PNC Bank 2009 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.N

OTE

28 S

UBSEQUENT

E

VENTS

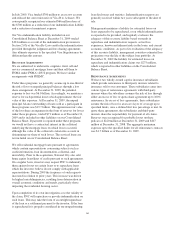

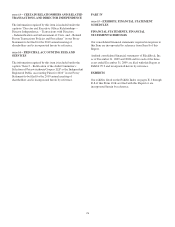

See Note 2 Acquisitions and Divestitures regarding our

pending sale of GIS.

C

OMMON

S

TOCK AND

S

ENIOR

N

OTES

O

FFERINGS

On February 8, 2010, we raised $3.0 billion in new common

equity through the issuance of 55.6 million shares of common

stock in an underwritten offering at $54 per share. On

March 4, 2010, the underwriters exercised their option to

purchase an additional 8.3 million shares of common stock at

the offering price of $54 per share, totaling approximately

$450 million, to cover over-allotments. We expect to complete

this issuance on March 11, 2010.

On February 8, 2010, PNC Funding Corp issued the following

securities:

• $1 billion of senior notes due February 2015; interest

will be paid semiannually at a fixed rate of 3.625%.

• $1 billion of senior notes due February 2020; interest

will be paid semiannually at a fixed rate of 5.125%.

R

EPURCHASE OF

O

UTSTANDING

TARP P

REFERRED

S

TOCK

See Note 19 Equity regarding our December 31, 2008,

issuance of 75,792 shares of our Fixed Rate Cumulative

Perpetual Preferred Shares, Series N (Series N Preferred

Stock), related issuance discount and the warrant to purchase

common shares to the US Treasury under the TARP Capital

Purchase Program.

As approved by the Federal Reserve Board, US Treasury and

our other banking regulators, on February 10, 2010, we

redeemed all 75,792 shares of our Series N Preferred Stock

held by the US Treasury totaling $7.6 billion. We used the net

proceeds from the common stock and senior notes offerings

described above and other funds to redeem the Series N

Preferred Stock.

In connection with the redemption of the Series N Preferred

Stock, we accelerated the accretion of the remaining issuance

discount on the Series N Preferred Stock and recorded a

corresponding reduction in retained earnings of $250.0

million. This resulted in a one-time, noncash reduction in net

income available to common stockholders and related basic

and diluted earnings per share. This transaction will be

reflected in our consolidated financial statements for the first

quarter of 2010.

Dividends of $89 million were paid on February 10, 2010

when the Series N Preferred Stock was redeemed. PNC paid

total dividends of $421 million to the US Treasury while the

Series N preferred shares were outstanding.

We did not exercise our right to seek to repurchase the related

warrant to purchase common shares at the time we redeemed

the Series N Preferred Stock.

168