PNC Bank 2009 Annual Report Download - page 100

Download and view the complete annual report

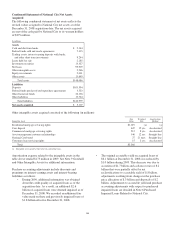

Please find page 100 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.undiscounted expected cash flows at acquisition for each loan

either individually or on a pool basis. We estimate the cash

flows expected to be collected using internal and third-party

models that incorporate management’s best estimate of current

key assumptions, such as default rates, loss severity and

payment speeds. Collateral values are also incorporated into

cash flow estimates. Late fees, which are contractual but not

expected to be collected, are excluded from expected future

cash flows. The accretable yield is calculated based upon the

difference between the undiscounted expected future cash

flows of the loans and the recorded investment in the loans.

This amount is accreted into income over the life of the loan

or pool using the constant effective yield method. Subsequent

decreases in expected cash flows that are attributable, at least

in part, to credit quality are recognized as impairments

through a charge to the provision for credit losses resulting in

an increase in the allowance for loan and lease losses.

Subsequent increases in expected cash flows are recognized as

a recovery of previously recorded allowance for loan and lease

losses or prospectively through an adjustment of the loan’s or

pool’s yield over its remaining life.

The nonaccretable yield represents the difference between the

expected undiscounted cash flows of the loans and the total

contractual cash flows (including principal and future interest

payments) at acquisition and throughout the remaining lives of

the loans.

L

EASES

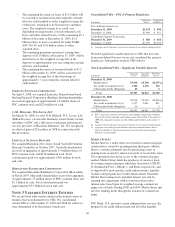

We provide financing for various types of equipment, aircraft,

energy and power systems, and rolling stock and automobiles

through a variety of lease arrangements. Direct financing

leases are carried at the aggregate of lease payments plus

estimated residual value of the leased property, less unearned

income. Leveraged leases, a form of financing lease, are

carried net of nonrecourse debt. We recognize income over

the term of the lease using the constant effective yield method.

Lease residual values are reviewed for other-than-temporary

impairment on a quarterly basis. Gains or losses on the sale of

leased assets are included in other noninterest income while

valuation adjustments on lease residuals are included in other

noninterest expense.

L

OAN

S

ALES

,L

OAN

S

ECURITIZATIONS

A

ND

R

ETAINED

I

NTERESTS

We recognize the sale of loans or other financial assets when

the transferred assets are legally isolated from our creditors

and the appropriate accounting criteria are met. We also sell

mortgage, credit card and other loans through securitization

transactions. In a securitization, financial assets are transferred

into trusts or to special-purpose entities (SPEs) in transactions

to effectively legally isolate the assets from PNC. Where the

transferor is a depository institution, legal isolation is

accomplished through compliance with specific rules and

regulations of the relevant regulatory authorities. Where the

transferor is not a depository institution, legal isolation is

accomplished through utilization of a two-step securitization

structure.

Transfers and Servicing (Topic 860) – Accounting For

Transfers of Financial Assets requires a true sale legal analysis

to be obtained to address several relevant factors, such as the

nature and level of recourse to the transferor, and the amount

and nature of retained interests in the loans sold. The

analytical conclusion as to a true sale is never absolute and

unconditional, but contains qualifications based on the

inherent equitable powers of a bankruptcy court, as well as the

unsettled state of the common law. Once the legal isolation

test has been met under GAAP, other factors concerning the

nature and extent of the transferor’s control over the

transferred assets are taken into account in order to determine

whether derecognition of assets is warranted, including

whether the SPE has complied with rules concerning

qualifying special-purpose entities.

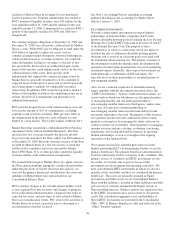

In a securitization, the trust or SPE issues beneficial interests

in the form of senior and subordinated asset-backed securities

backed or collateralized by the assets sold to the trust. The

senior classes of the asset-backed securities typically receive

investment grade credit ratings at the time of issuance. These

ratings are generally achieved through the creation of lower-

rated subordinated classes of asset-backed securities, as well

as subordinated or residual interests. In certain cases, we may

retain a portion or all of the securities issued, interest-only

strips, one or more subordinated tranches, servicing rights and,

in some cases, cash reserve accounts. Refer to Note 10

Securitization Activity for further details. In accordance with

GAAP, securitized loans are removed from the balance sheet

and a net gain or loss is recognized in noninterest income at

the time of initial sale, and each subsequent sale for revolving

securitization structures. Gains or losses recognized on the

sale of the loans depend on the allocation of carrying value

between the loans sold and the retained interests, based on

their relative fair market values at the date of sale. We

generally estimate the fair value of the retained interests based

on the present value of future expected cash flows using

assumptions as to discount rates, interest rates, prepayment

speeds, credit losses and servicing costs, if applicable.

Our loan sales and securitizations are generally structured

without recourse to us and with no restrictions on the retained

interests with the exception of loan sales to certain US

government chartered entities.

When we are obligated for loss-sharing or recourse in a sale,

our policy is to record such liabilities at fair value upon sale

based on the guidance contained in applicable GAAP.

We originate, sell and service mortgage loans under the

Federal National Mortgage Association (FNMA) Delegated

Underwriting and Servicing (DUS) program. Under the

provisions of the DUS program, we participate in a loss-

sharing arrangement with FNMA. We participate in a similar

program with the Federal Home Loan Mortgage Corporation

(FHLMC). Refer to Note 25 Commitments and Guarantees for

more information about our obligations related to sales of

loans under these programs.

96