PNC Bank 2009 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

22 S

UMMARIZED

F

INANCIAL

I

NFORMATION OF

B

LACK

R

OCK

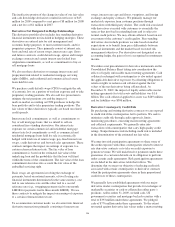

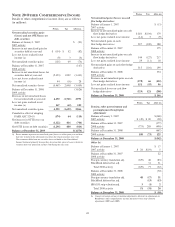

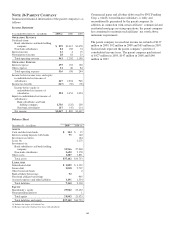

As required by SEC Regulation S-X, summarized

consolidated financial information of BlackRock follows (in

millions).

December 31 2009 2008

Total assets $177,994 $19,924

Total liabilities 153,392 7,364

Non-controlling interests 273 491

Stockholders’ equity 24,329 12,069

Total liabilities, non-controlling interests and

stockholders’ equity $177,994 $19,924

Year ended December 31 2009 2008 2007

Total revenue $4,700 $5,064 $4,845

Total expenses 3,422 3,471 3,551

Operating income 1,278 1,593 1,294

Non-operating income (expense) (6) (577) 526

Income before income taxes 1,272 1,016 1,820

Income tax expense 375 387 463

Net income 897 629 1,357

Less: net income (loss) attributable to

non-controlling interests 22 (155) 364

Net income attributable to BlackRock $ 875 $ 784 $ 993

N

OTE

23 R

EGULATORY

M

ATTERS

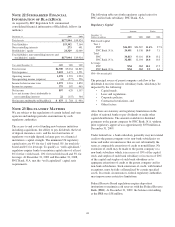

We are subject to the regulations of certain federal and state

agencies and undergo periodic examinations by such

regulatory authorities.

The access to and cost of funding new business initiatives

including acquisitions, the ability to pay dividends, the level

of deposit insurance costs, and the level and nature of

regulatory oversight depend, in large part, on a financial

institution’s capital strength. The minimum US regulatory

capital ratios are 4% for tier 1 risk-based, 8% for total risk-

based and 4% for leverage. To qualify as “well capitalized,”

regulators require banks to maintain capital ratios of at least

6% for tier 1 risk-based, 10% for total risk-based and 5% for

leverage. At December 31, 2009 and December 31, 2008,

PNC Bank, N.A. met the “well capitalized” capital ratio

requirements.

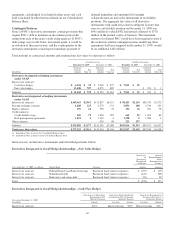

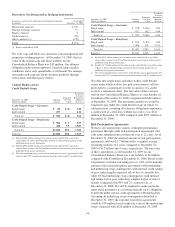

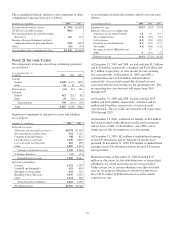

The following table sets forth regulatory capital ratios for

PNC and its bank subsidiary, PNC Bank, N.A.

Regulatory Capital

Amount Ratios

December 31

Dollars in millions 2009 2008 2009 2008

Risk-based capital

Tier 1

PNC $26,523 $24,287 11.4% 9.7%

PNC Bank, N.A. 24,491 8,338 10.9 7.1

Total

PNC 34,813 33,116 15.0 13.2

PNC Bank, N.A. 32,481 12,104 14.4 10.3

Leverage

PNC NM NM 10.1 17.5

PNC Bank, N.A. NM NM 9.3 6.3

NM—Not meaningful.

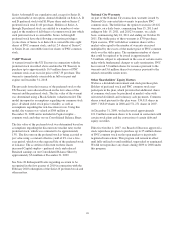

The principal source of parent company cash flow is the

dividends it receives from its subsidiary bank, which may be

impacted by the following:

• Capital needs,

• Laws and regulations,

• Corporate policies,

• Contractual restrictions, and

• Other factors.

Also, there are statutory and regulatory limitations on the

ability of national banks to pay dividends or make other

capital distributions. The amount available for dividend

payments to the parent company by PNC Bank, N.A. without

prior regulatory approval was approximately $378 million at

December 31, 2009.

Under federal law, a bank subsidiary generally may not extend

credit to the parent company or its non-bank subsidiaries on

terms and under circumstances that are not substantially the

same as comparable extensions of credit to nonaffiliates. No

extension of credit may be made to the parent company or a

non-bank subsidiary which is in excess of 10% of the capital

stock and surplus of such bank subsidiary or in excess of 20%

of the capital and surplus of such bank subsidiary as to

aggregate extensions of credit to the parent company and its

non-bank subsidiaries. Such extensions of credit, with limited

exceptions, must be fully collateralized by certain specified

assets. In certain circumstances, federal regulatory authorities

may impose more restrictive limitations.

Federal Reserve Board regulations require depository

institutions to maintain cash reserves with the Federal Reserve

Bank (FRB). At December 31, 2009, the balance outstanding

at the FRB was $38 million.

155