 .45% 15.70% 7.29% 15.00% 12.10%

Decline in fair value:

10% adverse change $ .7 $ 3.2 $ 5.3

20% adverse change $ .3 $ 1.4 $ 6.5 $ 10.6

(a) Series 2005-1, 2006-1, 2007-1, and 2008-3.

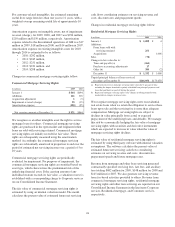

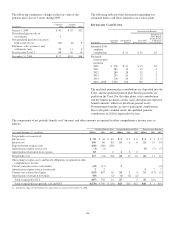

December 31, 2008

Dollars in millions

Fair

Value

Weighted-

Average

Life

(in months)

Variable

Annual

Coupon

Rate To

Investors

Monthly

Principal

Repayment

Rate

Expected

Annual

Credit

Losses

Annual

Discount

Rate Yield

Interest-only strip (a) $19.6 3.3 1.19% 17.54% 5.18% 15.00% 12.55%

Decline in fair value:

10% adverse change $ .1 $ 1.4 $ 2.3 $ 5.4

20% adverse change $ .3 $ 2.6 $ 4.7 $ 10.8

(a) Series 2005-1, 2006-1, 2007-1, 2008-1, 2008-2, and 2008-3.

131