PNC Bank 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

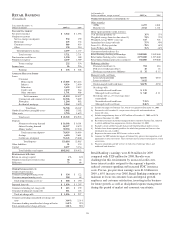

C

ORPORATE

&I

NSTITUTIONAL

B

ANKING

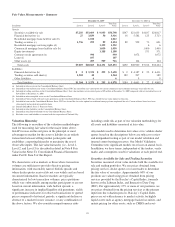

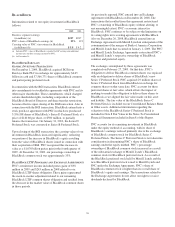

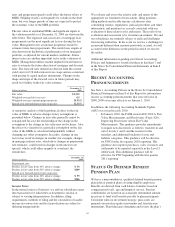

(Unaudited)

Year ended December 31

Dollars in millions except as noted 2009 (a) 2008

I

NCOME

S

TATEMENT

Net interest income $ 3,833 $ 1,323

Noninterest income

Corporate service fees 915 583

Other 518 (47)

Noninterest income 1,433 536

Total revenue 5,266 1,859

Provision for credit losses 1,603 575

Noninterest expense 1,800 945

Pretax earnings 1,863 339

Income taxes 673 124

Earnings $ 1,190 $ 215

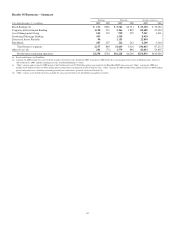

A

VERAGE

B

ALANCE

S

HEET

Loans

Commercial $41,132 $20,439

Commercial real estate 15,489 5,584

Commercial – real estate related 3,772 3,049

Asset-based lending 6,344 5,274

Equipment lease financing 5,390 1,482

Total loans 72,127 35,828

Goodwill and other intangible assets 3,583 3,149

Loans held for sale 1,679 2,053

Other assets 7,300 6,020

Total assets $84,689 $47,050

Deposits

Noninterest-bearing demand $19,948 $ 8,388

Money market 9,697 5,817

Other 7,911 3,129

Total deposits 37,556 17,334

Other liabilities 9,118 5,357

Capital 7,837 3,087

Total liabilities and equity $54,511 $25,778

P

ERFORMANCE

R

ATIOS

Return on average capital 15% 7%

Noninterest income to total revenue 27 29

Efficiency 34 51

C

OMMERCIAL

M

ORTGAGE

S

ERVICING

P

ORTFOLIO

(in billions)

Beginning of period $ 270 $ 243

Acquisitions/additions 50 51

Repayments/transfers (33) (24)

End of period $ 287 $ 270

O

THER

I

NFORMATION

Consolidated revenue from: (b)

Treasury Management $ 1,137 $ 567

Capital Markets $ 533 $ 336

Commercial mortgage loans held for sale (c) $ 205 $ (115)

Commercial mortgage loan servicing (d) 280 180

Total commercial mortgage banking

activities $ 485 $65

Total loans (e) $66,206 $38,063

Credit-related statistics:

Nonperforming assets (e) (f) $ 3,167 $ 1,173

Impaired loans (e) (g) $ 1,075 $ 1,816

Net charge-offs $ 1,052 $ 267

Net carrying amount of commercial

mortgage servicing rights (e) $ 921 $ 654

(a) Includes the impact of National City, which we acquired on December 31, 2008.

(b) Represents consolidated PNC amounts.

(c) Includes valuations on commercial mortgage loans held for sale and related

commitments, derivative valuations, origination fees, gains on sale of loans and net

interest income on loans held for sale.

(d) Includes net interest income and noninterest income from loan servicing and

ancillary services.

(e) At December 31.

(f) Includes nonperforming loans of $3.0 billion at December 31, 2009 and $1.2 billion

at December 31, 2008.

(g) Recorded investment of purchased impaired loans related to National City, adjusted

to reflect additional loan impairments effective December 31, 2008.

Corporate & Institutional Banking earned $1.2 billion in 2009

compared with $215 million in 2008. The acquisition of

National City positively impacted operating results as

revenues nearly tripled while expenses approximately doubled

in the comparison. As a result, operating leverage of $2.6

billion more than offset a $1.0 billion increase in the provision

for credit losses.

Highlights of Corporate & Institutional Banking performance

during 2009 include:

• Net interest income for 2009 was $3.8 billion, an

increase of $2.5 billion from 2008 driven primarily

by the National City acquisition, higher deposit levels

and improved loan spreads.

• Corporate service fees were $915 million for 2009,

an increase of $332 million over 2008. The major

components of corporate service fees are treasury

management, corporate finance fees and commercial

mortgage servicing revenue.

• We continued to invest in our healthcare initiative

which is designed to help provide our customers

opportunities to reduce operating costs. Healthcare-

related revenues in 2009 increased 23% from 2008,

to $85 million.

• The commercial real estate servicing portfolio

remained relatively flat except for the impact of the

National City acquisition. At Midland Loan Services,

growth within the agency servicing portfolio offset

the impact of the downturn in the CMBS market

during 2008 and 2009. Rising commercial real estate

delinquencies and defaults have resulted in growth in

the special servicing portfolio, which increased from

$2.9 billion at year-end 2008, to $12.1 billion at

December 31, 2009.

• Midland Loan Services is the only company in the

industry to hold the highest US CMBS primary,

master and special servicer ratings from both Fitch

and Standard & Poor’s.

• In a challenging business environment, our multi-

family origination activities for FNMA and FHMLC

remained robust with 2009 originations of $4.2

billion.

• Our PNC Loan Syndications business led financings

for over 160 middle market clients during 2009.

• Merger and advisory revenues declined $68 million

from 2008 reflecting the impact of the difficult

economic environment on acquisition activity.

53