PNC Bank 2009 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

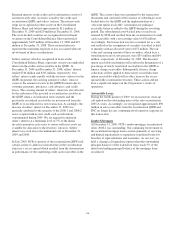

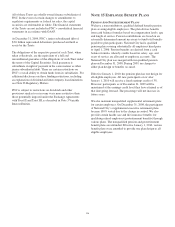

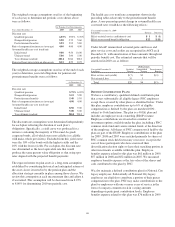

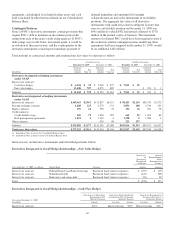

The following summarizes changes in the fair value of the

pension plan’s Level 3 assets during 2009:

In millions

Corporate

debt

Limited

partnerships Other

January 1, 2009 $ 41 $ 55 $12

Net realized gain on sale of

investments 2

Net unrealized gain/(loss) on assets

held at end of year (23) (6) 9

Purchases, sales, issuances, and

settlements (net) 29 11 9

Transfers into Level 3 68 59 14

December 31, 2009 $117 $119 $44

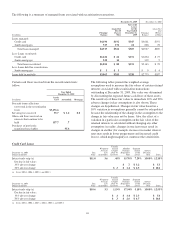

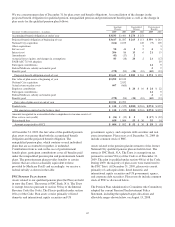

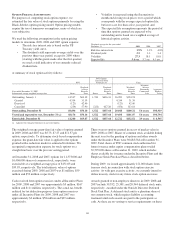

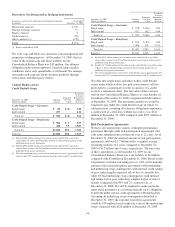

The following table provides information regarding our

estimated future cash flows related to our various plans:

E

STIMATED

C

ASH

F

LOWS

Postretirement Benefits

In millions

Qualified

Pension

Nonqualified

Pension

Gross PNC

Benefit Payments

Reduction in

PNC Benefit

Payments Due

to Medicare

Part D Subsidy

Estimated 2010

employer

contributions $ 31 $ 35 $2

Estimated

future benefit

payments

2010 $ 278 $ 31 $ 35 $2

2011 285 32 32 2

2012 289 28 32 2

2013 297 26 32 2

2014 304 24 32 2

2015 – 2019 1,555 102 150 7

The qualified pension plan contributions are deposited into the

Trust, and the qualified pension plan benefit payments are

paid from the Trust. For the other plans, total contributions

and the benefit payments are the same and represent expected

benefit amounts, which are paid from general assets.

Postretirement benefits are net of participant contributions.

Due to the plan’s funded status, the qualified pension

contribution in 2010 is expected to be zero.

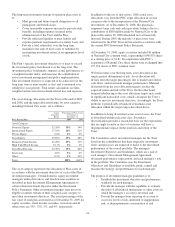

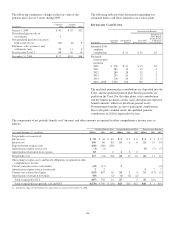

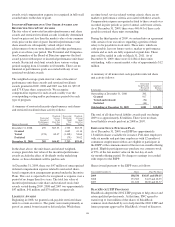

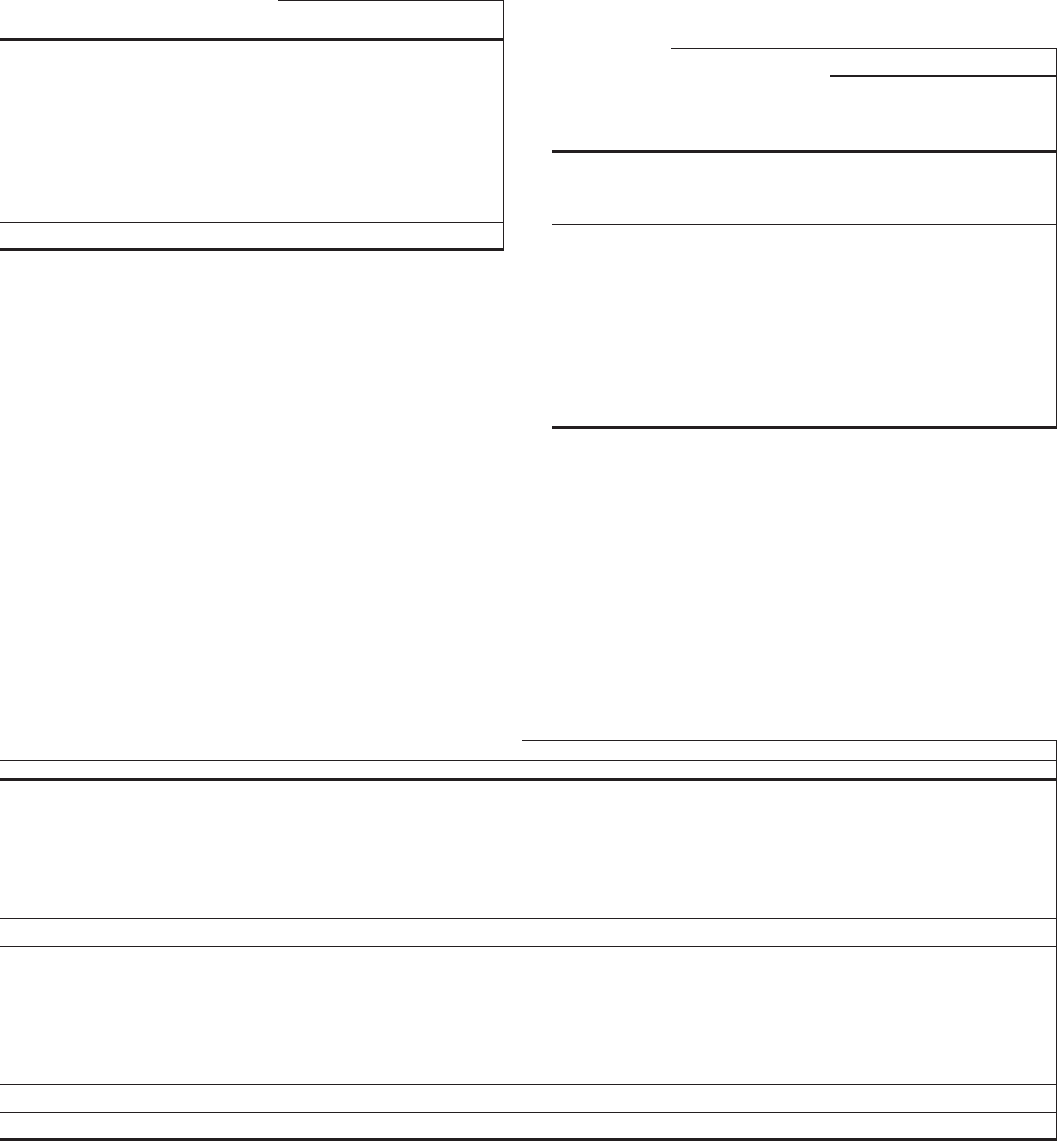

The components of net periodic benefit cost/ (income) and other amounts recognized in other comprehensive income were as

follows.

Qualified Pension Plan Nonqualified Pension Plan Postretirement Benefits

Year ended December 31 – in millions 2009(a) 2008 2007 2009(a) 2008 2007 2009(a) 2008 2007

Net periodic cost consists of:

Service cost $90 $44 $42 $2 $2 $2 $4 $3 $3

Interest cost 206 86 82 15 6621 15 14

Expected return on plan assets (260) (160) (156)

Amortization of prior service cost (2) (2) (5) (7) (7)

Amortization of actuarial losses (gains) 83 2122

Net periodic cost 117 (32) (30) 18 10 10 20 11 10

Other changes in plan assets and benefit obligations recognized in other

comprehensive income:

Current year prior service cost/(credit) (43) (17) 2(5)

Amortization of prior service (cost)/credit 22577

Current year actuarial loss/(gain) (263) 807 16 24 2421 (17) (2)

Amortization of actuarial (loss)/gain (83) (2) (1) (2) (2)

Total recognized in OCI (387) 792 14 25 226 (10)

Total recognized in net periodic cost and OCI $(270) $ 760 $ (16) $43 $10 $12 $46 $ 1 $10

(a) Includes the impact of the National City plans which we acquired on December 31, 2008.

140