PNC Bank 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

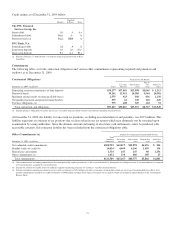

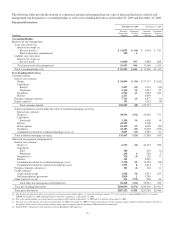

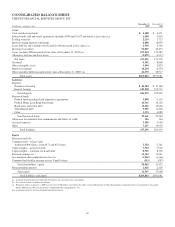

Funding Sources

Total funding sources were $245.1 billion at December 31,

2008 and $113.6 billion at December 31, 2007. Funding

sources increased $131.5 billion as total deposits increased

$110.2 billion and total borrowed funds increased $21.3

billion.

Our acquisition of National City added $104.0 billion of

deposits and $18.2 billion of borrowed funds at December 31,

2008. In addition, borrowed funds at that date included $2.9

billion of senior notes issued in December 2008 and

guaranteed under the FDIC’s TLGP-Debt Guarantee Program.

Shareholders’ Equity

Total shareholders’ equity increased $10.6 billion, to $25.4

billion, at December 31, 2008 compared with December 31,

2007 and reflected the following:

• The December 2008 issuance of $7.6 billion of

preferred stock and a common stock warrant to the

US Department of Treasury under the TARP Capital

Purchase Program,

• The December 2008 issuance of $5.6 billion of

common stock in connection with the National City

acquisition,

• The May 2008 issuance of $500 million of Series K

preferred stock,

• The April 2008 issuance of $312 million of common

stock in connection with the Sterling acquisition, and

• The December 2008 issuance of $150 million of

Series L preferred stock in connection with the

National City acquisition.

These factors were partially offset by the $3.8 billion increase

from December 31, 2007 in accumulated other comprehensive

loss which included $3.5 billion of net unrealized securities

losses.

Regulatory capital ratios at December 31, 2008 were 17.5%

for leverage, 9.7% for Tier 1 risk-based and 13.2% for total

risk-based capital. At December 31, 2007, the regulatory

capital ratios were 6.2% for leverage, 6.8% for Tier 1 risk-

based and 10.3% for total risk-based capital.

The leverage ratio at December 31, 2008 reflected the

favorable impact on Tier I risk-based capital from the issuance

of securities under TARP and the issuance of PNC common

stock in connection with the National City acquisition, both of

which occurred on December 31, 2008. In addition, the ratio

as of that date did not reflect any impact of National City on

PNC’s adjusted average total assets.

Glossary of Terms

Accretable net interest - The excess of cash flows expected to

be collected on a purchased impaired loan over the carrying

value of the loan. The accretable net interest is recognized into

interest income over the remaining life of the loan using the

constant effective yield method.

Accretable yield - The excess of a loan’s cash flows expected

to be collected over the carrying value of the loan. The

accretable yield is recognized in interest income over the

remaining life of the loan using the constant effective yield

method.

Adjusted average total assets - Primarily comprised of total

average quarterly (or annual) assets plus (less) unrealized

losses (gains) on investment securities, less goodwill and

certain other intangible assets (net of eligible deferred taxes).

Annualized - Adjusted to reflect a full year of activity.

Assets under management - Assets over which we have sole or

shared investment authority for our customers/clients. We do

not include these assets on our Consolidated Balance Sheet.

Basis point - One hundredth of a percentage point.

Cash recoveries - Cash recoveries used in the context of

purchased impaired loans represent cash payments from

customers that exceeded the recorded investment of the

designated impaired loan.

Charge-off - Process of removing a loan or portion of a loan

from our balance sheet because it is considered uncollectible.

We also record a charge-off when a loan is transferred to held

for sale by reducing the loan carrying amount to the fair value

of the loan, if fair value is less than carrying amount.

Client-related noninterest income - Total noninterest income

included on our Consolidated Income Statement less amounts

for net gains (losses) on sales of securities, net other-than-

temporary impairments, and other noninterest income.

Common shareholders’ equity to total assets - Common

shareholders’ equity divided by total assets. Common

shareholders’ equity equals total shareholders’ equity less the

liquidation value of preferred stock.

Credit derivatives - Contractual agreements, primarily credit

default swaps, that provide protection against a credit event of

one or more referenced credits. The nature of a credit event is

established by the protection buyer and protection seller at the

inception of a transaction, and such events include

bankruptcy, insolvency and failure to meet payment

obligations when due. The buyer of the credit derivative pays

a periodic fee in return for a payment by the protection seller

upon the occurrence, if any, of a credit event.

Credit spread - The difference in yield between debt issues of

similar maturity. The excess of yield attributable to credit

spread is often used as a measure of relative creditworthiness,

with a reduction in the credit spread reflecting an

improvement in the borrower’s perceived creditworthiness.

81