PNC Bank 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

dividend in connection with the implementation of a

shareholders’ rights plan, or the redemption or repurchase of

any rights under any such plan, (iv) as a result of an exchange

or conversion of any class or series of PNC’s capital stock for

any other class or series of PNC’s capital stock, (v) the

purchase of fractional interests in shares of PNC capital stock

pursuant to the conversion or exchange provisions of such

stock or the security being converted or exchanged or (vi) any

stock dividends paid by PNC where the dividend stock is the

same stock as that on which the dividend is being paid.

PNC Bank, N.A. has contractually committed to Trust I that if

full dividends are not paid in a dividend period on the Trust I

Securities, LLC Preferred Securities or any other parity equity

securities issued by the LLC, neither PNC Bank, N.A. nor its

subsidiaries will declare or pay dividends or other

distributions with respect to, or redeem, purchase or acquire or

make a liquidation payment with respect to, any of its equity

capital securities during the next succeeding period (other than

to holders of the LLC Preferred Securities and any parity

equity securities issued by the LLC) except: (i) in the case of

dividends payable to subsidiaries of PNC Bank, N.A., to PNC

Bank, N.A. or another wholly-owned subsidiary of PNC Bank,

N.A. or (ii) in the case of dividends payable to persons that are

not subsidiaries of PNC Bank, N.A., to such persons only if,

(A) in the case of a cash dividend, PNC has first irrevocably

committed to contribute amounts at least equal to such cash

dividend or (B) in the case of in-kind dividends payable by

PNC REIT Corp., PNC has committed to purchase such

in-kind dividend from the applicable PNC REIT Corp. holders

in exchange for a cash payment representing the market value

of such in-kind dividend, and PNC has committed to

contribute such in-kind dividend to PNC Bank, N.A.

N

OTE

4L

OANS

,C

OMMITMENTS TO

E

XTEND

C

REDIT AND

C

ONCENTRATIONS OF

C

REDIT

R

ISK

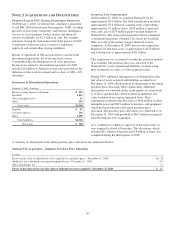

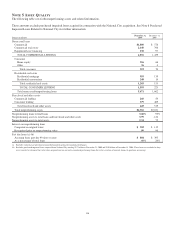

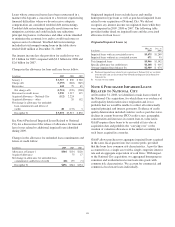

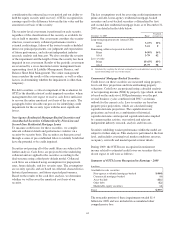

Loans outstanding were as follows:

In millions

December 31

2009

December 31

2008

Commercial $ 54,818 $ 69,220

Commercial real estate 23,131 25,736

Consumer 53,582 52,489

Residential real estate 19,810 21,583

Equipment lease financing 6,202 6,461

Total loans $157,543 $175,489

Loans are presented net of unearned income, net deferred loan

fees, unamortized discounts and premiums, and purchase

discounts and premiums totaling $3.2 billion and $4.3 billion

at December 31, 2009 and December 31, 2008, respectively.

Future accretable interest related to purchased impaired loans

is not included in loans outstanding.

Concentrations of credit risk exist when changes in economic,

industry or geographic factors similarly affect groups of

counterparties whose aggregate exposure is material in

relation to our total credit exposure. Loans outstanding and

related unfunded commitments are concentrated in our

primary geographic markets. At December 31, 2009, no

specific industry concentration exceeded 6% of total

commercial loans outstanding.

In the normal course of business, we originate or purchase

loan products whose contractual features, when concentrated,

may increase our exposure as a holder and servicer of those

loan products. Possible product terms and features that may

create a concentration of credit risk would include loan

products whose terms permit negative amortization, a high

loan-to-value ratio, features that may expose the borrower to

future increases in repayments above increases in market

interest rates, below-market interest rates and interest-only

loans, among others.

We originate interest-only loans to commercial borrowers.

These products are standard in the financial services industry

and the features of these products are considered during the

underwriting process to mitigate the increased risk of this

product feature that may result in borrowers not being able to

make interest and principal payments when due. We do not

believe that these product features create a concentration of

credit risk.

We also originate home equity loans and lines of credit that

result in a credit concentration of high loan-to-value ratio loan

products at the time of origination. In addition, these loans are

concentrated in our primary geographic markets.

Certain loans are accounted for at fair value with changes in

the fair value reported in current period earnings. The fair

value of these loans was $107 million, or approximately .07%

of the total loan portfolio, at December 31, 2009. Loans held

for sale are reported separately on the Consolidated Balance

Sheet and are not included in the table above. Interest income

from total loans held for sale was $270 million in 2009, $166

million in 2008 and $184 million in 2007 and is included in

Other interest income on our Consolidated Income Statement.

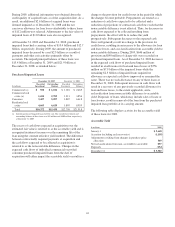

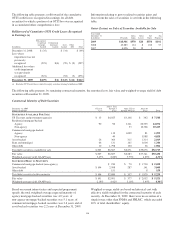

Net Unfunded Credit Commitments

In millions

December 31

2009

December 31

2008

Commercial and commercial real estate $ 60,143 $ 60,020

Home equity lines of credit 20,367 23,195

Consumer credit card and other

unsecured lines 18,800 20,207

Other 1,485 1,466

Total $100,795 $104,888

Commitments to extend credit represent arrangements to lend

funds or provide liquidity subject to specified contractual

conditions. At December 31, 2009 commercial commitments

are reported net of $13.2 billion of participations, assignments

and syndications, primarily to financial institutions. The

comparable amount at December 31, 2008 was $8.6 billion.

108