PNC Bank 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

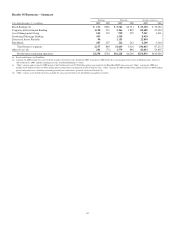

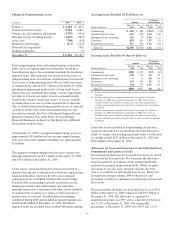

D

ISTRESSED

A

SSETS

P

ORTFOLIO

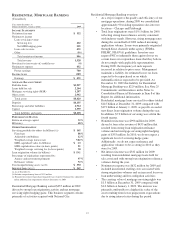

(Unaudited)

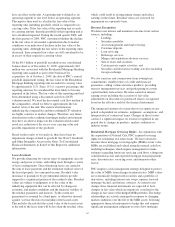

Year ended December 31

Dollars in millions, except as noted 2009

I

NCOME

S

TATEMENT

Net interest income $ 1,079

Noninterest income 74

Total revenue 1,153

Provision for credit losses 771

Noninterest expense 246

Pretax earnings 136

Income taxes 52

Earnings $84

A

VERAGE

B

ALANCE

S

HEET

COMMERCIAL LENDING:

Commercial $ 155

Commercial real estate

Real estate projects 2,780

Commercial mortgage 97

Equipment lease financing 818

Total commercial lending 3,850

CONSUMER LENDING:

Consumer:

Home equity lines of credit 4,952

Home equity installment loans 2,134

Other consumer 15

Total consumer 7,101

Residential real estate:

Residential mortgage 8,729

Residential construction 1,436

Total residential real estate 10,165

Total consumer lending 17,266

Total portfolio loans 21,116

Other assets 1,728

Total assets $22,844

Deposits $39

Other liabilities 92

Capital 1,574

Total liabilities and equity $ 1,705

O

THER

I

NFORMATION

Nonperforming assets (a) (b) $ 1,787

Impaired loans (a) (c) $ 7,577

Net charge-offs (d) $ 544

Net charge-offs as a percentage of portfolio loans (d) 2.58%

L

OANS

(

IN BILLIONS

) (a)

Commercial

Residential development $ 2.6

Cross-border leases .8

Consumer

Brokered home equity 6.4

Retail mortgages 5.2

Non-prime mortgages 1.7

Residential completed construction 1.3

Residential construction .5

Total loans $ 18.5

(a) As of December 31.

(b) Includes nonperforming loans of $1.456 billion.

(c) Recorded investment of purchased impaired loans related to National City, adjusted

to reflect additional loan impairments effective December 31, 2008.

(d) For the year ended December 31.

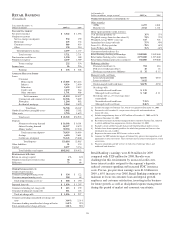

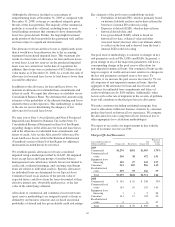

This business segment consists primarily of assets acquired

with National City. The Distressed Assets Portfolio had

earnings of $84 million for 2009. Earnings were largely driven

by net interest income of $1.1 billion. The provision for credit

losses was $771 million in 2009, which reflected credit quality

deterioration, particularly in the commercial residential

development and consumer residential construction portfolios.

Noninterest expense was $246 million for 2009, comprised

primarily of costs associated with foreclosed assets and

servicing costs.

Distressed Assets Portfolio overview:

• Total loans were $18.5 billion at December 31, 2009

compared with $27 billion at January 1, 2009. The

reduction in loans during 2009 was primarily due to

net paydowns and charge-offs.

• The loan portfolio included commercial residential

development loans, cross border leases, consumer

brokered home equity loans, retail mortgages,

non-prime mortgages and residential construction

loans.

• Certain loans in this business segment may require

special servicing given current loan performance and

market conditions. Consequently, the business

activities of this segment are focused on maximizing

the value of the portfolios assigned to it while

mitigating risk. Business intent drives the inclusion

of assets in this business segment. Not all impaired

loans are included in this business segment, nor are

all of the loans included in this business segment

considered impaired.

• The $18.5 billion of loans held in this portfolio are

stated inclusive of a fair value mark at acquisition.

Taking the mark and loan loss allowance into

account, the net carrying basis of this loan portfolio is

75% of customer outstandings.

• The commercial residential development portfolio

has undergone a loan review of the project collateral,

including certain site visits. A team of asset managers

has been assembled to address workout strategies.

Actions taken on the portfolio included reducing

unfunded loan exposure, foreclosing on residential

real estate development properties, and selling loans.

• Brokered home equity loans include closed-end

second liens and open-end home equity lines of

credit. Our focus for managing these portfolios is to

maximize the value of the portfolio. We have

implemented several modification programs to assist

the loss mitigation teams that manage this risk.

Additionally, we have initiated several voluntary and

involuntary programs to reduce and/or block line

availability on home equity lines of credit.

• Retail mortgages are primarily jumbo and ALT-A

first lien mortgages originated for sale in the second

half of 2007 for which firm commitments to lend had

been extended but there was no market to sell the

production. As part of our loss mitigation strategy,

59