PNC Bank 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

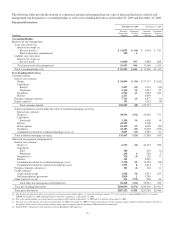

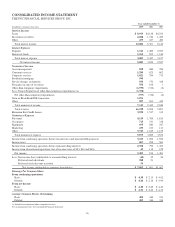

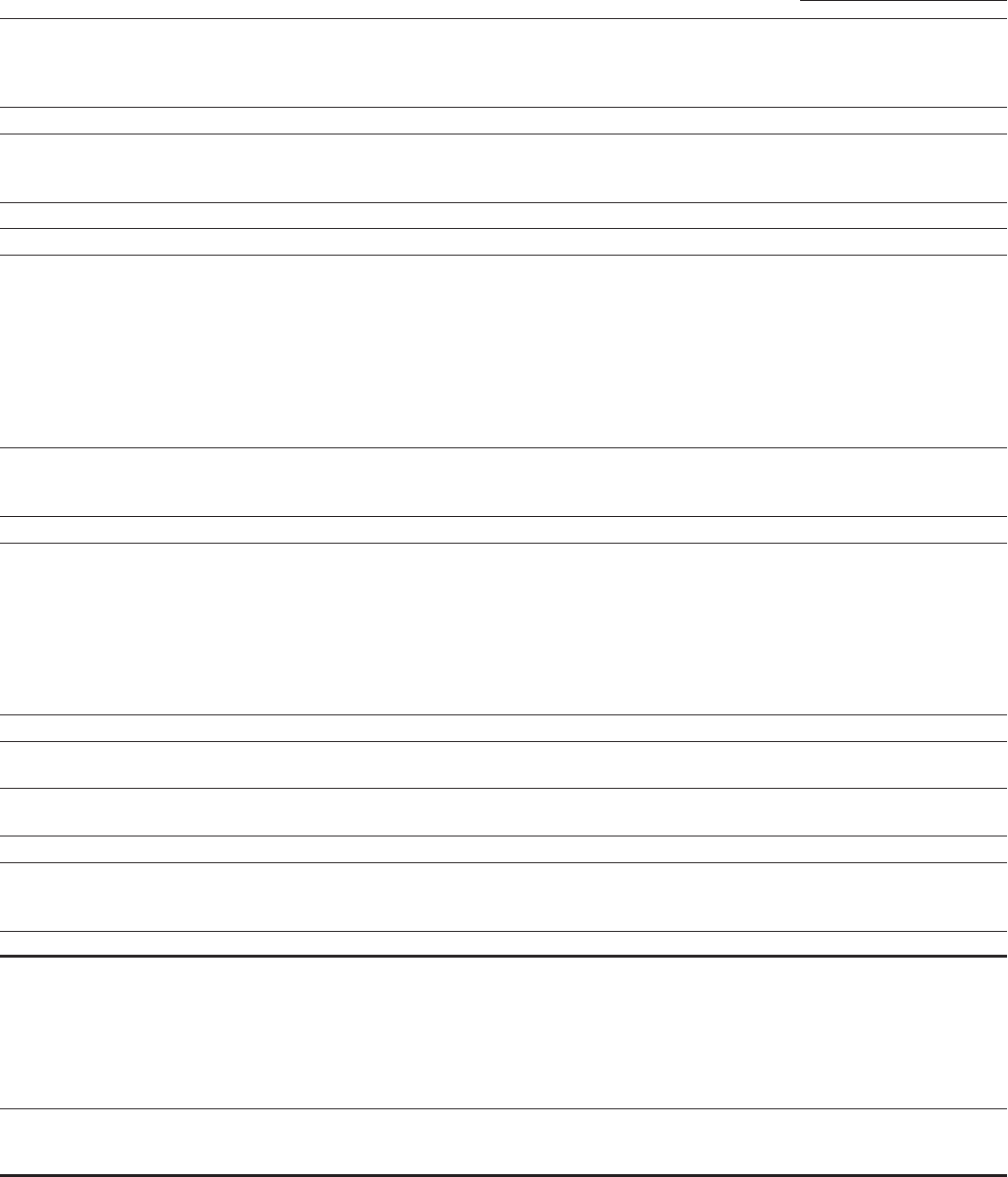

CONSOLIDATED INCOME STATEMENT

THE PNC FINANCIAL SERVICES GROUP, INC.

Year ended December 31

In millions, except per share data 2009 2008 2007

Interest Income

Loans $ 8,919 $4,138 $4,232

Investment securities 2,688 1,746 1,429

Other 479 417 483

Total interest income 12,086 6,301 6,144

Interest Expense

Deposits 1,741 1,485 2,053

Borrowed funds 1,262 962 1,144

Total interest expense 3,003 2,447 3,197

Net interest income 9,083 3,854 2,947

Noninterest Income

Asset management 858 686 784

Consumer services 1,290 623 692

Corporate services 1,021 704 713

Residential mortgage 990

Service charges on deposits 950 372 348

Net gains on sales of securities 550 106 1

Other-than-temporary impairments (1,935) (312) (6)

Less: Noncredit portion of other-than-temporary impairments (a) (1,358)

Net other-than-temporary impairments (577) (312) (6)

Gain on BlackRock/BGI transaction 1,076

Other 987 263 412

Total noninterest income 7,145 2,442 2,944

Total revenue 16,228 6,296 5,891

Provision For Credit Losses 3,930 1,517 315

Noninterest Expense

Personnel 4,119 1,766 1,815

Occupancy 713 331 318

Equipment 695 280 247

Marketing 233 123 113

Other 3,313 1,185 1,159

Total noninterest expense 9,073 3,685 3,652

Income from continuing operations before income taxes and noncontrolling interests 3,225 1,094 1,924

Income taxes 867 298 561

Income from continuing operations before noncontrolling interests 2,358 796 1,363

Income from discontinued operations (net of income taxes of $54, $63 and $66) 45 118 128

Net income 2,403 914 1,491

Less: Net income (loss) attributable to noncontrolling interests (44) 32 24

Preferred stock dividends 388 21

Preferred stock discount accretion 56

Net income attributable to common shareholders $ 2,003 $ 861 $1,467

Earnings Per Common Share

From continuing operations

Basic $ 4.30 $ 2.15 $ 4.02

Diluted $ 4.26 $ 2.10 $ 3.94

From net income

Basic $ 4.40 $ 2.49 $ 4.40

Diluted $ 4.36 $ 2.44 $ 4.32

Average Common Shares Outstanding

Basic 454 344 331

Diluted 455 346 334

(a) Included in accumulated other comprehensive loss.

See accompanying Notes To Consolidated Financial Statements.

88