PNC Bank 2009 Annual Report Download - page 80

Download and view the complete annual report

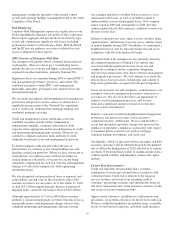

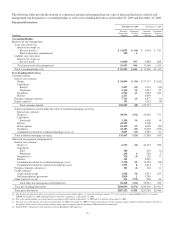

Please find page 80 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Trading revenue excludes the impact of economic hedging

activities, which related primarily to residential mortgage

servicing rights and residential and commercial real estate

loans.

Improved valuations resulted in better trading results in 2009

compared with 2008. Lower trading revenue in 2008 was

primarily related to our proprietary trading activities and

reflected the negative impact of a very illiquid market on the

assets that we held during the first quarter of 2008.

M

ARKET

R

ISK

M

ANAGEMENT

–E

QUITY

A

ND

O

THER

I

NVESTMENT

R

ISK

Equity investment risk is the risk of potential losses associated

with investing in both private and public equity markets. In

addition to extending credit, taking deposits, and underwriting

and trading financial instruments, we make and manage direct

investments in a variety of transactions, including

management buyouts, recapitalizations, and later-stage growth

financings in a variety of industries. We also have investments

in affiliated and non-affiliated funds that make similar

investments in private equity and in debt and equity-oriented

hedge funds. The economic and/or book value of these

investments and other assets such as loan servicing rights are

directly affected by changes in market factors.

The primary risk measurement for equity and other

investments is economic capital. Economic capital is a

common measure of risk for credit, market and operational

risk. It is an estimate of the worst-case value depreciation over

a one year horizon to a level commensurate with a financial

institution with an A rating by the credit rating agencies.

Given the illiquid nature of many of these types of

investments, it can be a challenge to determine their fair

values. Market Risk Management and Finance provide

independent oversight of the valuation process.

Various PNC business units manage our private equity and

other investment activities. Our businesses are responsible for

making investment decisions within the approved policy limits

and associated guidelines.

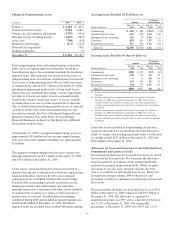

BlackRock

PNC owns approximately 44 million common stock

equivalent shares of BlackRock equity, accounted for under

the equity method. Our investment in BlackRock was $5.8

billion at December 31, 2009 compared with $4.2 billion at

December 31, 2008. The market value of our investment in

BlackRock was $10.1 billion at December 31, 2009. The

primary risk measurement, similar to other equity investments,

is economic capital.

The discussion of BlackRock within the Business Segments

Review section of this Item 7 includes information about

changes in our ownership structure of BlackRock during 2009

and BlackRock’s December 1, 2009 acquisition of BGI.

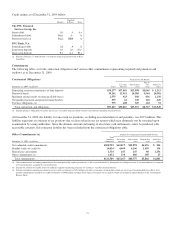

Tax Credit Investments

Included in our equity investments are tax credit investments.

These investments, as well as equity investments held by

consolidated partnerships, totaled $2.5 billion at December 31,

2009 and $2.3 billion at December 31, 2008. Investments

accounted for under the equity method totaled $2.0 billion

while investments accounted for under the cost method totaled

$488 million at December 31, 2009. The comparable amounts

at December 31, 2008 were $1.7 billion and $648 million.

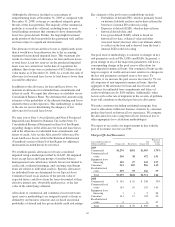

Visa

At December 31, 2009, our investment in Visa Class B

common shares totaled approximately 23 million shares.

Considering the adjustment to the conversion ratio due to

settled litigation reported by Visa, these shares would convert

to approximately 13.6 million of the publicly traded Visa

Class A common shares. As of December 31, 2009, we had

recognized $456 million of our Visa ownership, which we

acquired with National City, on our Consolidated Balance

Sheet. Based on the December 31, 2009 closing price of

$87.46 for the Visa shares the market value of our investment

was $1.2 billion. The Visa Class B common shares we own

generally will not be transferable, except under limited

circumstances, until they can be converted into shares of the

publicly traded class of stock, which cannot happen until the

later of three years after the IPO or settlement of all of the

specified litigation. It is expected that Visa will continue to

adjust the conversion ratio of Visa Class B to Class A shares

in connection with settlements in excess of any amounts then

in escrow for that purpose and will also reduce the conversion

ratio to the extent that it adds any funds to the escrow in the

future.

In July 2009, Visa funded $700 million to the litigation

escrow account and reduced the conversion ratio of Visa B to

A shares. We consequently recognized our estimated $66

million share of the $700 million as a reduction of our

indemnification liability and a reduction of noninterest

expense.

Note 25 Commitments and Guarantees in the Notes To

Consolidated Financial Statements in Item 8 of this Report has

further information on our Visa indemnification obligation.

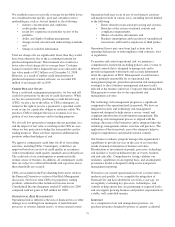

Private Equity

The private equity portfolio is an illiquid portfolio comprised

of equity and mezzanine investments that vary by industry,

stage and type of investment. Private equity investments are

reported at fair value. Changes in the values of private equity

investments are reflected in our results of operations. Due to

the nature of the investments, the valuations incorporate

assumptions as to future performance, financial condition,

liquidity, availability of capital, and market conditions, among

other factors, to determine the estimated fair value of the

investments. Market conditions and actual performance of the

investments could differ from these assumptions.

76