PNC Bank 2009 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

9G

OODWILL AND

O

THER

I

NTANGIBLE

A

SSETS

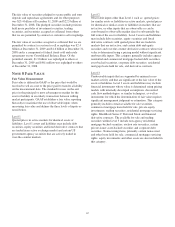

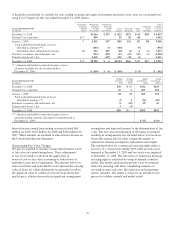

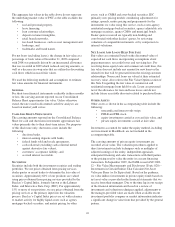

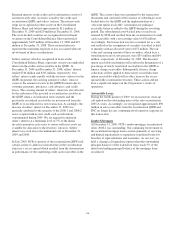

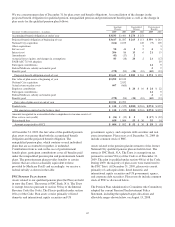

Changes in goodwill by business segment during 2008 and 2009 follow:

Changes in Goodwill by Business Segment (a)

In millions

Retail

Banking

Corporate &

Institutional

Banking

Asset

Management

Group

Black-

Rock

Residential

Mortgage

Banking Other (b) Total

January 1, 2008 $4,702 $2,403 $14 $ 57 $1,229 $8,405

Sterling acquisition 517 76 593

Hilliard Lyons divestiture (140) (140)

Harris Williams contingent consideration 44 44

Other acquisitions (23) (2) 4 (21)

BlackRock (13) (13)

December 31, 2008 5,056 2,521 14 44 1,233 8,868

National City acquisition 315 235 54 $43 647

Other acquisitions (2) 10 8

BlackRock (18) (18)

December 31, 2009 $5,369 $2,756 $68 $26 $43 $1,243 $9,505

(a) The Distressed Assets Portfolio business segment does not have any goodwill allocated to it.

(b) Represents goodwill related to GIS.

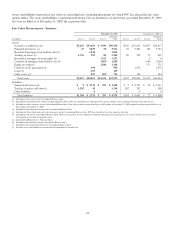

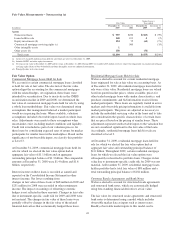

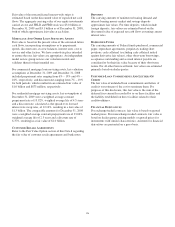

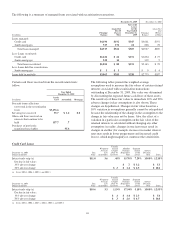

Changes in goodwill and other intangible assets during 2009

follow:

Summary of Changes in Goodwill and Other Intangible

Assets

In millions Goodwill

Customer-

Related

Servicing

Rights

January 1, 2009 $8,868 $ 930 $1,890

Additions/adjustments:

National City acquisition 647 451 18

Other acquisitions 8

Mortgage and other loan

servicing rights 503

BlackRock (18)

Reversal of prior impairment charge,

net 29

Sale of servicing rights (74)

Amortization (236) (107)

December 31, 2009 $9,505 $1,145 $2,259

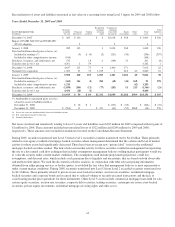

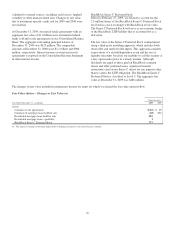

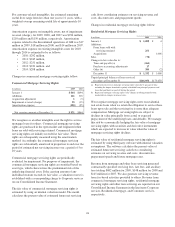

We conduct a goodwill impairment test on our reporting units

at least annually or more frequently if any adverse triggering

events occur. Based on the results of our analysis, there were

no impairment charges related to goodwill recognized in 2009,

2008 or 2007. The fair value of our reporting units is

determined by using discounted cash flow and market

comparability methodologies.

Assets and liabilities of acquired entities are recorded at

estimated fair value as of the acquisition date and are subject

to refinement as information relative to the fair values at the

date of acquisition becomes available.

The purchase price allocation for the National City acquisition

was completed as of December 31, 2009 with goodwill of

$647 million recognized.

Our investment in BlackRock changes when BlackRock

repurchases its shares in the open market or issues shares for

an acquisition or pursuant to its employee compensation plans.

We adjust goodwill when BlackRock repurchases its shares at

an amount greater (or less) than book value per share which

results in an increase (or decrease) in our percentage

ownership interest.

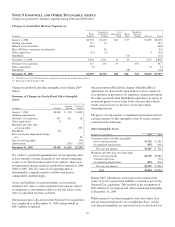

The gross carrying amount, accumulated amortization and net

carrying amount of other intangible assets by major category

consisted of the following:

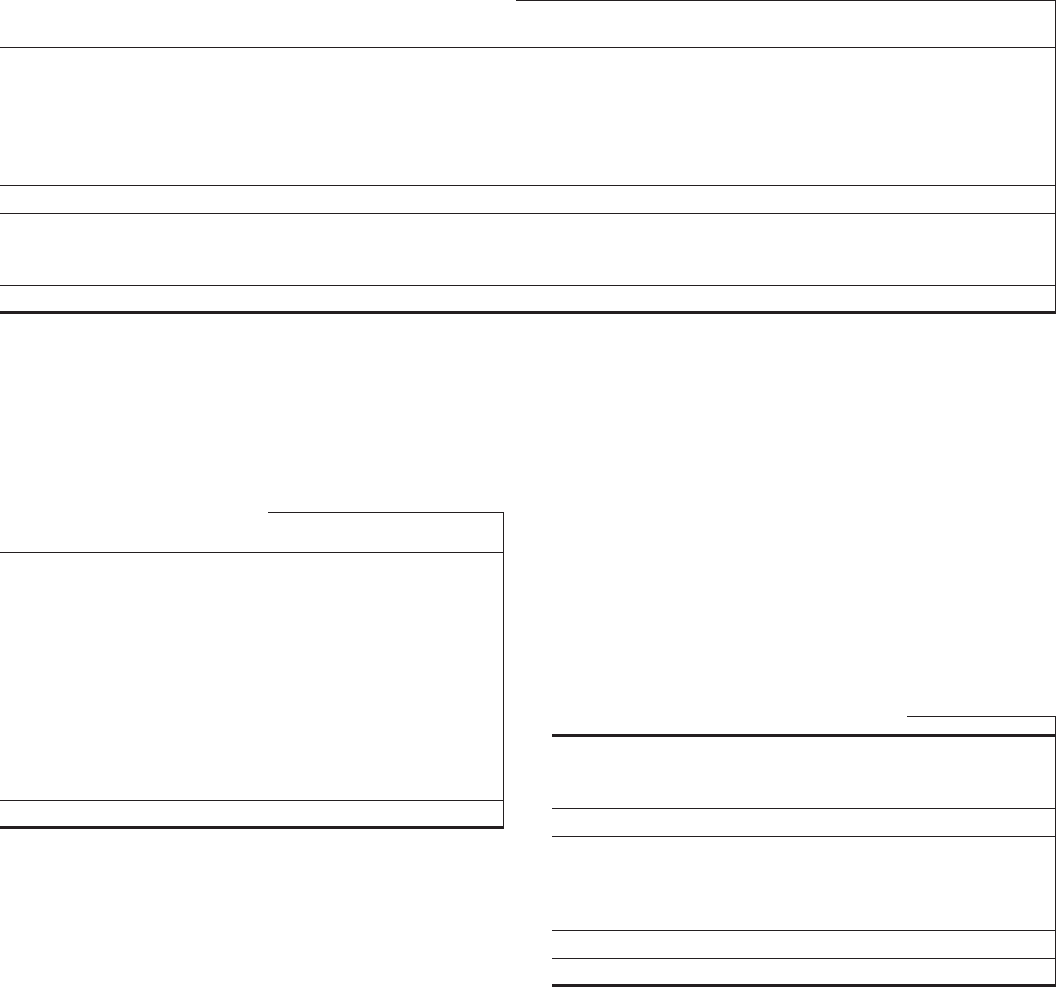

Other Intangible Assets

December 31 - In millions 2009 2008

Customer-related and other intangibles

Gross carrying amount $1,742 $1,291

Accumulated amortization (597) (361)

Net carrying amount $1,145 $ 930

Mortgage and other loan servicing rights

Gross carrying amount $2,729 $2,286

Valuation allowance (35)

Accumulated amortization (470) (361)

Net carrying amount $2,259 $1,890

Total $3,404 $2,820

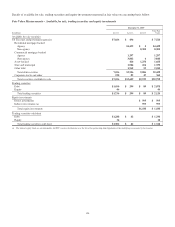

During 2009, adjustments were made to the estimated fair

values of assets acquired and liabilities assumed as part of the

National City acquisition. This resulted in the recognition of

$451 million of core deposit and other relationship intangibles

at December 31, 2009.

While certain of our other intangible assets have finite lives

and are amortized primarily on a straight-line basis, certain

core deposit intangibles are amortized on an accelerated basis.

127