PNC Bank 2009 Annual Report Download - page 76

Download and view the complete annual report

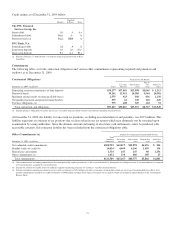

Please find page 76 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Dividends may also be impacted by the bank’s capital needs

and by contractual restrictions. We provide additional

information on certain contractual restrictions under the

“Perpetual Trust Securities,” “PNC Capital Trust E Trust

Preferred Securities,” and “Acquired Entity Trust Preferred

Securities” sections of the Off-Balance Sheet Arrangements

And Variable Interest Entities section of this Item 7. The

amount available for dividend payments to the parent

company by PNC Bank, N.A. without prior regulatory

approval was approximately $378 million at December 31,

2009.

In addition to dividends from PNC Bank, N.A., other sources

of parent company liquidity include cash and short-term

investments, as well as dividends and loan repayments from

other subsidiaries and dividends or distributions from equity

investments. As of December 31, 2009, the parent company

had approximately $4.7 billion in funds available from its cash

and short-term investments.

We can also generate liquidity for the parent company and

PNC’s non-bank subsidiaries through the issuance of debt and

equity securities in public or private markets.

PNC Funding Corp issued the following securities during 2009:

• September – $500 million of senior notes due

September 2015; interest paid semiannually at a fixed

rate of 4.25%.

• June – $600 million of senior notes due June 2019;

interest paid semiannually at a fixed rate of 6.7%.

• June – $400 million of senior notes due June 2014;

interest paid semiannually at a fixed rate of 5.4%.

• March – $1.0 billion of floating rate senior notes due

April 2012 under the TLGP-Debt Guarantee

Program. Interest will be reset quarterly to 3-month

LIBOR plus 20 basis points and paid quarterly. These

senior notes are guaranteed by the parent company

and by the FDIC and are backed by the full faith and

credit of the United States of America through

maturity.

As further described in the Executive Summary and

Consolidated Balance Sheet sections of this Item 7, in May

2009 we raised $624 million in common equity through the

issuance of 15 million shares of common stock.

PNC Bank, N.A., through its subsidiary PNC Funding Corp,

has the ability to offer up to $3.0 billion of commercial paper

to provide the parent company with additional liquidity. As of

December 31, 2009, there were no issuances outstanding

under this program.

As of December 31, 2009, there were $1.1 billion of parent

company contractual obligations with maturities of less than

one year.

We have effective shelf registration statements pursuant to

which we can issue additional debt and equity securities,

including certain hybrid capital instruments.

February 2010 Actions

On February 8, 2010, we raised $3.0 billion in new common

equity through the issuance of 55.6 million shares of common

stock in an underwritten offering at $54 per share. On March 4,

2010, the underwriters exercised their option to purchase an

additional 8.3 million shares of common stock at the offering

price of $54 per share, totaling approximately $450 million, to

cover over-allotments. We expect to complete this issuance on

March 11, 2010.

Also on February 8, 2010 PNC Funding Corp issued the

following securities:

• $1 billion of senior notes due February 2015; interest

will be paid semiannually at a fixed rate of 3.625%.

• $1 billion of senior notes due February 2020; interest

will be paid semiannually at a fixed rate of 5.125%.

As approved by the Federal Reserve Board, US Treasury and our

other banking regulators, on February 10, 2010, we redeemed all

75,792 shares of our Fixed Rate Cumulative Perpetual Preferred

Shares, Series N (Series N Preferred Stock) issued to the US

Treasury on December 31, 2008 totaling $7.6 billion. We used

the net proceeds from the common stock and senior notes

offerings described above and other parent company funds to

redeem the Series N Preferred Stock.

Dividends of $89 million were paid on February 10, 2010

when the Series N Preferred Stock was redeemed. PNC paid

total dividends of $421 million to the US Treasury while the

Series N Preferred Stock was outstanding.

In connection with the redemption of the Series N Preferred

Stock, we accelerated the accretion of the remaining issuance

discount on the Series N Preferred Stock and recorded a

corresponding reduction in retained earnings of $250.0

million. This resulted in a one-time, noncash reduction in net

income available to common stockholders and related basic

and diluted earnings per share. This transaction will be

reflected in our consolidated financial statements for the first

quarter of 2010.

We did not exercise our right to seek to repurchase the related

warrant to purchase common shares at the time we redeemed

the Series N Preferred Stock.

See Note 19 Equity in the Notes To Consolidated Financial

Statements in Item 8 of this Report for more details regarding

the issuance of Series N Preferred Stock, related issuance

discount and the warrant to purchase common shares to the

US Treasury under the TARP Capital Purchase Program.

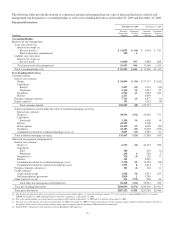

Status of Credit Ratings

The cost and availability of short- and long-term funding, as

well as collateral requirements for certain derivative

instruments, is influenced by debt ratings. A decrease, or

potential decrease, in credit ratings could impact access to the

capital markets and/or increase the cost of debt, and thereby

adversely affect liquidity and financial condition.

72