PNC Bank 2009 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.financial statement reporting (GAAP), including the

presentation of net income attributable to noncontrolling

interests. Assets, revenue and earnings attributable to foreign

activities were not material in the periods presented for

comparative purposes.

B

USINESS

S

EGMENT

P

RODUCTS

A

ND

S

ERVICES

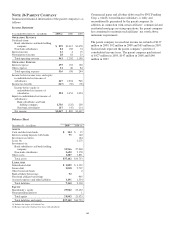

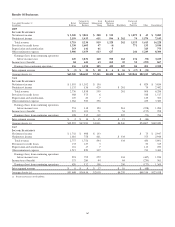

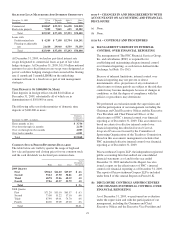

Retail Banking provides deposit, lending, brokerage, trust,

investment management, and cash management services to

consumer and small business customers within our primary

geographic markets. Our customers are serviced through our

branch network, call centers and the internet. The branch

network is located primarily in Pennsylvania, Ohio, New

Jersey, Michigan, Maryland, Illinois, Indiana, Kentucky,

Florida, Missouri, Virginia, Delaware, Washington, D.C., and

Wisconsin.

Corporate & Institutional Banking provides lending, treasury

management, and capital markets-related products and

services to mid-sized corporations, government and

not-for-profit entities, and selectively to large corporations.

Lending products include secured and unsecured loans, letters

of credit and equipment leases. Treasury management services

include cash and investment management, receivables

management, disbursement services, funds transfer services,

information reporting, and global trade services. Capital

markets-related products and services include foreign

exchange, derivatives, loan syndications, mergers and

acquisitions advisory and related services to middle-market

companies, securities underwriting, and securities sales and

trading. Corporate & Institutional Banking also provides

commercial loan servicing, and real estate advisory and

technology solutions for the commercial real estate finance

industry. Corporate & Institutional Banking provides products

and services generally within our primary geographic markets,

with certain products and services offered nationally.

Asset Management Group includes personal wealth

management for high net worth and ultra high net worth

clients and institutional asset management. Wealth

management products and services include financial planning,

customized investment management, private banking, tailored

credit solutions and trust management and administration for

individuals and their families. Institutional asset management

provides investment management, custody, and retirement

planning services. The institutional clients include

corporations, foundations and unions and charitable

endowments located primarily in our geographic footprint.

This segment includes the asset management businesses

acquired through the National City acquisition and the legacy

PNC wealth management business previously included in the

Retail Banking segment.

Residential Mortgage Banking directly originates primarily

first lien residential mortgage loans on a nationwide basis with

a significant presence within the retail banking footprint and

also originates loans through joint venture partners. Mortgage

loans represent loans collateralized by one-to-four-family

residential real estate and are made to borrowers in good

credit standing. These loans are typically underwritten to

government agency and/or third party standards, and sold,

servicing retained, to primary mortgage market conduits

Federal National Mortgage Association (Fannie Mae), Federal

Home Loan Mortgage Corporation (Freddie Mac), Federal

Home Loan Banks and third-party investors, or are securitized

and issued under the Government National Mortgage

Association (Ginnie Mae) program. The mortgage servicing

operation performs all functions related to servicing first

mortgage loans for various investors. Certain loans originated

through our joint ventures are serviced by a joint venture

partner. In November 2009, we reduced our joint venture

relationship related to our legacy PNC business and rebranded

the former National City Mortgage as PNC Mortgage.

BlackRock is the largest publicly traded investment

management firm in the world. BlackRock manages assets on

behalf of institutional and individual investors worldwide

through a variety of equity, fixed income, multi-asset class,

alternative and cash management separate accounts and funds.

In addition, BlackRock provides market risk management,

financial markets advisory and enterprise investment system

services globally to a broad base of clients. At December 31,

2009, our share of BlackRock’s earnings was approximately

23%.

Distressed Assets Portfolio includes commercial residential

development loans, cross-border leases, consumer brokered

home equity loans, retail mortgages, non-prime mortgages,

and residential construction loans. These loans require special

servicing and management oversight given current market

conditions. The majority of these loans are from acquisitions,

primarily National City.

166