PNC Bank 2009 Annual Report Download - page 130

Download and view the complete annual report

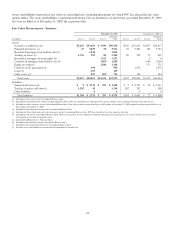

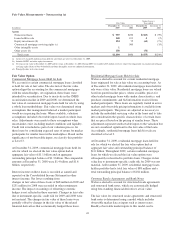

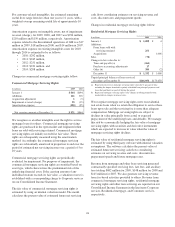

Please find page 130 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fair value of the noncertificated interest-only strips is

estimated based on the discounted value of expected net cash

flows. The aggregate carrying value of our equity investments

carried at cost and FHLB and FRB stock was $3.0 billion at

December 31, 2009 and $3.1 billion as of December 31, 2008,

both of which approximate fair value at each date.

M

ORTGAGE

A

ND

O

THER

L

OAN

S

ERVICING

A

SSETS

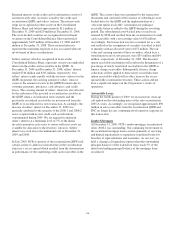

Fair value is based on the present value of the estimated future

cash flows, incorporating assumptions as to prepayment

speeds, discount rates, escrow balances, interest rates, cost to

service and other factors. We have controls in place intended

to ensure that our fair values are appropriate. An independent

model review group reviews our valuation models and

validates them for their intended use.

For commercial mortgage loan servicing assets, key valuation

assumptions at December 31, 2009 and December 31, 2008

included prepayment rates ranging from 6% – 19% and 4% –

16%, respectively, and discount rates ranging from 7% – 10%

for both periods, which resulted in an estimated fair value of

$1.0 billion and $873 million, respectively.

For residential mortgage servicing assets, key assumptions at

December 31, 2009 were a weighted average constant

prepayment rate of 19.92%, weighted average life of 4.5 years

and a discount rate, calculated as the spread over forward

interest rate swap rates, of 12.16%, resulting in a fair value of

$1.3 billion. The comparable amounts for December 31, 2008

were a weighted average constant prepayment rate of 33.04%,

weighted average life of 2.3 years and a discount rate of

6.37%, resulting in a fair value of $1.0 billion.

C

USTOMER

R

ESALE

A

GREEMENTS

Refer to the Fair Value Option section of this Note 8 regarding

the fair value of customer resale agreements and bank notes.

D

EPOSITS

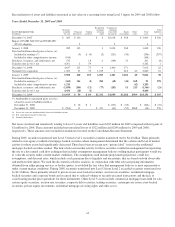

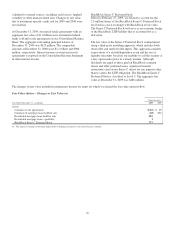

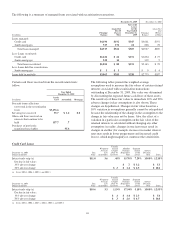

The carrying amounts of noninterest-bearing demand and

interest-bearing money market and savings deposits

approximate fair values. For time deposits, which include

foreign deposits, fair values are estimated based on the

discounted value of expected net cash flows assuming current

interest rates.

B

ORROWED

F

UNDS

The carrying amounts of Federal funds purchased, commercial

paper, repurchase agreements, proprietary trading short

positions, cash collateral (excluding cash collateral netted

against derivative fair values), other short-term borrowings,

acceptances outstanding and accrued interest payable are

considered to be their fair value because of their short-term

nature. For all other borrowed funds, fair values are estimated

primarily based on dealer quotes.

U

NFUNDED

L

OAN

C

OMMITMENTS

A

ND

L

ETTERS

O

F

C

REDIT

The fair value of unfunded loan commitments and letters of

credit is our estimate of the cost to terminate them. For

purposes of this disclosure, this fair value is the sum of the

deferred fees currently recorded by us on these facilities and

the liability established on these facilities related to their

creditworthiness.

F

INANCIAL

D

ERIVATIVES

For exchange-traded contracts, fair value is based on quoted

market prices. For nonexchange-traded contracts, fair value is

based on dealer quotes, pricing models or quoted prices for

instruments with similar characteristics. Amounts for financial

derivatives are presented on a gross basis.

126