PNC Bank 2009 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

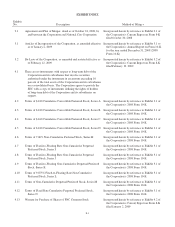

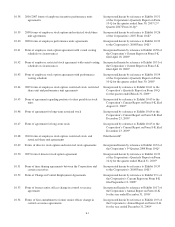

|

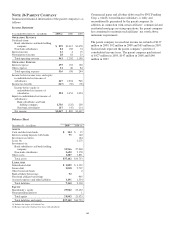

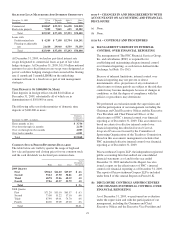

|

R

ECONCILIATION

O

F

C

ERTAIN

R

ISK

-B

ASED

C

APITAL AND

R

ATIOS AT

D

ECEMBER

31, 2009

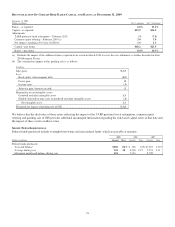

December 31, 2009

Dollars in billions Tier 1 common Tier 1 risk-based

Ratios – as reported 6.0% 11.4%

Capital – as reported $13.9 $26.5

Adjustments:

TARP preferred stock redemption – February 2010 (.3) (7.6)

Common equity offering – February 2010 (a) 3.0 3.0

Net impact of pending 2010 sale of GIS (b) 1.6 1.6

Capital – pro forma $18.2 $23.5

Ratios – pro forma 8.0% 10.3%

(a) Excludes the impact of the additional shares expected to be issued in March 2010 to cover the over-allotments as further described in Note

28 Subsequent Events.

(b) The estimated net impact of this pending sale is as follows:

In billions

Sales price $ 2.3

Less:

Book equity / intercompany debt (1.5)

Pretax gain .8

Income taxes (.3)

After-tax gain / increase in cash .5

Elimination of net intangible assets:

Goodwill and other intangible assets 1.3

Eligible deferred income taxes on goodwill and other intangible assets (.2)

Net intangible assets 1.1

Estimated net impact of pending sale of GIS $ 1.6

We believe that the disclosure of these ratios reflecting the impact of the TARP preferred stock redemption, common equity

offering and pending sale of GIS provides additional meaningful information regarding the risk-based capital ratios at that date and

the impact of these events on these ratios.

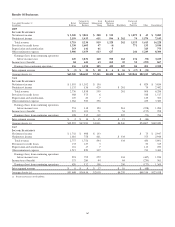

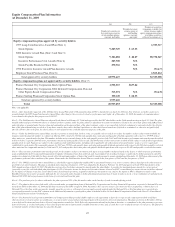

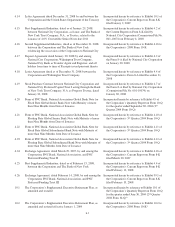

S

HORT

-T

ERM

B

ORROWINGS

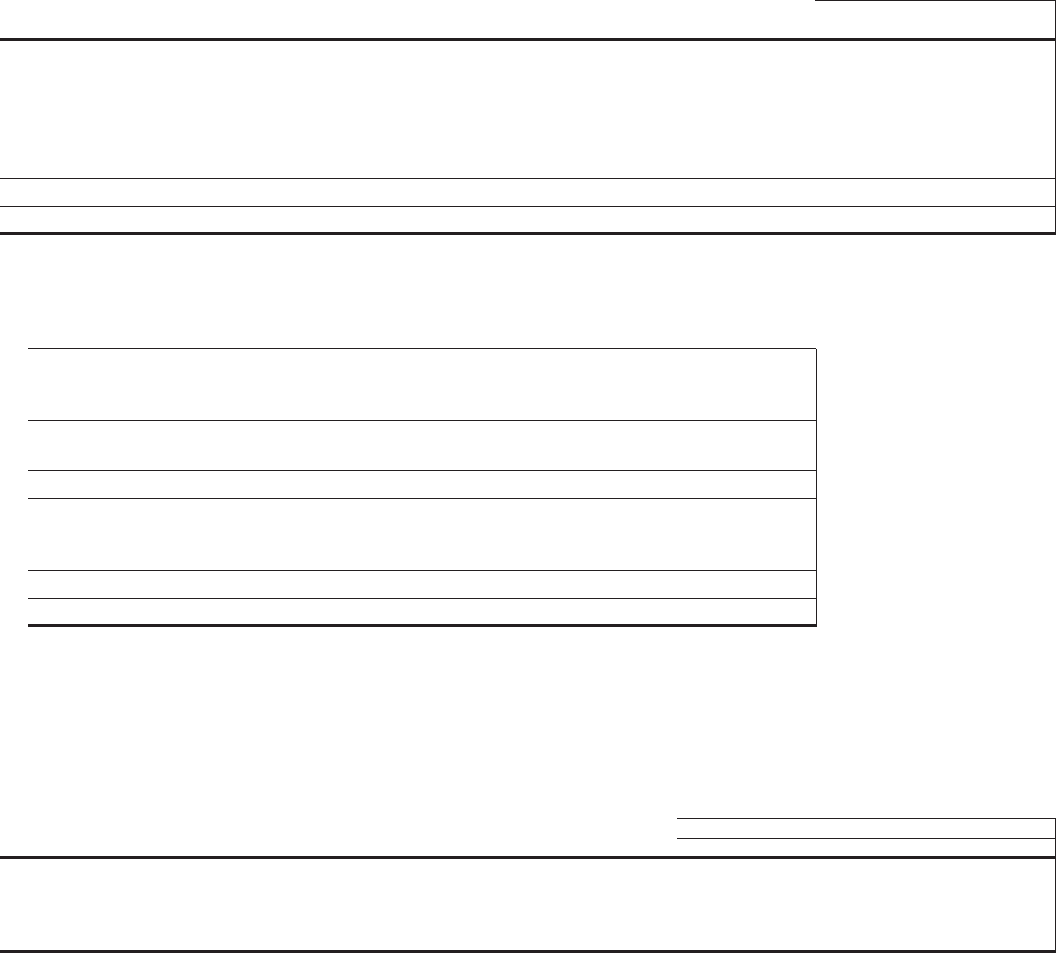

Federal funds purchased include overnight borrowings and term federal funds, which are payable at maturity.

2009 2008 2007

Dollars in millions Amount Rate Amount Rate Amount Rate

Federal funds purchased

Year-end balance $182 .06% $ 128 .01% $7,037 3.17%

Average during year 324 .18 4,518 2.15 5,533 5.13

Maximum month-end balance during year 421 7,343 8,798

174