PNC Bank 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

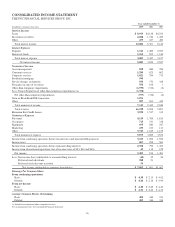

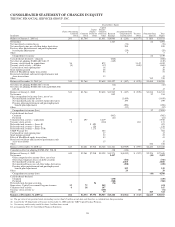

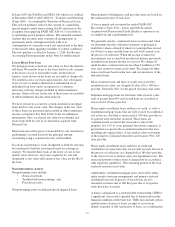

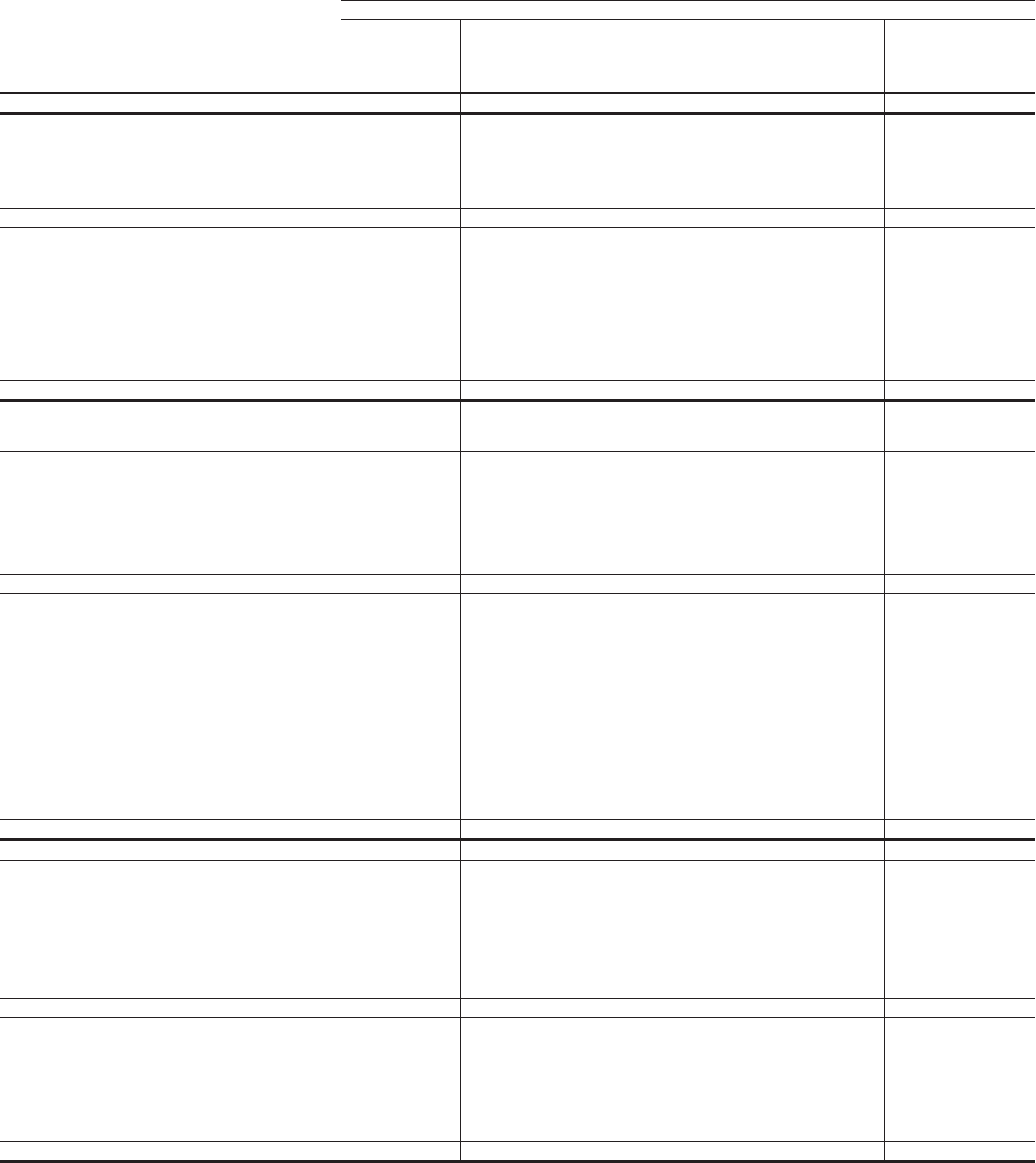

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

THE PNC FINANCIAL SERVICES GROUP, INC.

Shareholders’ Equity

In millions

Shares Outstanding

Common

Stock

Common

Stock

Capital

Surplus -

Preferred

Stock

Capital

Surplus -

Common

Stock and

Other

Retained

Earnings

Accumulated Other

Comprehensive

Income (Loss)

Treasury

Stock

Noncontrolling

Interests

Total

Equity

Balance at January 1, 2007 (a) 293 $1,764 $1,651 $10,985 $ (235) $(3,377) $ 885 $11,673

Net income 1,467 24 1,491

Net unrealized securities losses (76) (76)

Net unrealized gains on cash flow hedge derivatives 188 188

Pension, other postretirement and postemployment

benefit plan adjustments (29) (29)

Other 55

Comprehensive income 24 1,579

Cash dividends declared – common (806) (806)

Net effect of adopting FASB ASC 840-35 (149) (149)

Treasury stock issued for acquisitions 56 872 3,147 4,019

Treasury stock activity – all other (8) (17) (648) (665)

Tax benefit of stock option plans 18 18

Stock options granted 28 28

Effect of BlackRock equity transactions 53 53

Restricted stock/unit and incentive/performance unit

share transactions 13 13

Other 745 745

Balance at December 31, 2007 (a) 341 $1,764 $2,618 $11,497 $ (147) $ (878) $1,654 $16,508

Net effect of adopting FASB ASC 715-60 (12) (12)

Net effect of adopting FASB ASC 820 and FASB ASC

825-10 17 17

Balance at January 1, 2008 341 $1,764 $2,618 $11,502 $ (147) $ (878) $1,654 $16,513

Net income 882 32 914

Other comprehensive income (loss), net of tax

Net unrealized securities losses (3,459) (3,459)

Net unrealized gains on cash flow hedge derivatives 199 199

Pension, other postretirement and postemployment

benefit plan adjustments (490) (490)

Other (52) (52)

Comprehensive income (loss) 32 (2,888)

Cash dividends declared

Common (902) (902)

Preferred (21) (21)

Common stock activity – acquisition 99 497 5,419 5,916

Treasury stock activity 3 (110) 281 171

Preferred stock issuance – Series K $ 493 493

Preferred stock issuance – Series L 150 150

Preferred stock issuance – Series N (b) 7,275 7,275

TARP Warrant (b) 304 304

Tax benefit of stock option plans 17 17

Stock options granted 22 22

Effect of BlackRock equity transactions 43 43

Restricted stock/unit and incentive/ performance unit

share transactions 15 15

Other 540 540

Balance at December 31, 2008 (a) 443 $2,261 $7,918 $8,328 $11,461 $(3,949) $ (597) $2,226 $27,648

Cumulative effect of adopting FASB ASC 320-10 110 (110)

Balance at January 1, 2009 443 $2,261 $7,918 $8,328 $11,571 $(4,059) $ (597) $2,226 $27,648

Net income 2,447 (44) 2,403

Other comprehensive income (loss), net of tax

Other-than-temporary losses on debt securities (706) (706)

Net unrealized securities gains 2,866 2,866

Net unrealized losses on cash flow hedge derivatives (208) (208)

Pension, other postretirement and postemployment

benefit plan adjustments 125 125

Other 20 20

Comprehensive income (loss) (44) 4,500

Cash dividends declared

Common (430) (430)

Preferred (388) (388)

Preferred stock discount accretion 56 (56)

Supervisory Capital Assessment Program issuance 15 75 549 624

Common stock activity 4 18 147 165

Treasury stock activity (c) (158) 84 (74)

Other 79 443 522

Balance at December 31, 2009 (a) 462 $2,354 $7,974 $8,945 $13,144 $(1,962) $ (513) $2,625 $32,567

(a) The par value of our preferred stock outstanding was less than $.5 million at each date and, therefore, is excluded from this presentation.

(b) Issued to the US Department of Treasury on December 31, 2008 under the TARP Capital Purchase Program.

(c) Net treasury stock activity totaled less than .5 million shares issued.

See accompanying Notes To Consolidated Financial Statements.

90