PNC Bank 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Revenue growth,

• A sustained focus on expense management, including

achieving our cost savings targets associated with our

National City integration, and creating positive

pre-tax, pre-provision earnings,

• Managing the distressed assets portfolio and other

impaired assets,

• Maintaining our overall asset quality and continuing

to meet evolving regulatory capital standards,

• Continuing to maintain and grow our deposit base as

a low-cost funding source,

• Prudent risk and capital management leading to a

return to our desired moderate risk profile, and

• Actions we take within the capital and other financial

markets.

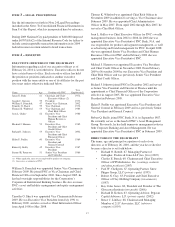

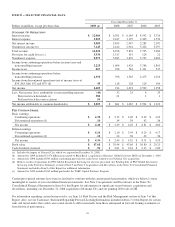

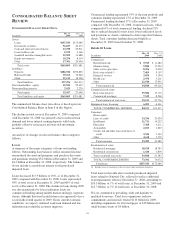

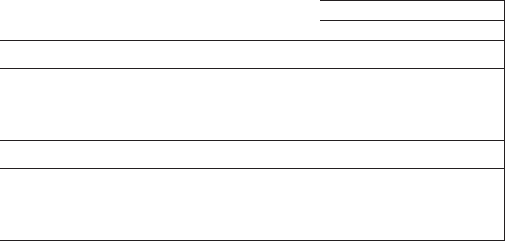

Summary Financial Results Year ended December 31

2009 2008

Net income, in millions $2,403 $ 914

Diluted earnings per common share

Continuing operations $ 4.26 $2.10

Discontinued operations .10 .34

Net income $ 4.36 $2.44

Return on

Average common shareholders’ equity 9.78% 6.52%

Average assets .87% .64%

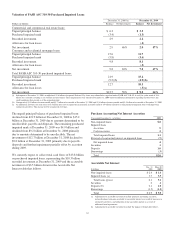

On December 1, 2009, BlackRock acquired Barclays Global

Investors (BGI) from Barclays Bank PLC. PNC recognized a

pretax gain of $1.076 billion, or $687 million after taxes, in

the fourth quarter of 2009 related to this transaction.

Additional information regarding this transaction is included

within the BlackRock section of our Business Segments

Review section of this Item 7.

Our earnings and related per share amounts for 2008 do not

include the impact of National City, which we acquired

effective December 31, 2008, other than a conforming

adjustment to our provision for credit losses of $504 million

and other integration costs of $71 million, both of which were

recognized in the fourth quarter of 2008. Our Consolidated

Balance Sheet at December 31, 2008 includes National City’s

assets and liabilities at estimated fair value.

Our performance in 2009 included the following:

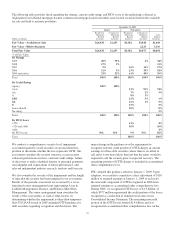

• We remain committed to responsible lending to

support economic growth. Loans and commitments

originated and renewed totaled approximately $110

billion in 2009. Included were $4 billion of small

business loans originated and renewed in 2009, and

we have enhanced our second-look programs for

small business loan applications. As of December 31,

2009, we had funded approximately 2,100 refinances

totaling $.4 billion through the Home Affordable

Refinance Program and over 70,000 solicitations

under the Home Affordable Modification Program

had been sent to eligible borrowers.

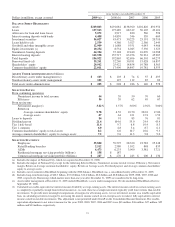

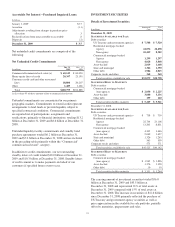

• Loans totaled $158 billion at December 31, 2009 and

declined 2% during the fourth quarter reflecting a

slower pace of decline compared with the first nine

months of 2009.

• We effectively managed deposit pricing and

realigned the deposit mix during 2009, growing

transaction deposits by $15 billion, or 14%, and

reducing nonrelationship certificates of deposit by

approximately $16 billion.

• Pretax, pre-provision earnings of $7.2 billion exceeded

the provision for credit losses by $3.2 billion for 2009.

• Total revenue was $16.2 billion for 2009, reflecting

our diverse revenue sources. The net interest margin

increased 45 basis points to 3.82% in 2009 compared

with 2008.

• Noninterest expense totaled $9.1 billion in 2009,

including $421 million of integration costs offset by

$800 million of acquisition cost savings.

• The pace of credit quality deterioration continued to

ease during the fourth quarter of 2009.

Nonperforming assets increased $.7 billion over the

third quarter to $6.3 billion, a lower increase

compared with the $1.0 billion increase in the third

quarter. We strengthened loan loss reserves for the

11th consecutive quarter. The allowance for loan and

lease losses of $5.1 billion combined with $4.9

billion of marks on acquired impaired loans

represented approximately 6% of loans outstanding at

December 31, 2009.

• Capital ratios continued to grow. The Tier 1 common

equity ratio increased by 50 basis points to 6.0% at

December 31, 2009 and the Tier 1 risk-based capital

ratio increased by 50 basis points to 11.4% as of

year-end.

• We continued to maintain a strong bank liquidity

position with an 84% loan to deposit ratio at

December 31, 2009. Holding company liquidity

remained strong with sufficient liquid assets to fund

2010 debt maturities and other corporate obligations.

• The acquisition of National City Corporation

exceeded our expectations during 2009.

- The transaction was accretive to 2009 earnings.

- Cost savings of over $800 million were

realized in 2009. We increased our multi-year

acquisition-related annualized cost savings goal

to $1.5 billion from $1.2 billion and are on

track to meet the new goal.

- We have successfully completed two major

conversions of National City customers to the

PNC platform – one in November 2009 and

another in February 2010. We expect to

complete the two remaining conversions by

June 2010, ahead of original plans.

- We completed the consolidation of bank

charters in November 2009.

25