PNC Bank 2009 Annual Report Download - page 149

Download and view the complete annual report

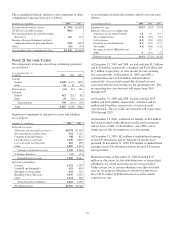

Please find page 149 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.subject to certain conditions and limitations. Prior to 2006,

BlackRock granted awards of approximately $233 million

under the 2002 LTIP program, of which approximately $208

million were paid on January 30, 2007. The award payments

were funded by 17% in cash from BlackRock and

approximately one million shares of BlackRock common

stock transferred by PNC and distributed to LTIP participants.

As permitted under the award agreements, employees elected

to put approximately 95% of the stock portion of the awards

back to BlackRock. These shares were retained by BlackRock

as treasury stock. We recognized a pretax gain of $82 million

in the first quarter of 2007 from the transfer of BlackRock

shares. The gain was included in other noninterest income and

reflected the excess of market value over book value of the

one million shares transferred in January 2007.

BlackRock granted awards in 2007 under an additional LTIP

program, all of which are subject to achieving earnings

performance goals prior to the vesting date of September 29,

2011. Of the shares of BlackRock common stock that we have

agreed to transfer to fund their LTIP programs, approximately

1.6 million shares have been committed to fund the awards

vesting in 2011 and the amount remaining would then be

available for future awards.

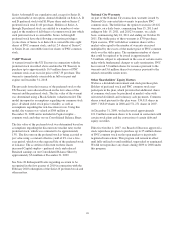

PNC’s noninterest income included pretax gains of $98

million in 2009 and $243 million in 2008 related to our

BlackRock LTIP shares obligation. These gains represented

the mark-to-market adjustment related to our remaining

BlackRock LTIP common shares obligation and resulted from

the decrease in the market value of BlackRock common shares

in those periods. Noninterest income for 2007 included pretax

charges totaling $209 million related to an increase in the

market value of BlackRock common shares in that period.

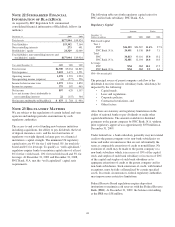

As previously reported, PNC entered into an Exchange

Agreement with BlackRock on December 26, 2008. The

transactions that resulted from this agreement restructured

PNC’s ownership of BlackRock equity without altering, to

any meaningful extent, PNC’s economic interest in

BlackRock. PNC continues to be subject to the limitations on

its voting rights in its existing agreements with BlackRock.

Also on December 26, 2008, BlackRock entered into an

Exchange Agreement with Merrill Lynch in anticipation of the

consummation of the merger of Bank of America Corporation

and Merrill Lynch that occurred on January 1, 2009. The PNC

and Merrill Lynch Exchange Agreements restructured PNC’s

and Merrill Lynch’s respective ownership of BlackRock

common and preferred equity.

The exchange contemplated by these agreements was

completed on February 27, 2009. On that date, PNC’s

obligation to deliver BlackRock common shares was replaced

with an obligation to deliver shares of BlackRock’s new

Series C Preferred Stock. PNC acquired 2.9 million shares of

Series C Preferred Stock from BlackRock in exchange for

common shares on that same date. PNC accounts for these

preferred shares at fair value, which offsets the impact of

marking-to-market the obligation to deliver these shares to

BlackRock as we aligned the fair value marks on this asset

and liability. The fair value of the BlackRock Series C

Preferred Stock is included on our Consolidated Balance Sheet

in Other assets. Additional information regarding the

valuation of the BlackRock Series C Preferred Stock is

included in Note 8.

N

OTE

17 F

INANCIAL

D

ERIVATIVES

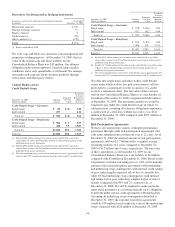

We use a variety of derivative financial instruments to help

manage interest rate, market and credit risk and reduce the

effects that changes in interest rates may have on net income,

fair value of assets and liabilities, and cash flows. These

instruments include interest rate swaps, swaptions, interest

rate caps and floors, credit default swaps, futures contracts,

and total return swaps. All derivatives are carried at fair value.

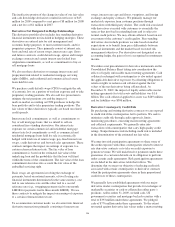

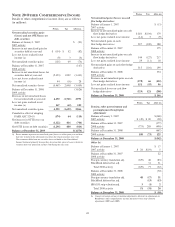

Derivatives Designated in Hedge Relationships

We enter into interest rate swaps to hedge the fair value of

bank notes, Federal Home Loan Bank borrowings, senior debt

and subordinated debt for changes in interest rates.

Adjustments related to the ineffective portion of fair value

hedging instruments are recorded in interest expense.

We enter into interest rate swap contracts to modify the

interest rate characteristics of designated commercial loans

from variable to fixed in order to reduce the impact of changes

in future cash flows due to interest rate changes. We hedged

our exposure to the variability of future cash flows for all

forecasted transactions for a maximum of 10 years for hedges

converting floating-rate commercial loans to fixed. The fair

value of these derivatives is reported in other assets or other

liabilities and offset in accumulated other comprehensive

income (loss) for the effective portion of the derivatives. We

subsequently reclassify any unrealized gains or losses related

to these swap contracts from accumulated other

comprehensive income (loss) into interest income in the same

period or periods during which the hedged forecasted

transaction affects earnings. Ineffectiveness of the strategies,

if any, is recognized immediately in earnings.

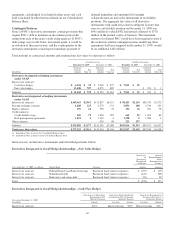

During the next twelve months, we expect to reclassify to

earnings $317 million of pretax net gains, or $206 million

after-tax, on cash flow hedge derivatives currently reported in

accumulated other comprehensive loss. This amount could

differ from amounts actually recognized due to changes in

interest rates and the addition of other hedges subsequent to

December 31, 2009. These net gains are anticipated to result

from net cash flows on receive fixed interest rate swaps that

would impact interest income recognized on the related

floating rate commercial loans.

During 2009, there were no gains or losses from cash flow

hedge derivatives that were reclassified to earnings arising

from the determination that the original forecasted transaction

would not occur.

145