PNC Bank 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

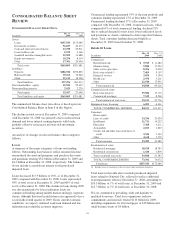

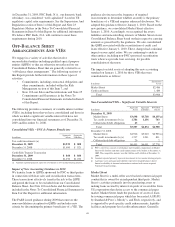

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

S

UMMARIZED

B

ALANCE

S

HEET

D

ATA

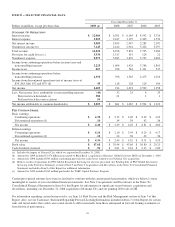

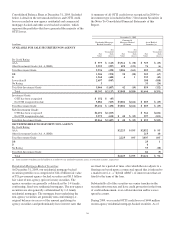

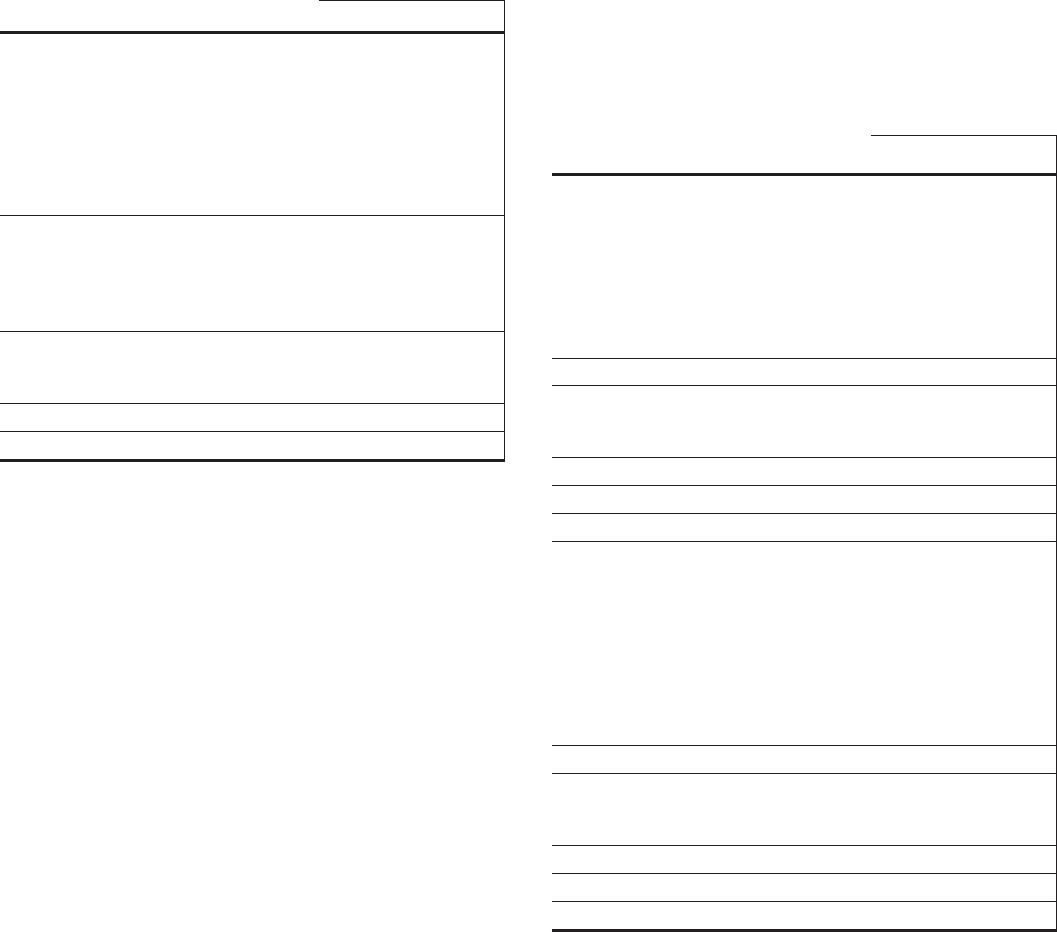

In millions

Dec. 31

2009

Dec. 31

2008

Assets

Loans $157,543 $175,489

Investment securities 56,027 43,473

Cash and short-term investments 13,290 22,911

Loans held for sale 2,539 4,366

Goodwill and other intangible assets 12,909 11,688

Equity investments 10,254 8,554

Other 17,301 24,600

Total assets $269,863 $291,081

Liabilities

Deposits $186,922 $192,865

Borrowed funds 39,261 52,240

Other 11,113 18,328

Total liabilities 237,296 263,433

Total shareholders’ equity 29,942 25,422

Noncontrolling interests 2,625 2,226

Total equity 32,567 27,648

Total liabilities and equity $269,863 $291,081

The summarized balance sheet data above is based upon our

Consolidated Balance Sheet in Item 8 of this Report.

The decline in total assets at December 31, 2009 compared

with December 31, 2008 was primarily due to reduced loan

demand and lower interest-earning deposits with banks,

partially offset by an increase in lower risk investment

securities.

An analysis of changes in selected balance sheet categories

follows.

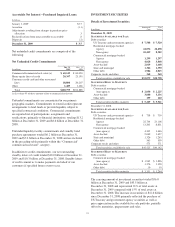

L

OANS

A summary of the major categories of loans outstanding

follows. Outstanding loan balances reflect unearned income,

unamortized discount and premium, and purchase discounts

and premiums totaling $3.2 billion at December 31, 2009 and

$4.3 billion at December 31, 2008, respectively. The balances

do not include accretable net interest on the purchased

impaired loans.

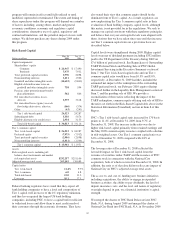

Loans decreased $17.9 billion, or 10%, as of December 31,

2009 compared with December 31, 2008. Loans represented

58% of total assets at December 31, 2009 and 60% of total

assets at December 31, 2008. The decline in loans during 2009

was driven primarily by lower utilization levels for

commercial lending among middle market and large corporate

clients, although this trend in utilization rates appeared to have

eased in the fourth quarter of 2009. Given current economic

conditions, we expect continued weak loan demand and low

utilization rates until the economy improves.

Commercial lending represented 53% of the loan portfolio and

consumer lending represented 47% at December 31, 2009.

Commercial lending declined 17% at December 31, 2009

compared with December 31, 2008. Commercial loans, which

comprised 65% of total commercial lending, declined 21%

due to reduced demand for new loans, lower utilization levels

and paydowns as clients continued to deleverage their balance

sheets. Total consumer lending decreased slightly at

December 31, 2009 from December 31, 2008.

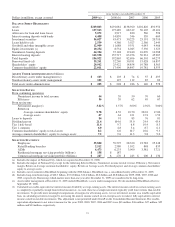

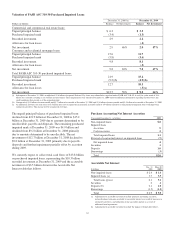

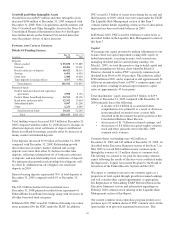

Details Of Loans

In millions

Dec. 31

2009

Dec. 31

2008

Commercial

Retail/wholesale $ 9,515 $ 11,482

Manufacturing 9,880 13,263

Other service providers 8,256 9,038

Real estate related (a) 7,403 9,107

Financial services 3,874 5,194

Health care 2,970 3,201

Other 12,920 17,935

Total commercial 54,818 69,220

Commercial real estate

Real estate projects 15,582 17,176

Commercial mortgage 7,549 8,560

Total commercial real estate 23,131 25,736

Equipment lease financing 6,202 6,461

TOTAL COMMERCIAL LENDING 84,151 101,417

Consumer

Home equity

Lines of credit 24,236 24,024

Installment 11,711 14,252

Education 7,468 4,211

Automobile 2,013 1,667

Credit card and other unsecured lines of

credit 3,536 3,163

Other 4,618 5,172

Total consumer 53,582 52,489

Residential real estate

Residential mortgage 18,190 18,783

Residential construction 1,620 2,800

Total residential real estate 19,810 21,583

TOTAL CONSUMER LENDING 73,392 74,072

Total loans $157,543 $175,489

(a) Includes loans to customers in the real estate and construction industries.

Total loans in the table above include purchased impaired

loans related to National City, adjusted to reflect additional

loan impairments effective December 31, 2008, amounting to

$10.3 billion, or 7% of total loans, at December 31, 2009 and

$12.7 billion, or 7% of total loans, at December 31, 2008.

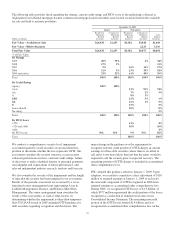

We are committed to providing credit and liquidity to

qualified borrowers. Total loan originations and new

commitments and renewals totaled $110 billion for 2009,

including originations for first mortgages of $19 billion and

small business loans of $4 billion.

30