PNC Bank 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

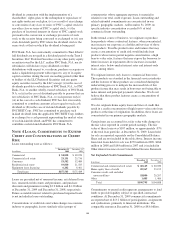

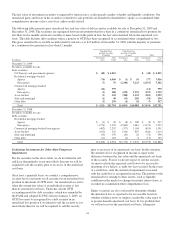

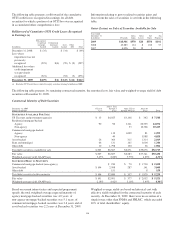

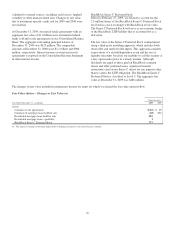

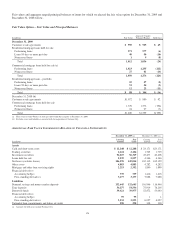

The fair value of securities pledged to secure public and trust

deposits and repurchase agreements and for other purposes

was $23.4 billion at December 31, 2009 and $22.5 billion at

December 31, 2008. The pledged securities include positions

held in our portfolio of investment securities, trading

securities, and securities accepted as collateral from others

that we are permitted by contract or custom to sell or repledge.

The fair value of securities accepted as collateral that we are

permitted by contract or custom to sell or repledge was $2.4

billion at December 31, 2009 and $1.6 billion at December 31,

2008 and is a component of federal funds sold and resale

agreements on our Consolidated Balance Sheet. Of the

permitted amount, $1.3 billion was repledged to others at

December 31, 2009 and $461 million was repledged to others

at December 31, 2008.

N

OTE

8F

AIR

V

ALUE

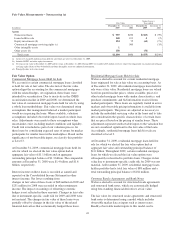

Fair Value Measurement

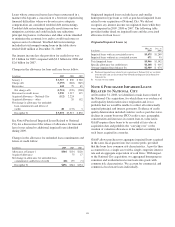

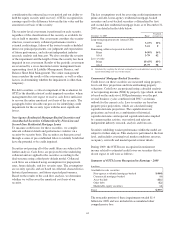

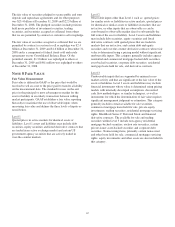

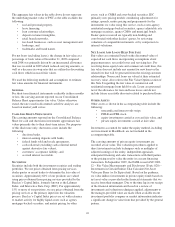

Fair value is defined in GAAP as the price that would be

received to sell an asset or the price paid to transfer a liability

on the measurement date. The standard focuses on the exit

price in the principal or most advantageous market for the

asset or liability in an orderly transaction between willing

market participants. GAAP establishes a fair value reporting

hierarchy to maximize the use of observable inputs when

measuring fair value and defines the three levels of inputs as

noted below.

Level 1

Quoted prices in active markets for identical assets or

liabilities. Level 1 assets and liabilities may include debt

securities, equity securities and listed derivative contracts that

are traded in an active exchange market and certain US

government agency securities that are actively traded in

over-the-counter markets.

Level 2

Observable inputs other than Level 1 such as: quoted prices

for similar assets or liabilities in active markets, quoted prices

for identical or similar assets or liabilities in markets that are

not active, or other inputs that are observable or can be

corroborated to observable market data for substantially the

full term of the asset or liability. Level 2 assets and liabilities

may include debt securities, equity securities and listed

derivative contracts with quoted prices that are traded in

markets that are not active, and certain debt and equity

securities and over-the-counter derivative contracts whose fair

value is determined using a pricing model without significant

unobservable inputs. This category generally includes agency

residential and commercial mortgage-backed debt securities,

asset-backed securities, corporate debt securities, residential

mortgage loans held for sale, and derivative contracts.

Level 3

Unobservable inputs that are supported by minimal or no

market activity and that are significant to the fair value of the

assets or liabilities. Level 3 assets and liabilities may include

financial instruments whose value is determined using pricing

models with internally developed assumptions, discounted

cash flow methodologies, or similar techniques, as well as

instruments for which the determination of fair value requires

significant management judgment or estimation. This category

generally includes certain available for sale securities,

commercial mortgage loans held for sale, private equity

investments, trading securities, residential mortgage servicing

rights, BlackRock Series C Preferred Stock and financial

derivative contracts. The available for sale and trading

securities within Level 3 include non-agency residential

mortgage-backed securities, auction rate securities, certain

private-issuer asset-backed securities and corporate debt

securities. Nonrecurring items, primarily certain nonaccrual

and other loans held for sale, commercial mortgage servicing

rights, equity investments and other assets are also included in

this category.

117