PNC Bank 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

characterized by disciplined credit management and limited

exposure to earnings volatility resulting from interest rate

fluctuations and the shape of the interest rate yield curve. We

made substantial progress in transitioning our balance sheet

throughout 2009, working to institute our moderate risk

philosophy throughout our expanded franchise. Our actions

have created a well-positioned balance sheet, strong bank

level liquidity and investment flexibility to adjust, where

appropriate and permissible, to changing interest rates and

market conditions.

We also continue to be focused on building capital in the

current environment characterized by economic and

regulatory uncertainty. See the Funding and Capital Sources

section of the Consolidated Balance Sheet Review section and

the Liquidity Risk Management section of this Item 7.

S

UPERVISORY

C

APITAL

A

SSESSMENT

P

ROGRAM

(S

TRESS

TESTS

)

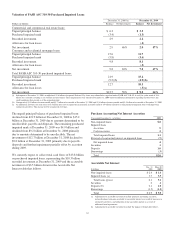

On May 7, 2009, the Board of Governors of the Federal

Reserve System announced the results of the stress tests

conducted by banking regulators under the Supervisory

Capital Assessment Program with respect to the 19 largest

bank holding companies. As a result of this test, the Federal

Reserve concluded that PNC was well capitalized but that, in

order to provide a greater cushion against the risk that

economic conditions over the next two years are worse than

currently anticipated, PNC needed to augment the

composition of its capital by increasing the common

shareholders’ equity component of Tier 1 capital. In May

2009 we raised $624 million in new common equity through

the issuance of 15 million shares of common stock. In

connection with the Supervisory Capital Assessment Program,

we submitted a capital plan which was accepted by the Federal

Reserve.

R

ECENT

M

ARKET AND

I

NDUSTRY

D

EVELOPMENTS

Since the middle of 2007 and with a heightened level of

activity during 2008 and 2009, there has been unprecedented

turmoil, volatility and illiquidity in worldwide financial

markets, accompanied by uncertain prospects for sustaining a

fragile economic recovery that began mid-year 2009. In

addition, there have been dramatic changes in the competitive

landscape of the financial services industry during this time.

Recent efforts by the Federal government, including the US

Congress, the US Department of the Treasury, the Federal

Reserve, the FDIC, and the Securities and Exchange

Commission, to stabilize and restore confidence in the

financial services industry have impacted and will likely

continue to impact PNC and our stakeholders. These efforts,

which will continue to evolve, include the Emergency

Economic Stabilization Act of 2008, the American Recovery

and Reinvestment Act of 2009, and other legislative,

administrative and regulatory initiatives, including the US

Treasury’s TARP Capital Purchase Program, the FDIC’s

Temporary Liquidity Guarantee Program (TLGP) and the

Federal Reserve’s Commercial Paper Funding Facility

(CPFF).

These programs include the following:

TARP C

APITAL

P

URCHASE

P

ROGRAM

The TARP Capital Purchase Program enabled US financial

institutions to build capital through the sale to the US

Treasury of senior preferred shares of stock to increase the

flow of financing to US businesses and consumers and to

support the US economy.

Note 19 Equity included in our Notes To Consolidated

Financial Statements within Item 8 of this Report includes

information regarding the preferred stock and the related

warrant that we issued under this program. See Repurchase of

Outstanding TARP Preferred Stock above.

FDIC T

EMPORARY

L

IQUIDITY

G

UARANTEE

P

ROGRAM

The FDIC’s TLGP is designed to strengthen confidence and

encourage liquidity in the banking system by:

• Guaranteeing newly issued senior unsecured debt of

eligible institutions, including FDIC-insured banks

and thrifts, as well as certain holding companies

(TLGP-Debt Guarantee Program), and

• Providing full deposit insurance coverage for

non-interest bearing transaction accounts in FDIC-

insured institutions, regardless of the dollar amount

(TLGP -Transaction Account Guarantee Program).

In December 2008, PNC Funding Corp issued fixed and

floating rate senior notes totaling $2.9 billion under the

FDIC’s TLGP-Debt Guarantee Program. In March 2009, PNC

Funding Corp issued floating rate senior notes totaling $1.0

billion under this program. Each of these series of senior notes

is guaranteed through maturity by the FDIC.

From October 14, 2008 through December 31, 2009, PNC

Bank, National Association (PNC Bank, N.A.) participated in

the TLGP-Transaction Account Guarantee Program. Under

this program, all non-interest bearing transaction accounts

were fully guaranteed by the FDIC for the entire amount in the

account. Coverage under this program is in addition to, and

separate from, the coverage available under the FDIC’s

general deposit insurance rules.

Beginning January 1, 2010, PNC Bank, N.A. is no longer

participating in the TLGP-Transaction Account Guarantee

Program. Thus, as of December 31, 2009, funds held in

noninterest-bearing transaction accounts were no longer

guaranteed in full under the TLGP—Transaction Account

Guarantee Program, but are insured up to $250,000 under the

FDIC’s general deposit insurance rules.

Federal Reserve Commercial Paper Funding Facility (CPFF)

Effective October 28, 2008, Market Street Funding LLC

(Market Street) was approved to participate in the Federal

23