PNC Bank 2009 Annual Report Download - page 140

Download and view the complete annual report

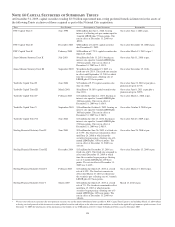

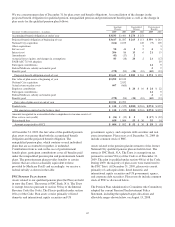

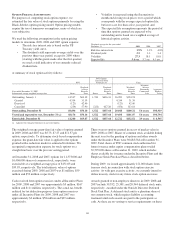

Please find page 140 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.All of these Trusts are wholly owned finance subsidiaries of

PNC. In the event of certain changes or amendments to

regulatory requirements or federal tax rules, the capital

securities are redeemable in whole. The financial statements

of the Trusts are not included in PNC’s consolidated financial

statements in accordance with GAAP.

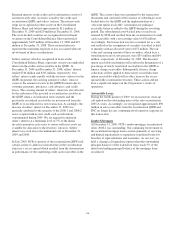

At December 31, 2009, PNC’s junior subordinated debt of

$3.0 billion represented debentures purchased and held as

assets by the Trusts.

The obligations of the respective parent of each Trust, when

taken collectively, are the equivalent of a full and

unconditional guarantee of the obligations of such Trust under

the terms of the Capital Securities. Such guarantee is

subordinate in right of payment in the same manner as other

junior subordinated debt. There are certain restrictions on

PNC’s overall ability to obtain funds from its subsidiaries. For

additional disclosure on these funding restrictions, including

an explanation of dividend and intercompany loan limitations,

see Note 23 Regulatory Matters.

PNC is subject to restrictions on dividends and other

provisions similar to or in some ways more restrictive than

those potentially imposed under the Exchange Agreements

with Trust II and Trust III, as described in Note 3 Variable

Interest Entities.

N

OTE

15 E

MPLOYEE

B

ENEFIT

P

LANS

P

ENSION

A

ND

P

OSTRETIREMENT

P

LANS

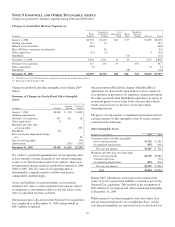

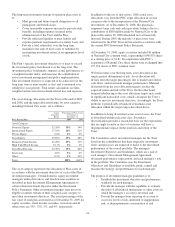

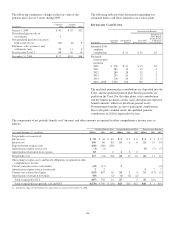

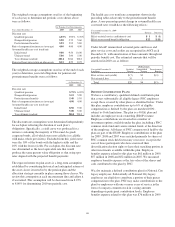

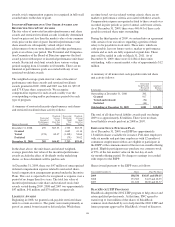

We have a noncontributory, qualified defined benefit pension

plan covering eligible employees. The plan derives benefits

from cash balance formulas based on compensation levels, age

and length of service. Pension contributions are based on an

actuarially determined amount necessary to fund total benefits

payable to plan participants. National City had a qualified

pension plan covering substantially all employees hired prior

to April 1, 2006. Pension benefits are derived from a cash

balance formula, whereby credits based on salary, age, and

years of service are allocated to employee accounts. The

National City plan was merged with our qualified pension

plan on December 31, 2008. During 2009, no changes to

either plan design or benefits occurred.

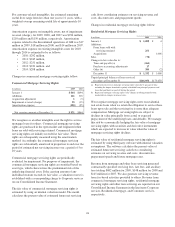

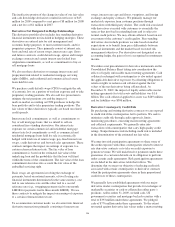

Effective January 1, 2010, the pension plan has one design for

all eligible employees. All new participants on or after

January 1, 2010 will receive a fixed earnings credit of 3%.

However, participants as of December 31, 2009 will be

maintained at the earnings credit level they have attained as of

that date going forward. The percentage will not increase in

future years.

We also maintain nonqualified supplemental retirement plans

for certain employees. On December 31, 2008, the participants

of National City’s supplemental executive retirement plans

became 100% vested due to the change in control. We also

provide certain health care and life insurance benefits for

qualifying retired employees (postretirement benefits) through

various plans. The nonqualified pension and postretirement

benefit plans are unfunded. Effective January 1, 2010, various

benefit plans were amended to provide one plan design to all

eligible employees.

136