PNC Bank 2009 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

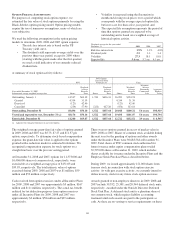

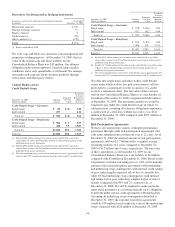

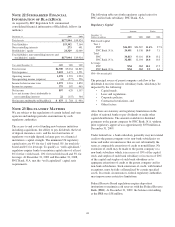

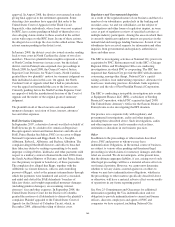

The accumulated balances related to each component of other

comprehensive income (loss) are as follows:

December 31 – in millions 2009 2008

Net unrealized securities losses $ (760) $(3,626)

OTTI losses on debt securities (816)

Net unrealized gains on cash flow hedge

derivatives 166 374

Pension, other postretirement and post

employment benefit plan adjustments (542) (667)

Other (10) (30)

Accumulated other comprehensive loss $(1,962) $(3,949)

N

OTE

21 I

NCOME

T

AXES

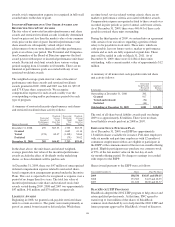

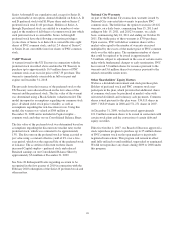

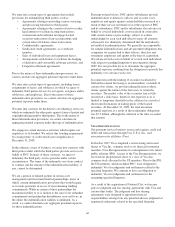

The components of income taxes from continuing operations

are as follows:

Year ended December 31

In millions 2009 2008 2007

Current

Federal $(109) $ 473 $409

State 46 61 52

Total current (63) 534 461

Deferred

Federal 912 (211) 82

State 18 (25) 18

Total deferred 930 (236) 100

Total $ 867 $ 298 $561

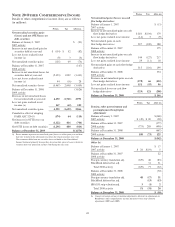

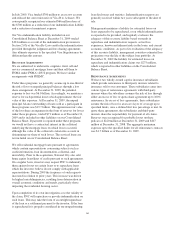

Significant components of deferred tax assets and liabilities

are as follows:

December 31 - in millions 2009 2008

Deferred tax assets

Allowance for loan and lease losses $1,978 $1,564

Net unrealized securities losses 922 2,121

Compensation and benefits 788 813

Unrealized losses on loans 1,349 1,825

Loss and credit carryforward 816 269

Other 1,287 1,672

Total gross deferred tax assets 7,140 8,264

Valuation allowance (31) (23)

Total deferred tax assets 7,109 8,241

Deferred tax liabilities

Leasing 1,191 1,292

Goodwill and Intangibles 619 636

Mortgage servicing rights 618 332

BlackRock basis difference 1,850 1,265

Other 1,124 968

Total deferred tax liabilities 5,402 4,493

Net deferred asset $1,707 $3,748

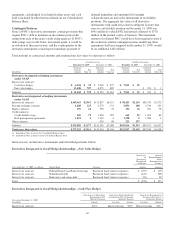

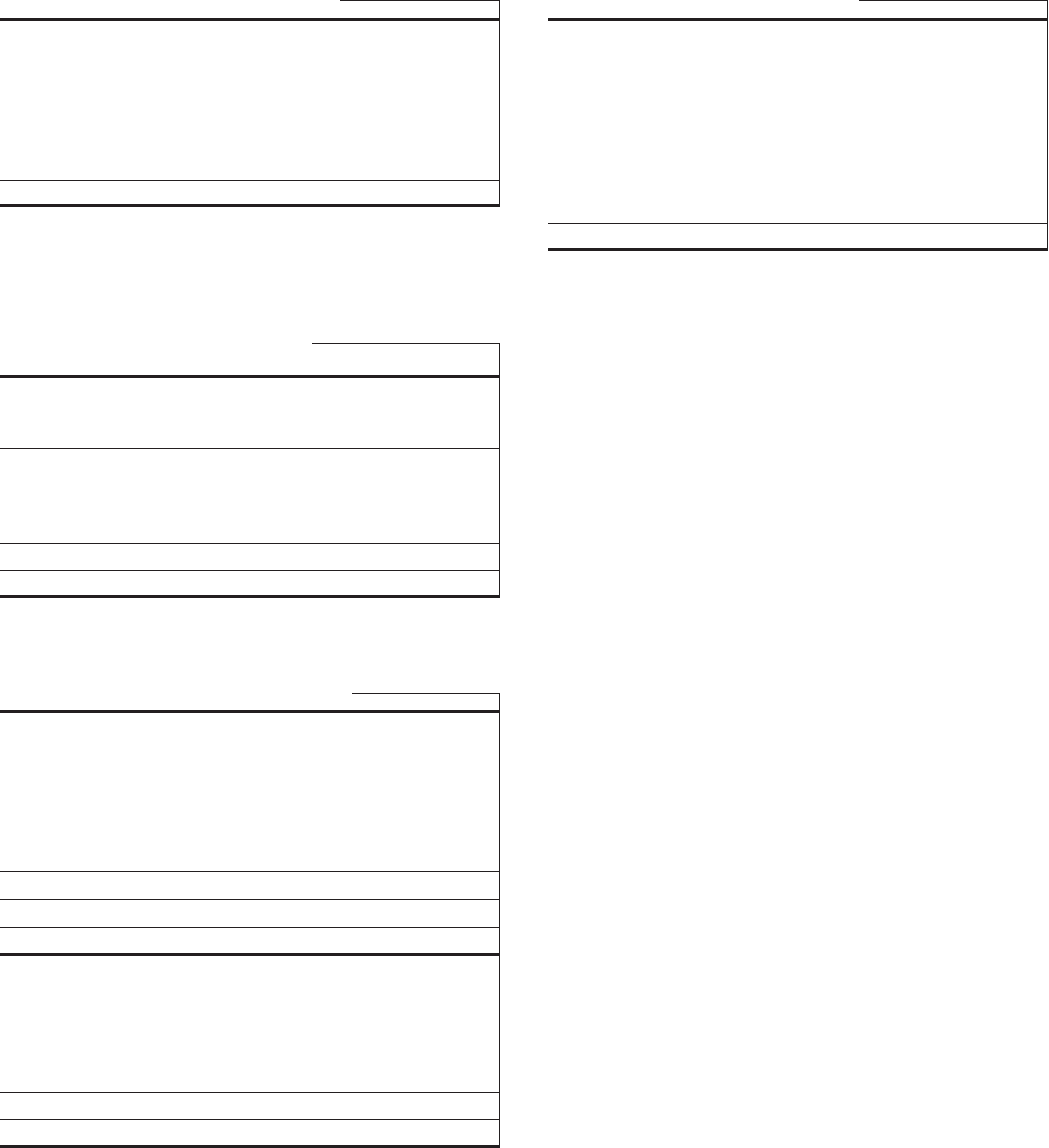

A reconciliation between the statutory and effective tax rates

follows:

Year ended December 31 2009 2008 2007

Statutory tax rate 35.0% 35.0% 35.0%

Increases (decreases) resulting from

State taxes net of federal benefit 1.2 2.3 2.3

Tax-exempt interest (1.2) (1.9) (.9)

Life insurance (1.9) (2.6) (1.8)

Dividend received deduction (1.2) (3.5) (1.7)

Tax credits (5.4) (4.8) (3.2)

Tax gain on sale of Hilliard Lyons 4.7

Other .4 (2.0) (.5)

Effective tax rate 26.9% 27.2% 29.2%

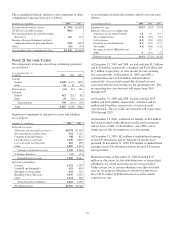

At December 31, 2009 and 2008, we had available $1.2 billion

and $124 million, respectively, of federal and $2.0 billion and

$1.7 billion, respectively, of state income tax net operating

loss carryforwards. At December 31, 2009 and 2008, a

valuation allowance of $31 million and $23 million,

respectively, was recorded against the deferred tax asset

associated with the state income tax net operating losses. The

net operating loss carryforwards will expire from 2010

through 2029.

At December 31, 2009 and 2008, we had available $254

million and $119 million, respectively, of federal and $4

million and $4 million, respectively, of state tax credit

carryforwards. The tax credit carryforwards will expire from

2010 through 2029.

At December 31, 2009, a deferred tax liability of $18 million

has been provided on the difference in the stock investment

and tax basis of GIS, a US subsidiary, since PNC can no

longer recover this investment in a tax-free manner.

At December 31, 2009, $62 million of undistributed earnings

of non-US subsidiaries had no deferred US income taxes

provided. At December 31, 2008, $59 million of undistributed

earnings of non-US subsidiaries had no deferred US income

taxes provided.

Retained earnings at December 31, 2009 included $117

million in allocations for bad debt deductions of former thrift

subsidiaries for which no income tax has been provided.

Under current law, if certain subsidiaries use these bad debt

reserves for purposes other than to absorb bad debt losses,

they will be subject to Federal income tax at the current

corporate tax rate.

153