PNC Bank 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

Net income for 2009 was $2.4 billion and for 2008 was $914

million. Amounts for 2009 include operating results of

National City and the fourth quarter impact of a $687 million

after-tax gain related to BlackRock’s acquisition of BGI.

Increases in income statement comparisons to 2008, except as

noted, are primarily due to the operating results of National

City. Our Consolidated Income Statement is presented in

Item 8 of this Report.

N

ET

I

NTEREST

I

NCOME AND

N

ET

I

NTEREST

M

ARGIN

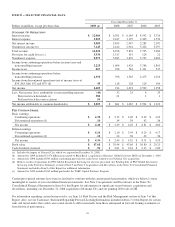

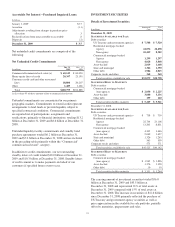

Year ended December 31

Dollars in millions 2009 2008

Net interest income $9,083 $3,854

Net interest margin 3.82% 3.37%

Changes in net interest income and margin result from the

interaction of the volume and composition of interest-earning

assets and related yields, interest-bearing liabilities and related

rates paid, and noninterest-bearing sources of funding. See

Statistical Information – Analysis Of Year-To-Year Changes

In Net Interest (Unaudited) Income And Average

Consolidated Balance Sheet and Net Interest Analysis in

Item 8 of this Report for additional information.

Higher net interest income for 2009 compared with 2008

reflected the increase in average interest-earning assets due to

National City and the improvement in the net interest margin.

The net interest margin was 3.82% for 2009 and 3.37% for

2008. The following factors impacted the comparison:

• A decrease in the rate accrued on interest-bearing

liabilities of 97 basis points. The rate accrued on

interest-bearing deposits, the largest component,

decreased 107 basis points.

• These factors were partially offset by a 45 basis point

decrease in the yield on interest-earning assets. The

yield on loans, which represented the largest portion

of our earning assets in 2009, decreased 30 basis

points.

• In addition, the impact of noninterest-bearing sources

of funding decreased 7 basis points.

For comparing to the broader market, the average Federal

funds rate was .16% for 2009 compared with 1.94% for 2008.

We expect our net interest income for 2010 will likely be

modestly lower as a result of cash recoveries on purchased

impaired loans in 2009 and additional run-off of higher-

yielding assets, which could be mitigated by rising interest

rates. This assumes our current expectations for interest rates

and economic conditions – we include our current economic

assumptions underlying our forward-looking statements in the

Cautionary Statement Regarding Forward-Looking

Information section of this Item 7.

N

ONINTEREST

I

NCOME

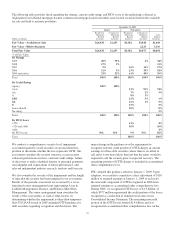

Summary

Noninterest income was $7.1 billion for 2009 and $2.4 billion

for 2008.

Noninterest income for 2009 included the following:

• The gain on BlackRock/BGI transaction of $1.076

billion,

• Net credit-related other-than-temporary impairments

(OTTI) on debt and equity securities of $577 million,

• Net gains on sales of securities of $550 million,

• Gains on hedging of residential mortgage servicing

rights of $355 million,

• Valuation and sale income related to our commercial

mortgage loans held for sale, net of hedges, of $107

million,

• Gains of $103 million related to our BlackRock LTIP

shares adjustment in the first quarter, and net losses

on private equity and alternative investments of $93

million.

Noninterest income for 2008 included the following:

• Net OTTI on debt and equity securities of $312

million,

• Gains of $246 million related to our BlackRock LTIP

shares adjustment,

• Valuation and sale losses related to our commercial

mortgage loans held for sale, net of hedges, of $197

million,

• Impairment and other losses related to private equity

and alternative investments of $180 million,

• Income from Hilliard Lyons totaling $164 million,

including the first quarter gain of $114 million from

the sale of this business,

• Net gains on sales of securities of $106 million, and

• A gain of $95 million related to the redemption of a

portion of our Visa Class B common shares related to

Visa’s March 2008 initial public offering.

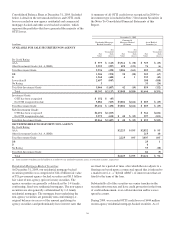

Additional analysis

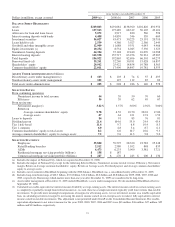

Asset management revenue increased $172 million to $858

million in 2009, compared with $686 million in 2008. This

increase reflected improving equity markets, new business

generation and a shift in assets into higher yielding equity

investments during the second half of 2009. Assets managed

totaled $103 billion at both December 31, 2009 and 2008,

including the impact of National City. The Asset Management

Group section of the Business Segments Review section of

this Item 7 includes further discussion of assets under

management.

Consumer services fees totaled $1.290 billion in 2009

compared with $623 million in 2008. Service charges on

deposits totaled $950 million for 2009 and $372 million for

2008. Both increases were primarily driven by the impact of

the National City acquisition. Reduced consumer spending,

27