PNC Bank 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

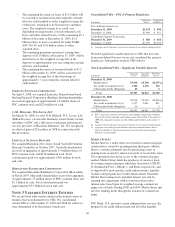

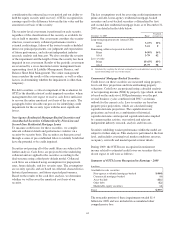

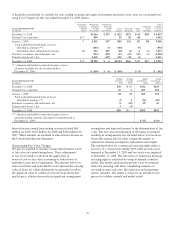

During 2009, additional information was obtained about the

credit quality of acquired loans as of the acquisition date. As a

result, an additional $2.6 billion of acquired loans were

deemed impaired as of December 31, 2008 and the net

carryover allowance for loan losses attributable to these loans

of $112 million was released. Adjustments to the fair value of

impaired loans of $1.8 billion were also recognized.

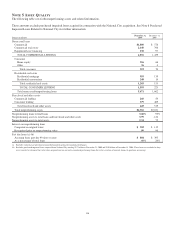

At December 31, 2009 and December 31, 2008, purchased

impaired loans had a carrying value of $10.4 billion and $12.7

billion, respectively. During 2009, the amount of purchased

impaired loans decreased by a net $2.3 billion as a result of

payments and other exit activities primarily offset by

accretion. The unpaid principal balance of these loans was

$15.4 billion at December 31, 2009 and $21.9 billion at

December 31, 2008, as detailed below:

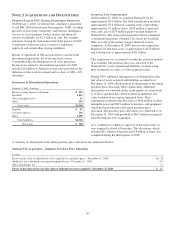

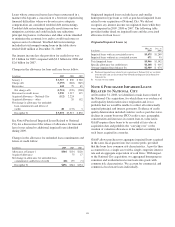

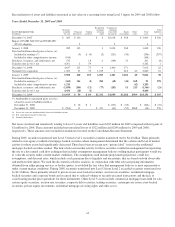

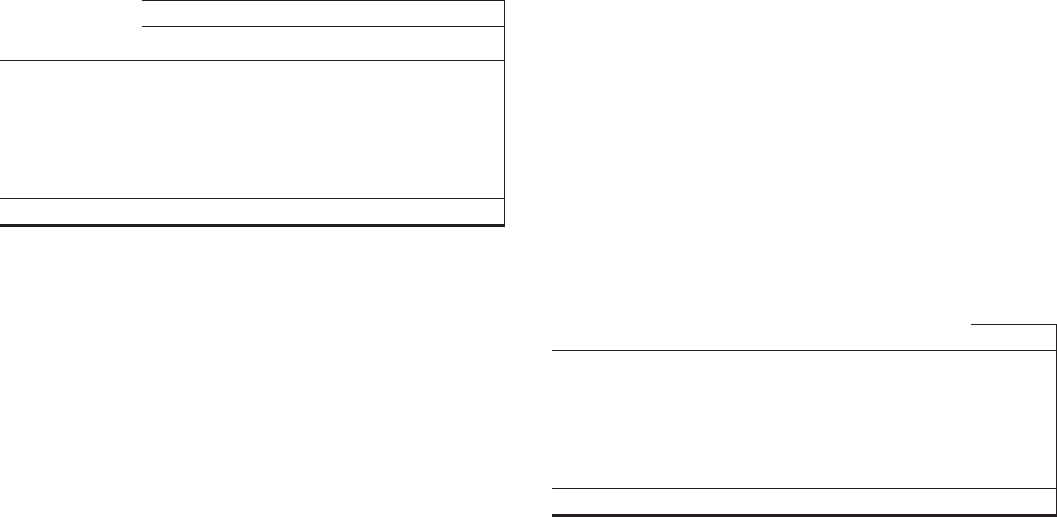

Purchased Impaired Loans

December 31, 2009 December 31, 2008

In millions

Recorded

Investment

Outstanding

Balance

Recorded

Investment

Outstanding

Balance

Commercial (a) $ 558 $ 1,016 $ 1,016 $ 2,485

Commercial real

estate (a) 1,694 2,705 1,911 3,856

Consumer 3,457 5,097 3,887 6,618

Residential real

estate 4,663 6,620 5,895 8,959

Total $10,372 $15,438 $12,709 $21,918

(a) Includes purchased impaired loans held for sale. The recorded investment and

outstanding balance of these loans was $85 million and $200 million, respectively,

at December 31, 2009.

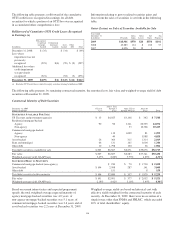

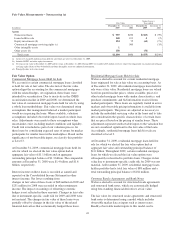

The excess of cash flows expected at acquisition over the

estimated fair value is referred to as the accretable yield and is

recognized in interest income over the remaining life of the

loan using the constant effective yield method. The difference

between contractually required payments at acquisition and

the cash flows expected to be collected at acquisition is

referred to as the nonaccretable difference. Changes in the

expected cash flows of individual commercial or pooled

consumer purchased impaired loans from the date of

acquisition will either impact the accretable yield or result in a

charge to the provision for credit losses in the period in which

the changes become probable. Prepayments are treated as a

reduction of cash flows expected to be collected and a

reduction of projections of contractual cash flows such that the

nonaccretable difference is not affected. Thus, for decreases in

cash flows expected to be collected resulting from

prepayments, the effect will be to reduce the yield

prospectively. Subsequent decreases to the expected cash

flows will generally result in a charge to the provision for

credit losses, resulting in an increase to the allowance for loan

and lease losses, and a reclassification from accretable yield to

nonaccretable difference. During 2009, $646 million of

provision and $90 million of charge-offs were recorded on

purchased impaired loans. As of December 31, 2009 decreases

in the expected cash flows of purchased impaired loans

resulted in an allowance for loan and lease losses of $556

million on $7.9 billion of the impaired loans while the

remaining $2.5 billion of impaired loans required no

allowance as expected cash flows improved or remained the

same. There was no such allowance on any of these loans at

December 31, 2008. Subsequent increases in cash flows will

result in a recovery of any previously recorded allowance for

loan and lease losses, to the extent applicable, and a

reclassification from nonaccretable difference to accretable

yield. Disposals of loans, which may include sales of loans or

foreclosures, result in removal of the loan from the purchased

impaired loan portfolio at its carrying amount.

The following table displays activity for the accretable yield

of these loans for 2009.

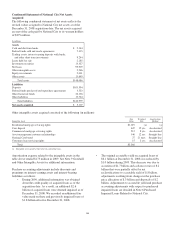

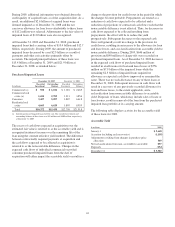

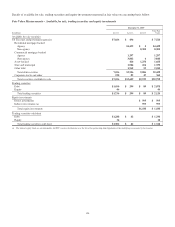

Accretable Yield

In millions 2009

January 1 $ 3,668

Accretion (including cash recoveries) (1,118)

Adjustments resulting from changes in purchase price

allocation 349

Net reclassifications from non- accretable to accretable 837

Disposals (234)

December 31 $ 3,502

112