PNC Bank 2009 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

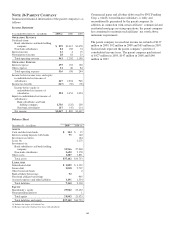

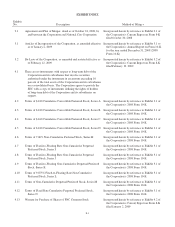

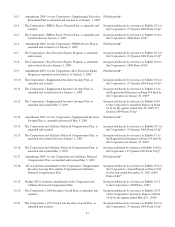

L

OANS

O

UTSTANDING

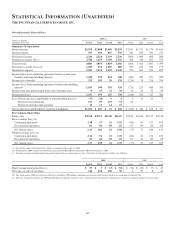

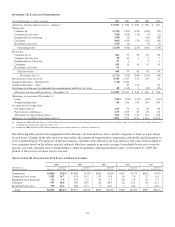

December 31 - in millions 2009 (a) 2008 (a) 2007 2006 2005

Commercial $ 54,818 $ 69,220 $28,952 $20,883 $19,599

Commercial real estate 23,131 25,736 8,903 3,527 3,157

Equipment lease financing 6,202 6,461 2,514 2,789 2,792

TOTAL COMMERCIAL LENDING 84,151 101,417 40,369 27,199 25,548

Consumer 53,582 52,489 18,393 16,569 16,246

Residential real estate 19,810 21,583 9,557 6,337 7,307

TOTAL CONSUMER LENDING 73,392 74,072 27,950 22,906 23,553

Total loans $157,543 $175,489 $68,319 $50,105 $49,101

(a) Amounts include the impact of National City, which we acquired on December 31, 2008.

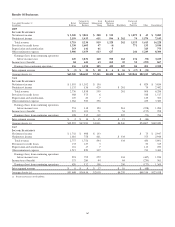

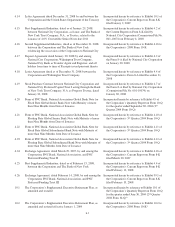

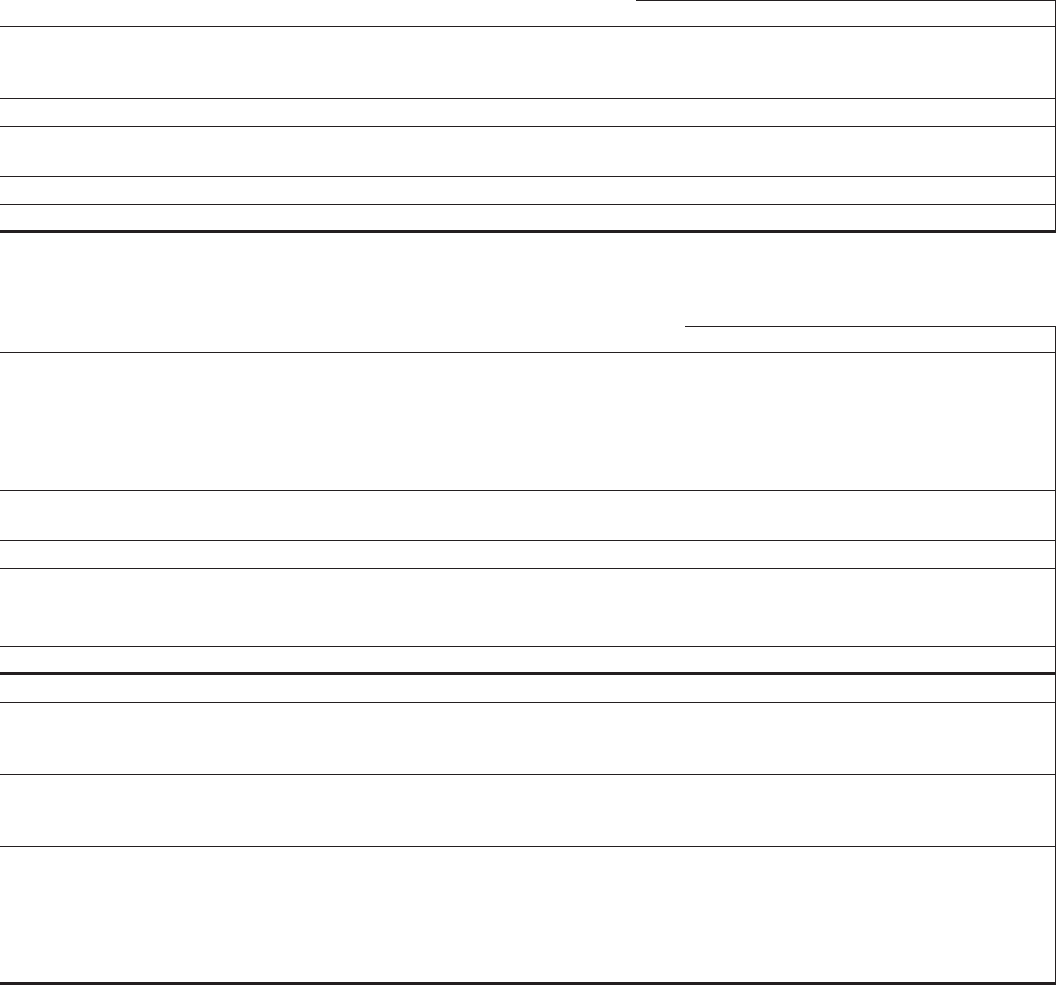

N

ONPERFORMING

A

SSETS AND

R

ELATED

I

NFORMATION

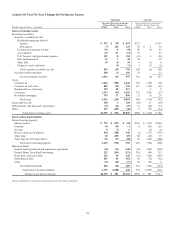

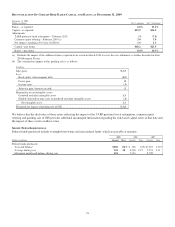

December 31 - dollars in millions 2009 (a) 2008 (a) 2007 2006 2005

Nonaccrual loans

Commercial $1,792 $ 576 $193 $109 $ 134

Commercial real estate 2,132 766 212 12 14

Equipment lease financing 130 973117

Consumer 152 70 17 13 10

Residential real estate 1,025 153 27 25 24

Total nonaccrual loans 5,231 1,662 452 160 199

Troubled debt restructured loans 440 2

Total nonperforming loans 5,671 1,662 454 160 199

Foreclosed and other assets

Commercial lending 266 50 11 12 13

Consumer lending 379 469 30 12 12

Total foreclosed and other assets 645 519 41 24 25

Total nonperforming assets $6,316 $2,181 $495 $184 $ 224

Nonperforming loans to total loans 3.60% .95% .66% .32% .41%

Nonperforming assets to total loans and foreclosed assets 3.99 1.24 .72 .37 .46

Nonperforming assets to total assets 2.34 .75 .36 .18 .24

Interest on nonperforming loans

Computed on original terms $ 302 $ 115 $ 51 $ 15 $ 16

Recognized prior to nonperforming status 90 60 32 4 5

Past due loans (b) (c)

Accruing loans past due 90 days or more $ 884 $ 395 $136 $ 55 $ 53

As a percentage of total loans .60% .24% .20% .11% .11%

Past due loans held for sale

Accruing loans held for sale past due 90 days or more $45 $40$8$9$47

As a percentage of total loans held for sale 1.77 .92% .20% .38% 1.92%

(a) Amounts include the impact of National City, which we acquired on December 31, 2008.

(b) Excludes loans that are government insured/guaranteed, primarily residential mortgages.

(c) Excludes impaired loans acquired from National City totaling $2.7 billion at December 31, 2009 and $2.0 billion at December 31, 2008. These loans are excluded as they were

recorded at estimated fair value when acquired and are currently considered performing loans due to the accretion of interest in purchase accounting.

172