PNC Bank 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We establish reserves to provide coverage for probable losses

not considered in the specific, pool and consumer reserve

methodologies, such as, but not limited to, the following:

• industry concentrations and conditions,

• credit quality trends,

• recent loss experience in particular sectors of the

portfolio,

• ability and depth of lending management,

• changes in risk selection and underwriting standards,

and

• timing of available information.

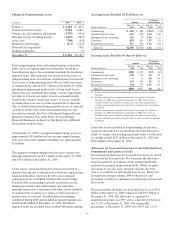

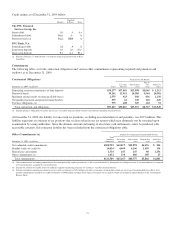

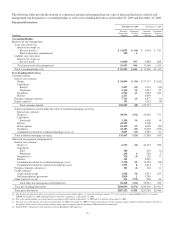

Total net charge-offs are significantly lower than they would

have been otherwise due to the accounting treatment for

purchased impaired loans. This treatment also results in a

lower ratio of net charge-offs to average loans. Customer

balances related to these impaired loans were reduced by the

fair value marks of $9.2 billion as of December 31, 2008.

However, as a result of further credit deterioration on

purchased impaired commercial loans, we recorded $90

million of net charge-offs in 2009.

C

REDIT

D

EFAULT

S

WAPS

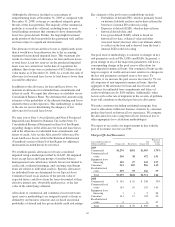

From a credit risk management perspective, we buy and sell

credit loss protection via the use of credit derivatives. When

we buy loss protection by purchasing a credit default swap

(CDS), we pay a fee to the seller, or CDS counterparty, in

return for the right to receive a payment if a specified credit

event occurs for a particular obligor or reference entity. We

purchase CDSs to mitigate the risk of economic loss on a

portion of our loan exposures and for trading purposes.

We also sell loss protection to mitigate the net premium cost

and the impact of fair value accounting on the CDS in cases

where we buy protection to hedge the loan portfolio and for

trading purposes. These activities represent additional risk

positions rather than hedges of risk.

We approve counterparty credit lines for all of our trading

activities, including CDSs. Counterparty credit lines are

approved based on a review of credit quality in accordance

with our traditional credit quality standards and credit policies.

The credit risk of our counterparties is monitored in the

normal course of business. In addition, all counterparty credit

lines are subject to collateral thresholds and exposures above

these thresholds are secured.

CDSs are included in the Free-Standing Derivatives table in

the Financial Derivatives section of this Risk Management

discussion. Net losses from CDSs for proprietary trading

positions, reflected in other noninterest income on our

Consolidated Income Statement, totaled $7 million for 2009

compared with net gains of $45 million for 2008.

O

PERATIONAL

R

ISK

M

ANAGEMENT

Operational risk is defined as the risk of financial loss or other

damage to us resulting from inadequate or failed internal

processes or systems, human factors, or from external events.

Operational risk may occur in any of our business activities

and manifests itself in various ways, including but not limited

to the following:

• Errors related to transaction processing and systems,

• Breaches of the system of internal controls and

compliance requirements,

• Misuse of sensitive information, and

• Business interruptions and execution of unauthorized

transactions and fraud by employees or third parties.

Operational losses may arise from legal actions due to

operating deficiencies or noncompliance with contracts, laws

or regulations.

To monitor and control operational risk, we maintain a

comprehensive framework including policies and a system of

internal controls that is designed to manage risk and to

provide management with timely and accurate information

about the operations of PNC. Management at each business

unit is primarily responsible for its operational risk

management program, given that operational risk management

is integral to direct business management and most easily

effected at the business unit level. Corporate Operational Risk

Management oversees day-to-day operational risk

management activities.

The technology risk management program is a significant

component of the operational risk framework. We have an

integrated security and technology risk management

framework designed to help ensure a secure, sound, and

compliant infrastructure for information management. The

technology risk management process is aligned with the

strategic direction of the businesses and is integrated into the

technology management culture, structure and practices. The

application of this framework across the enterprise helps to

support comprehensive and reliable internal controls.

Our business resiliency program manages the organization’s

capabilities to provide services in the case of an event that

results in material disruption of business activities.

Prioritization of investments in people, processes, technology

and facilities is based on different types of events, business

risk and criticality. Comprehensive testing validates our

resiliency capabilities on an ongoing basis, and an integrated

governance model is designed to help assure transparent

management reporting.

We believe our current operational risk level is in line with a

moderate risk profile. As we complete the integration of

National City and have doubled in size from a year ago, we

are regularly evaluating key processes, technologies, and

controls to help ensure they are performing at expected levels,

and can support growing business and product requirements in

a stable, well controlled manner.

Insurance

As a component of our risk management practices, we

purchase insurance designed to protect us against accidental

70