PNC Bank 2009 Annual Report Download - page 26

Download and view the complete annual report

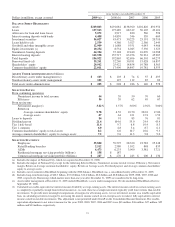

Please find page 26 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM

7–

MANAGEMENT

’

S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

E

XECUTIVE

S

UMMARY

PNC is one of the largest diversified financial services

companies in the United States and is headquartered in

Pittsburgh, Pennsylvania.

PNC has businesses engaged in retail banking, corporate and

institutional banking, asset management, residential mortgage

banking and global investment servicing, providing many of

its products and services nationally and others in PNC’s

primary geographic markets located in Pennsylvania, Ohio,

New Jersey, Michigan, Maryland, Illinois, Indiana, Kentucky,

Florida, Missouri, Virginia, Delaware, Washington, D.C., and

Wisconsin. PNC also provides certain investment servicing

internationally.

On December 31, 2008, PNC acquired National City

Corporation (National City). Our consolidated financial

statements for 2009 reflect the impact of National City. The

impact of National City is described where appropriate

throughout this Report.

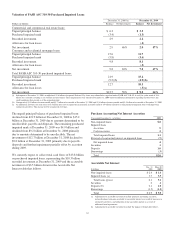

We expect to incur additional merger and integration costs in

2010 of approximately $285 million pretax in connection with

the acquisition of National City. We previously recognized

$421 million pretax in 2009, including $155 million pretax in

the fourth quarter, and $575 million pretax in the fourth

quarter of 2008. The transaction is expected to result in the

reduction of more than $1.5 billion of combined company

annualized noninterest expense through the elimination of

operational and administrative redundancies.

We continue to integrate the businesses and operations of

National City with those of PNC.

R

EPURCHASE OF

O

UTSTANDING

TARP P

REFERRED

S

TOCK

As further described in Note 19 Equity in the Notes To

Consolidated Financial Statements in Item 8 of this Report, on

December 31, 2008, we issued $7.6 billion of Fixed Rate

Cumulative Perpetual Preferred Shares, Series N (Series N

Preferred Stock), and the related warrant to the US Treasury

under the US Treasury’s Troubled Asset Relief Program

(TARP) Capital Purchase Program.

As approved by the Federal Reserve Board, the US Treasury

and our other banking regulators, on February 10, 2010, we

redeemed all 75,792 shares of our Series N Preferred Stock

held by the US Treasury totaling $7.6 billion. We used the net

proceeds from our February 2010 common stock and senior

notes offerings, described further in the Liquidity Risk

Management section of this Item 7, and other funds to redeem

the Series N Preferred Stock.

Dividends of $89 million were paid on February 10, 2010

when the Series N Preferred Stock was redeemed. PNC paid

total dividends of $421 million to the US Treasury while the

Series N Preferred Stock was outstanding.

We did not exercise our right to seek to repurchase the related

warrant at the time we redeemed the Series N Preferred Stock.

P

ENDING

S

ALE OF

PNC G

LOBAL

I

NVESTMENT

S

ERVICING

On February 2, 2010, we entered into a definitive agreement

to sell PNC Global Investment Servicing Inc. (GIS), a leading

provider of processing, technology and business intelligence

services to asset managers, broker-dealers and financial

advisors worldwide, for $2.3 billion in cash. Upon completion

of the sale, we expect to report an after-tax gain of

approximately $455 million.

We currently anticipate closing the transaction in the third

quarter of 2010. Completion of the transaction is subject to

regulatory approvals and certain other closing conditions. If

the sale of GIS is not completed by November 1, 2010, we

will be required, on or before that date, to raise $700 million

in additional Tier 1 common capital. We would do this either

through the sale of assets approved by the Federal Reserve

Board and/or through the issuance of additional common

stock. See Item 1A Risk Factors in this Report for additional

information.

Further information regarding the National City acquisition

and the pending sale of GIS is included in Note 2 Acquisitions

and Divestitures in our Notes To Consolidated Financial

Statements within Item 8 of this Report.

K

EY

S

TRATEGIC

G

OALS

We manage our company for the long term and are focused on

returning to a moderate risk profile while maintaining strong

capital and liquidity positions, investing in our markets and

products, and embracing our corporate responsibility to the

communities where we do business.

Our strategy to enhance shareholder value centers on driving

pre-tax, pre-provision earnings in excess of credit costs by

achieving growth in revenue from our balance sheet and

diverse business mix that exceeds growth in expenses

controlled through disciplined cost management. The primary

drivers of revenue growth are the acquisition, expansion and

retention of customer relationships. We strive to expand our

customer base by offering convenient banking options and

leading technology solutions, providing a broad range of

fee-based and credit products and services, focusing on

customer service, and through a significantly enhanced

branding initiative. We may also grow revenue through

appropriate and targeted acquisitions and, in certain

businesses, by expanding into new geographical markets.

We are focused on our strategies for quality growth. We are

committed to returning to a moderate risk profile

22